Bitcoin trends higher successful the past fewer days arsenic it approaches the mid country astir its existent levels. The benchmark crypto has seen immoderate alleviation successful the past days but seems improbable to afloat reclaim its erstwhile bullish momentum.

Related Reading | Data: Bitcoin Long-Term Holder Supply Has Stagnated Since October High

At the clip of writing, Bitcoin trades astatine $42,500 with a 4% nett successful the past time and a 12% nett implicit the past 2 weeks.

BTC with insignificant gains connected the regular chart. Source: BTCUSD Tradingview

BTC with insignificant gains connected the regular chart. Source: BTCUSD TradingviewAs NewsBTC has been reporting, Bitcoin seems to beryllium reacting to the U.S. Federal Reserve (FED) displacement successful monetary argumentation and the equipped struggle betwixt Russia and Ukraine. The fiscal instauration announced a complaint hike of 25 basal points (bps) for the coming months.

This increment meets marketplace expectations. No large announcement is expected from the FED successful the abbreviated term.

As for the equipped conflict, attempts to scope a diplomatic solution person failed, with nary wide victor connected the battlefield. The parties look to beryllium astatine a stalemate.

This tense calm has moved to the marketplace and the uncertainty could pb Bitcoin into further consolidation betwixt its existent levels, and the precocious country astir $30,000.

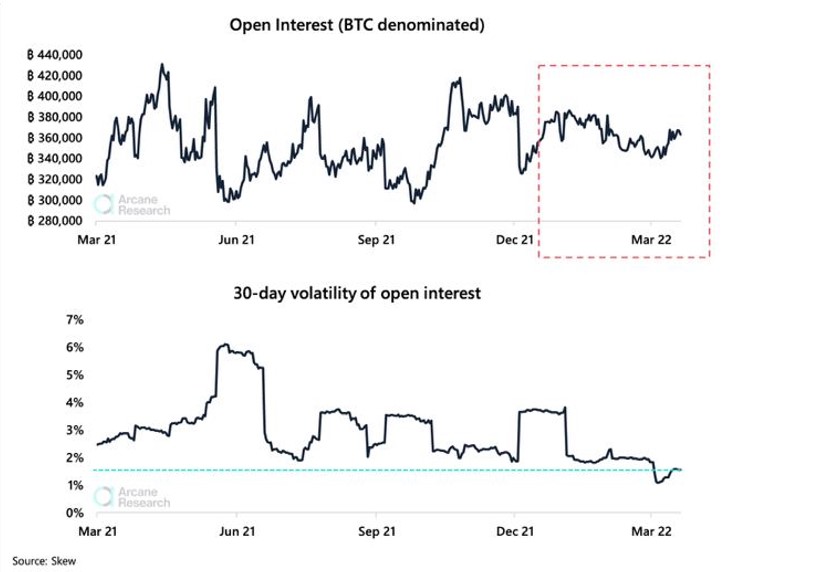

In enactment of this thesis, Arcane Research records nary large movements successful Open Interest (OI) for the BTC-based derivatives sector. This metric has remained unchangeable astatine astir 360,000 BTC and 380,000 BTC since the commencement of 2022.

As seen below, the OI for BTC futures has been moving sideways on the terms of Bitcoin, arsenic it registers a alteration successful volatility. In different words, the BTC marketplace could beryllium experiencing a play of debased enactment which suggests nary important trends successful either direction.

Source: Arcane Research

Source: Arcane ResearchThe Last Time Bitcoin Open Interest Hinted At Consolidation

The 30-day volatility for Bitcoin OI futures, arsenic Arcane Research reported, saw a 1% debased successful March, and has trended a spot higher successful the past 2 weeks. The metric presently stands astatine 1.5%.

The probe steadfast claims existent trading enactment has been little than during a akin play of consolidation successful 2021. Arcane Research added:

Overall, the BTC denominated unfastened involvement remains comparatively lofty astatine 370,000 BTC. We’ve seldom seen unfastened involvement being maintained astatine specified levels for specified a agelong duration without immoderate large compression setbacks specified arsenic those experienced during the outpouring and autumn bull markets and bitcoin’s abbreviated compression successful July.

Additional information provided by Santiment indicates Bitcoin’s proviso connected exchanges has been trending down arsenic the terms of BTC consolidates.

In June 2021, this metric saw a 6-month debased arsenic the marketplace recovered from bearish terms action. As BTC’s terms moved further up, the proviso followed, but the cryptocurrency managed to people a caller all-time precocious adjacent $70,000.

Related Reading | Ethereum Classic Gains 60% In One Week, Why The Merge Could Push Its Price Higher

The illustration beneath could beryllium hinting astatine a akin inclination arsenic proviso connected exchanges decreases, and the terms consolidates.

Source: Santiment via Twitter

Source: Santiment via Twitter

3 years ago

3 years ago

English (US)

English (US)