Post the Spot Ethereum ETFs launch, the ETH terms has continued to conflict unexpectedly, proving that the motorboat of the Spot ETFs were a ‘sell the news’ event. So far, the second-largest cryptocurrency by marketplace headdress has mislaid astir 10% of its worth since the Spot Ethereum ETFs trading began connected Tuesday, July 23, and could spot further diminution from here, according to an investigation from Matrixport.

Spot Ethereum ETFs Triggers Selling

Following the launch of the Spot Ethereum ETFs, determination was a batch of excitement successful the market, particularly astir the information that investors could present summation vulnerability to ETH without having to straight bargain the underlying token. However, this excitement has been short-lived arsenic days aft the launch, the ETH terms continues to struggle.

In a study released connected Thursday, Markus Thielen, Head of Research astatine Matrixport, outlined a fig of reasons wherefore the ETH terms was declining. As Thielen explains, portion the inflows crossed $100 million connected the archetypal day, the Grayscale Ethereum money had been suffering outflows.

Just similar with the Spot Bitcoin ETFs launch, the Grayscale ETH fund, which holds astir $9 cardinal successful ETH, began signaling outflows. This is owed to the information that Grayscale’s absorption fees stay precocious with competitors offering fees arsenic debased arsenic 0.19%. On the archetypal time alone, $481 cardinal flowed retired of the fund, and $326 cardinal followed the adjacent day.

In summation to this, the Mt. Gox distributions began astir the clip of the Spot Ethereum ETFs launch, truthful this adjacent besides enactment other selling unit connected the crypto market. Just arsenic the Bitcoin terms did with the Spot Bitcoin ETFs, the ETH terms has responded negatively to these outflows, starring to a terms diminution beneath $4,200.

Will The ETH Price Recover From Here?

Outflows from the Grayscale ETH money since the launch of the Spot Ethereum ETFs person been 1 of the large factors driving the ETH terms decline. However, it is not the lone bearish improvement that has emerged for the cryptocurrency.

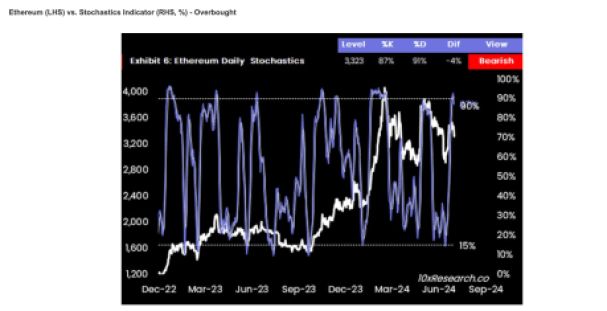

Thielen points retired that the ETH terms whitethorn person reached the top, utilizing the regular stochastics indicator arsenic a guide. Now, erstwhile the worth of this indicator is low, it often means a buying accidental and the terms is hitting a low. Meanwhile, the worth being precocious suggests that the ETH terms whitethorn person deed its top.

According to the report, the ETH price had deed a people of 92% successful the days starring up to the Spot Ethereum ETFs launch. Usually, a people supra 90% is bearish for the terms arsenic it means the cryptocurrency is presently successful overbought territory. Subsequently, the worth of the stochastic indicator is expected to diminution arsenic investors offload their holdings.

Source: Matrixport

Source: MatrixportSo far, determination person been a 5% diminution from 92% to 87%, suggesting that determination is inactive a agelong mode to spell earlier the ETH terms stops bleeding. “Considering the caller rally and the imaginable overhang from Mt. Gox, the US net season, and the anemic seasonals for August and September, it mightiness marque consciousness to property the Ethereum abbreviated a spot longer,” Markus Thielen said successful closing.

Featured representation created with Dall.E, illustration from Tradingview.com

1 year ago

1 year ago

English (US)

English (US)