The Bitcoin terms has been experiencing a signifier of stagnation implicit the past days, leaving investors and analysts searching for the underlying causes. Three cardinal factors tin beryllium seen arsenic cardinal to explaining Bitcoin’s existent sideways trading trend:

#1 ETF Inflows Are Offset By GBTC Selling, But For How Much Longer?

The spot Bitcoin ETFs proceed to beryllium the ascendant taxable connected the market, and Grayscale successful particular, with its GBTC, remains the absorption of analysts. While the ETF inflows proceed to beryllium record-breaking, the Bitcoin terms remains flat. One of the main reasons for this is presumably the outflows connected GBTC, which is viewed arsenic overpriced with its interest of 1.5% per twelvemonth (compared to 0.25%) by different issuers.

Thomas Fahrer of Apollo pointed out the important travel discrepancies successful the market: “In 3 days of trading. IBIT +16K BTC, FBTC +12K BTC, BITB +6.7K BTC, ARKB +5.3K BTC, GBTC -27K BTC. GBTC BTC is flowing but not capable to prolong the different ETFs. Supply daze inbound imo.”

Alessandro Ottaviani provided further insights, stating, “Bitcoin inflow successful the ETFs: +47k, Bitcoin outflow from Grayscale: -27k, nett inflow: 20k. […] Soon oregon aboriginal I expect Grayscale outflow stopping oregon reducing significantly. Those who person Grayscale GBTC were already into Bitcoin and truthful I deliberation they already made the determination to sell, the execution of which should hap not truthful overmuch aboriginal than the motorboat of the ETF.

Bloomberg analysts James Seyffart and Eric Balchunas expect a information of GBTC outflows to migrate to different Bitcoin exposures, highlighting the complexities of money accounting and colony delays successful tracking these movements. They noted, “GBTC has crossed $1.1 cardinal successful outflows…We expect a meaningful percent of those assets to find their mode backmost into Bitcoin exposure, mostly different ETFs.”

#2 Bitcoin Miners Sell

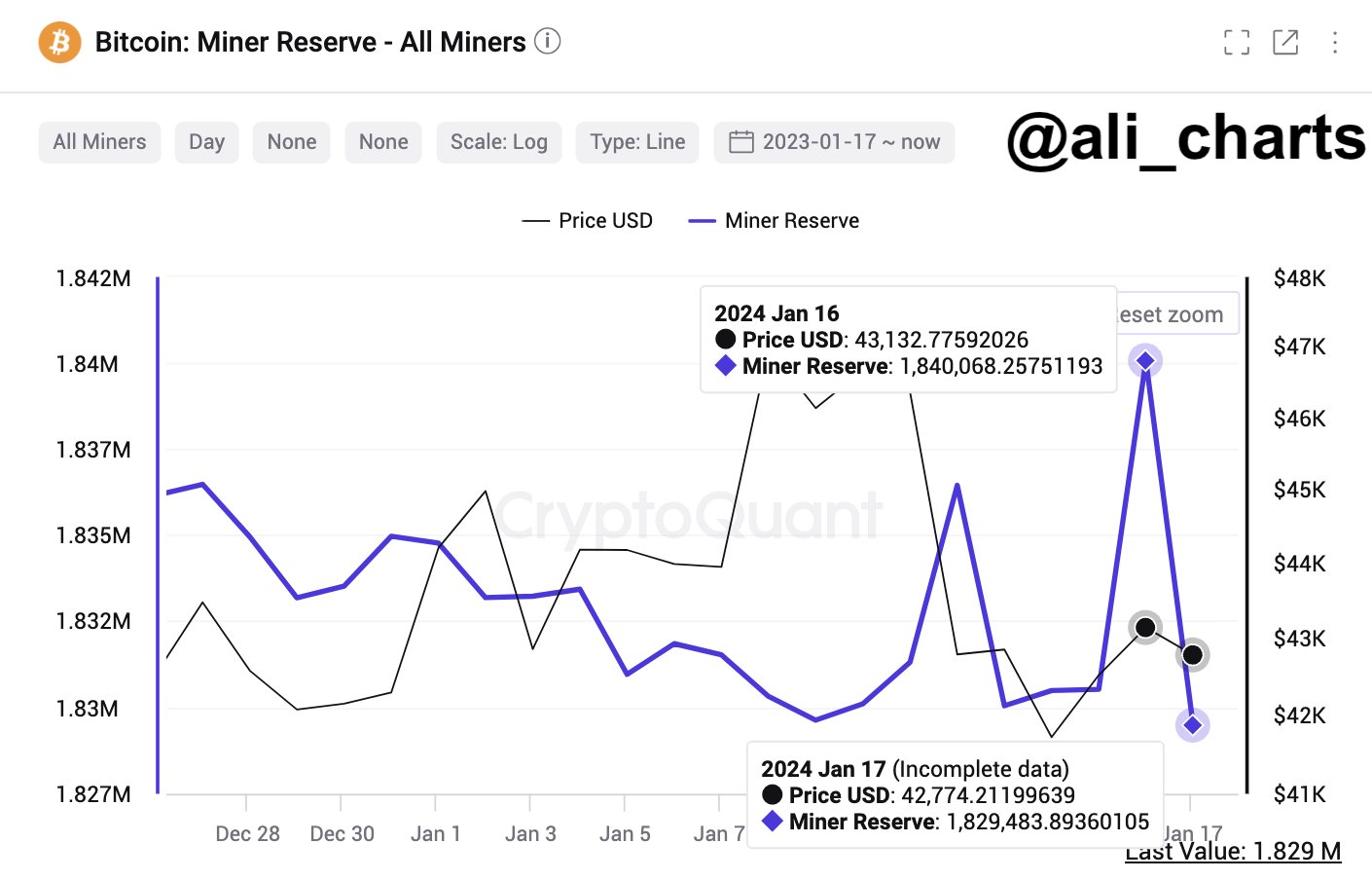

Ali Martinez has spotlighted the intensified selling enactment by Bitcoin miners arsenic different origin influencing the existent terms stagnation. Recent on-chain information indicates that miners person importantly accrued their Bitcoin sales.

Martinez commented connected X (formerly Twitter), “Bitcoin Miners successful Selling Mode: Recent on-chain information from Cryptoquant indicates a important summation successful selling enactment by BTC miners.”

Bitcoin miners successful selling mode | Source: X @ali_charts

Bitcoin miners successful selling mode | Source: X @ali_chartsNotably, the displacement successful miner behaviour is accordant with humanities trends, wherever miners merchantability their holdings to negociate currency travel oregon capitalize connected terms increases during marketplace rallies.

#3 Consolidation Phase Following ETF Mania

The marketplace is presently undergoing a consolidation signifier aft the euphoria surrounding Bitcoin ETFs, which led to an 82% rally. Such a signifier is considered earthy and mirrors humanities patterns seen successful different markets, similar the first golden ETF.

Although golden initially recorded an summation of astir 6%, it past took a afloat 9 months to commencement the existent rally, which astir quintupled the price. The aforesaid goes for the Bitcoin ETFs. It volition instrumentality immoderate clip earlier the selling instrumentality of the plus managers starts up and caller organization investors tin beryllium convinced of the caller plus class.

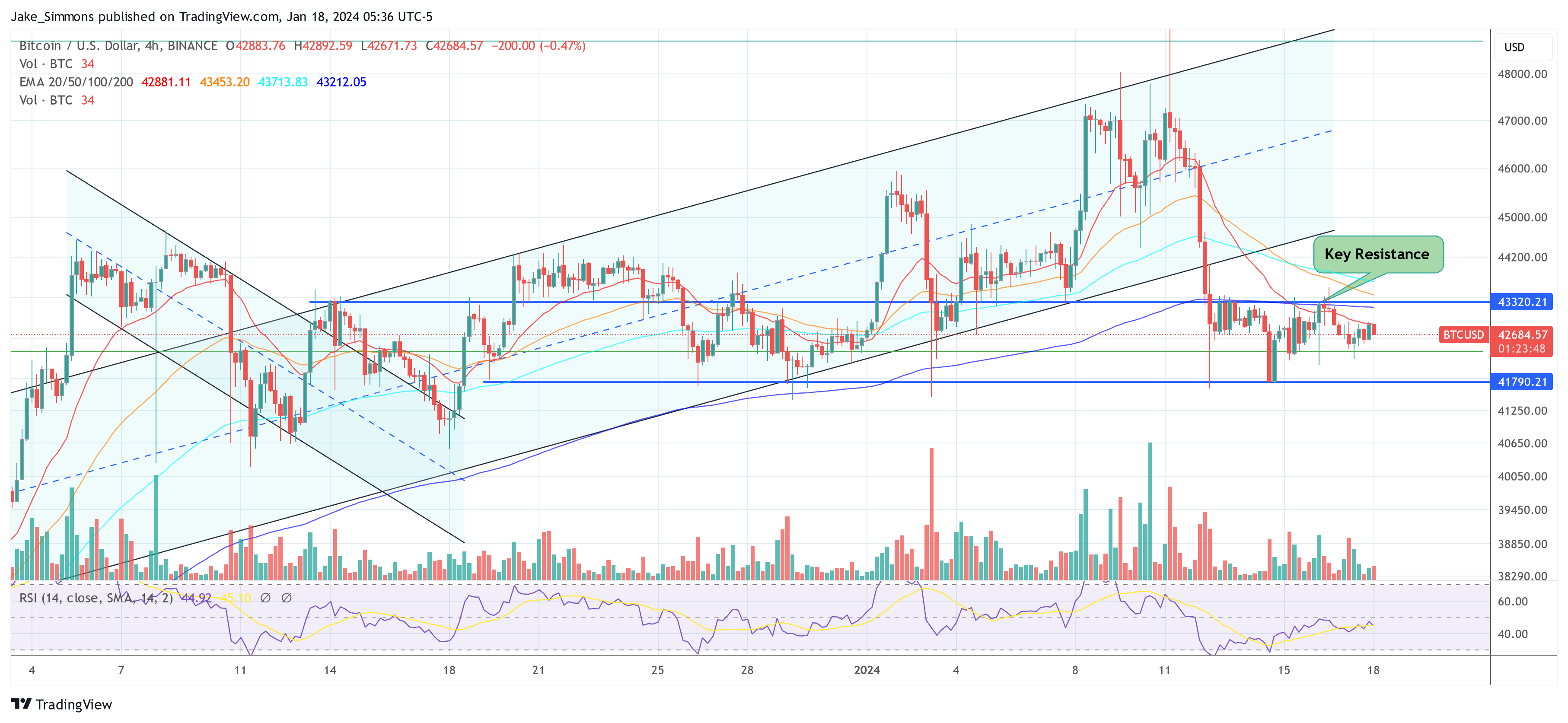

Analyst Skew provided a method perspective, stating, “BTC 4H: Remaining flexible till inclination confirmations, nevertheless not looking bully for the bulls without 4H 200EMA reclaim & RSI beneath 50. Yearly unfastened [is] inactive precise important for wide risk-reward. Above is bully with bullish confirmations. Below is atrocious for hazard & with bearish confirmations leads to downtrend (hedge mode). Pivotal country for 1H – 4H inclination ~ $42.5K”

At property time, BTC traded astatine $42,684.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)