Today’s Bitcoin terms question is simply a confluence of factors including monolithic liquidations, macroeconomic pressures, and the interaction of antagonistic Coinbase Premium alongside Bitcoin ETF dynamics. These elements combined person led to a noticeable dip successful Bitcoin’s price.

#1 Long Liquidations

Today’s Bitcoin marketplace saw a important terms drop, initiated by a sweeping liquidation lawsuit connected the futures market. Over the past 24 hours, crypto trader liquidations exceeded $682.54 cardinal crossed much than 191,000 traders, according to Coinglass data.

This surge successful liquidations resulted successful Bitcoin’s terms plummeting by 8% successful specified hours, falling from $72,000 to $66,500. Although determination was a insignificant recovery, with Bitcoin’s terms rebounding to the $68,000 level, it presently stands astir 10% beneath its March 14 all-time precocious of $73,737.

A notable 80% of these liquidations were agelong positions, contributing to $544.99 cardinal of the total. Short presumption liquidations made up the remaining $136.94 million, with Bitcoin longs unsocial accounting for $242.37 cardinal successful liquidations.

#2 Macro Conditions Weighing On Bitcoin Price

The macroeconomic scenery has placed further unit connected Bitcoin’s value. Ted, a macro expert known arsenic @tedtalksmacro, highlighted connected X the power of macro conditions connected the cryptocurrency market.

He stated, “If BTC is integer gold, expect it to commercialized successful lockstep with gold, however, with higher beta.” With the Federal Reserve’s gathering looming adjacent week, macroeconomic factors are expected to instrumentality halfway signifier temporarily.

Yesterday’s US Producer Price Index (PPI) data, showing a 0.6% summation successful February and surpassing forecasts of 0.3 month-over-month, has caused a ripple effect with CPI precocious besides hotter than expected, starring to a emergence successful US enslaved yields. The benchmark 10-year complaint saw an summation of 10 ground points to 4.29%, portion two-year rates roseate to 4.69% from 4.63%. These developments person led traders to set their expectations for the Federal Reserve’s involvement complaint policies successful 2024.

Mohamed A. El-Erian, from Queens’ College, Cambridge University, Allianz, and Gramercy, remarked connected the situation: “US authorities enslaved yields jumped contiguous successful absorption to yet different (slightly) hotter-than-expected ostentation people (this clip PPI).” This suggests a increasing consciousness of the challenges that persistent ostentation poses to achieving the Fed’s 2% ostentation target.

#3 Negative Coinbase Premium / Quiet Bitcoin ETF Day

The diminution of Bitcoin beneath the $70,000 threshold is besides attributed to the “Coinbase Premium” – the speech which custodies the bulk of each spot Bitcoin ETFs – dipping into antagonistic territory for the archetypal clip since February 26, indicating a bearish sentiment from US markets. This improvement is apt a effect of important income of Grayscale GBTC, portion the spot ETF experienced comparatively calm activity.

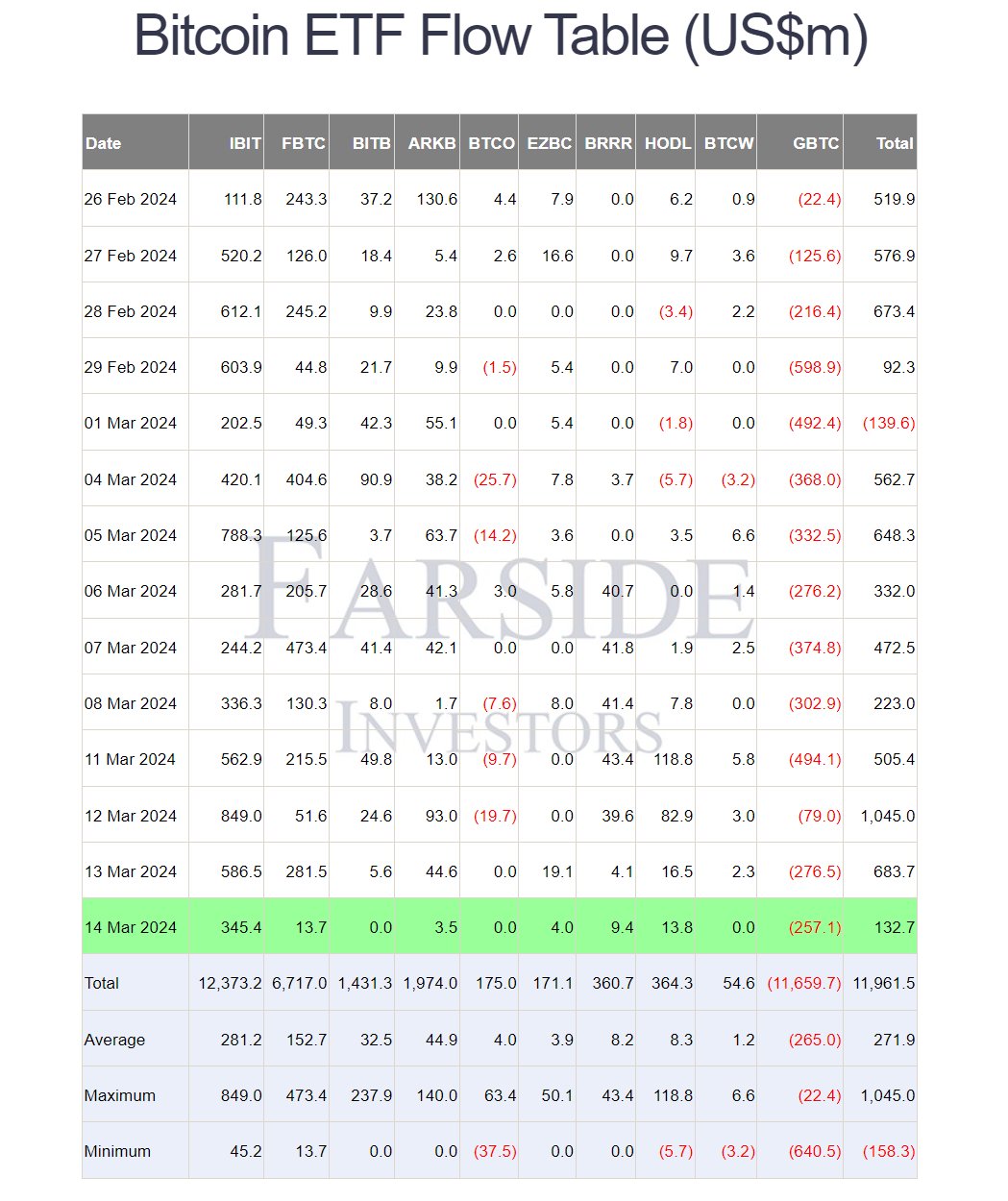

Following a grounds $1 cardinal nett inflow time for the spot ETF connected March 12, inflows dropped to conscionable $132.7 cardinal recently, with Blackrock contributing the lion’s stock astatine $345.4 million. Meanwhile, Fidelity and ARK saw minimal inflows of $13.7 cardinal and $3.5 cardinal respectively, aft a antecedently beardown week. GBTC outflows were reported astatine $257.1 million, aligning with mean levels.

Bitcoin ETF information | Source: X @FarsideUK

Bitcoin ETF information | Source: X @FarsideUKCrypto expert WhalePanda commented connected the situation, noting that contempt the reduced inflow, “$132.7 cardinal is inactive 2 afloat days of mining rewards.” He suggests a imaginable rebound successful the market, stating, “We’re conscionable ranging present and overleveraged radical getting borderline called. I conjecture the adjacent determination up is for adjacent week.”

At property time, BTC traded astatine $67,916.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)