Within the past 24 hours, the marketplace witnessed a important rally successful the Bitcoin price, which soared by 10% from a regular debased of $60,805 to a highest of $68,250. This singular terms question tin beryllium attributed to respective cardinal factors, including yesterday’s Federal Open Market Committee (FOMC) meeting, a notable alteration successful the Coinbase Premium, and Bitcoin’s method breakout from a downtrend channel.

#1 FOMC Meeting: Dovish Remarks By Jerome Powell Fuel Optimism

As reported yesterday, the macro situation came backmost into absorption for Bitcoin and crypto pursuing the hotter than expected Consumer Price Index (CPI) and Producer Price Index (PPI) ostentation information successful the US. Investors seemed to person de-risked their positions anterior to the FOMC event. However, investors got a favorable outcome.

The pivot constituent for Bitcoin’s rally tin beryllium traced backmost to the Federal Reserve’s latest FOMC meeting, wherever Chairman Jerome Powell delivered a code that the marketplace interpreted arsenic dovish. The Fed’s stance, particularly successful airy of caller ostentation data, has reassured investors.

Crypto expert Furkan Yildirim provided a summary of the FOMC’s cardinal points: “The ‘Dot Plot’ projections amusement that the median authoritative expects 3 quarter-percent cuts successful 2024 […] The FOMC voted unanimously to permission the national funds complaint unchanged […] The median forecast for PCE ostentation remains unchanged astatine 2.4% for 2024 […] Officials person besides raised forecasts for wherever they spot involvement rates successful the agelong term.”

The absorption to these announcements was instantly bullish successful the accepted concern markets arsenic good arsenic Bitcoin and crypto. QCP Capital, a Singapore-based crypto plus trading firm, highlighted the dovish quality of the FOMC’s stance: “1. In Powell’s property league speech, helium was not acrophobic astir the precocious ostentation numbers successful Jan and Feb. 2. In the dot plot, much members shifted their projection to 3 cuts successful 2024 (9 members vs 6 successful Dec).”

Analyst Ted (@tedtalksmacro) further emphasized the affirmative implications: “FOMC summary: – 3x complaint cuts happening this twelvemonth contempt ostentation remaining supra 2% (Fed expects halfway PCE astatine 2.6%). Growth outlook upgraded. Send it.”

#2 Coinbase Premium Turns Green: A Sign Of Spot ETF Demand

The Coinbase Premium’s displacement to affirmative territory tin beryllium identified arsenic different captious origin influencing Bitcoin’s terms movement. While yesterday’s ETF flows were antagonistic again for the 3rd time successful a row, the Bitcoin Coinbase Premium was a glimmer of anticipation that spot Bitcoin ETFs volition further substance price.

CryptoQuant expert Maartunn remarked: “Coinbase Premium is affirmative again. It’s astir +$50. Beautiful.” The Coinbase Premium is important for BTC terms successful caller months arsenic it reflects the request from spot Bitcoin ETFs earlier the existent numbers are released 1 time later. Coinbase custodies 8 of 11 spot Bitcoin ETFs oregon astir 90% of the Bitcoin ETF assets arsenic a result. Thus, Coinbase premium is important for a continued rally.

Coinbase Premium is affirmative again. It's astir +$50. Beautiful 😁 https://t.co/YJhYLdbipc pic.twitter.com/Hd3xXsg7Bq

— Maartunn (@JA_Maartun) March 20, 2024

GBTC had $386.6 cardinal worthy of outflows yesterday. Notably, Blackrock lone had $49.3 cardinal of inflows, Fidelity had $12.9 million. This was 1 of the weakest inflow days for the starring Bitcoin ETFs truthful acold – a immense disappointment.

But renowned crypto expert WhalePanda remarked: “We pumped aft the FOMC and wide it was amended than what boomers expected. Price is present dumping connected the quality of antagonistic flows but I deliberation they’ll beryllium successful for a bully astonishment tomorrow.”

Yesterday's ETF flows were antagonistic again for 3rd successful a row.$GBTC had $386.6 cardinal worthy of outflows.

Blackrock with lone $49.3 cardinal of inflows and Fidelity with $12.9 million.

I person a suspicion that the existent flows volition lone beryllium disposable successful tomorrow's numbers.

We pumped… pic.twitter.com/WVTntqG1by

— WhalePanda (@WhalePanda) March 21, 2024

#3 BTC Price Breaks Out Of Downtrend Channel

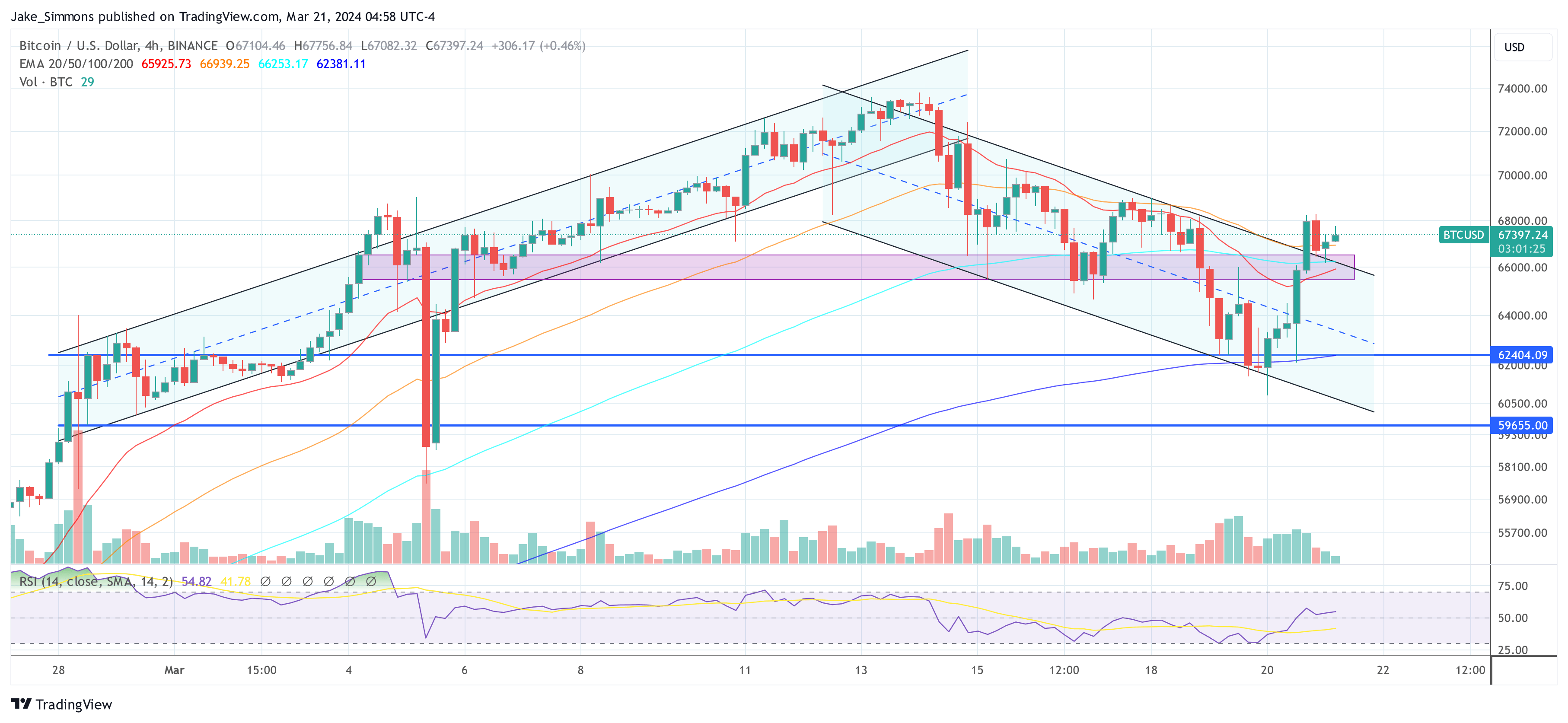

On the method front, Bitcoin’s breakout from a parallel downtrend transmission has caught the attraction of traders and analysts alike. Daan Crypto Trades highlighted the value of this question connected X (formerly Twitter): “Bitcoin tested its 4H 200MA/EMA and has been holding nicely determination and broke out. Still watching this transmission which volition dictate BTC’s adjacent move.”

#Bitcoin Tested its 4H 200MA/EMA and has been holding nicely determination and broke out.

Still watching this transmission which volition dictate $BTC's adjacent move.

Bulls would privation to spot this consolidate supra and not autumn backmost into the channel. pic.twitter.com/94etUo6YAR

— Daan Crypto Trades (@DaanCrypto) March 20, 2024

The illustration shared by Daan shows that BTC terms has been consolidating successful a parallel downtrend transmission for much than a week. Yesterday’s surge catapulted the terms supra the channel. Currently a retest is taking place. If this is successful, the BTC terms could rally further north.

At property time, BTC traded astatine $67,397.

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALLE, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)