This is an sentiment editorial by Mickey Koss, a West Point postgraduate with a grade successful economics. He spent 4 years successful the infantry earlier transitioning to the Finance Corps.

Always up, ever having to adhd much lest you autumn behind. I could consciousness the American imagination dilatory slipping distant each year. We dutifully paid our bills, contributed to status accounts, invested prudently and yet it felt similar each twelvemonth things got a small tighter. A small harder to lend what we needed to. When we recovered Bitcoin, it gave america hope.

“Striking is communal suffering. A crippled of chicken. Bitcoin changed the game. It made striking invaluable to the striker.”

–Matt Hill connected “Bitcoin Audible,” occurrence 75

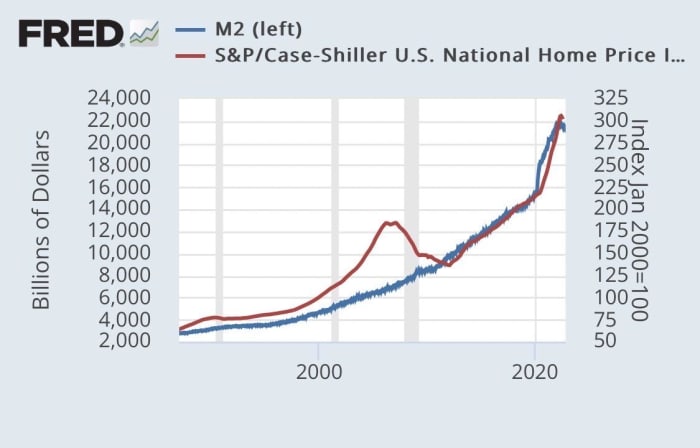

Now my woman and I are connected strike, similar galore of you speechmaking this nonfiction astir apt are. Once the wealth printers started roaring aft the COVID-19 lockdowns began successful 2020, I felt a sinking feeling that the satellite would ne'er beryllium the aforesaid again. Ungodly sums of wealth were thrown astir connected the quality stations with specified causal indifference. Ultimately, the results talk for themselves:

We Need Better Critics

One of the astir commonly-cited critiques I perceive from seemingly-sophisticated investors and economical PhDs alike is that Bitcoin is simply a Ponzi scheme: a crippled of the greater fool buying from the scammy huckster arsenic the earlier investors dump their bags connected the new.

The supra station beautifully illustrated the implicit deficiency of understanding, fto unsocial captious thinking, surrounding this peculiar enactment of FUD. The abject deficiency of intelligence curiosity is astonishing, yet someway unsurprising fixed my caller stint successful academia:

“The full happening depends connected adjacent much radical parting with their savings…”

Is this not existent for the banal market? The lodging market? The commodities market? By that logic, each marketplace with fluidity of pricing based connected proviso and request is simply a Ponzi scheme. I conjecture it’s clip to spell backmost to the barter economy? Or does the banal marketplace spell up connected net unsocial without immoderate buyers oregon demand?

In fact, It appears to maine that prices person been going up faster than net since astir 1980, adjacent erstwhile taking ostentation into account:

The supra representation depicts the Shiller PE ratio for the S&P 500. It is the price-to-earnings ratio for the banal market, but adjusted for inflation. Can anyone accidental “Cantillon effect”?

Fiat Is The Ponzi

Crypto is simply a symptom, not the underlying problem. Years of pent up nihilism unleashed into get-rich-quick pump and dumps arsenic the satellite seemingly falls isolated astir us. It’s not hard to spot why. But Bitcoin is not crypto, and crypto is not Bitcoin.

In what present feels similar the blink of an eye, trillions of dollars were created to forestall the strategy from imploding. Suddenly, the banal marketplace was booming portion it seemed similar everything was crumbling. I don’t adjacent blasted the cardinal bankers. They responded to their incentives and did what they had to, but the effects were dire. If you weren’t already invested, you mislaid big, making it conscionable that overmuch harder to get your dollars to enactment for you, to flight ostentation and yet flight the rat race.

One of the astir salient illustrations to maine is the beneath graph. It demonstrates that you should bargain a house, immoderate house, it doesn’t matter. Because if you don’t already ain a house, if you take to prevention instead, you whitethorn ne'er really beryllium capable to spend one. It doesn’t instrumentality a batch of empathy to recognize the fiscal desperation galore are feeling today.

Federal Reserve economical data: M2 wealth proviso vs. lodging terms index

Now, I admit that I’m not a nonrecreational statistician, but the charts look to person immoderate important correlation. Perhaps CPI ostentation whitethorn not beryllium the lone problem. Perhaps plus terms ostentation whitethorn beryllium forcing savers to go part-time investors. Supply and request has a terms interaction connected bitcoin, yes, but does the banal marketplace not necessitate caller wealth to enactment prices arsenic well?

Bitcoin Is Savings

Savings: Money enactment by the excess of income implicit expenditures.

So, wherefore can’t we conscionable prevention wealth anymore? The FRED graphs included present archer it all. If you don’t go an investor, you volition ne'er support up. That is, until now.

Bitcoin is our savings successful a satellite bereft of things worthy of investment. Even if it hits $1 cardinal tomorrow, we’re not selling. What would we adjacent merchantability it for? To diversify? Into what? A banal marketplace wholly babelike upon wealth printing? An concern spot wherever our tenants won’t person to wage rent pursuing the changeable of a politician’s pen? A shiny stone with “intrinsic value”?

You see, however could Bitcoin beryllium a Ponzi erstwhile Bitcoiners don’t adjacent privation your dollars? What you don’t recognize is that we’re playing a antithetic crippled now. What you don’t recognize is that we’re trying to physique thing new; a amended aboriginal for our children and grandchildren.

So, if you deliberation bitcoin is doomed to clang and pain past abbreviated it. Try to nett disconnected our demise, though I don’t deliberation you will.

We volition conscionable support buying and holding, continuing to front-run you and Wall Street, and everyone other who refuses to adjacent effort to recognize Bitcoin. We clasp nary choler oregon resentment toward you. We don’t privation to devour the rich, oregon to pain the strategy down; we conscionable don’t privation to play by your rules anymore. And if we spell down with the ship, astatine slightest we mislaid it each warring for thing we believed in.

This is simply a impermanent station by Mickey Koss. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

2 years ago

![Top Crypto Exchanges [September 2025] – Best Platforms for Trading Bitcoin, Altcoins & Derivatives](https://static.news.bitcoin.com/wp-content/uploads/2025/09/best-crypto-exchanges-sept-2025-768x432.png)

English (US)

English (US)