On-chain information lets america spot the grade and scope of the enactment surrounding spot Bitcoin ETFs beyond its interaction connected BTC price.

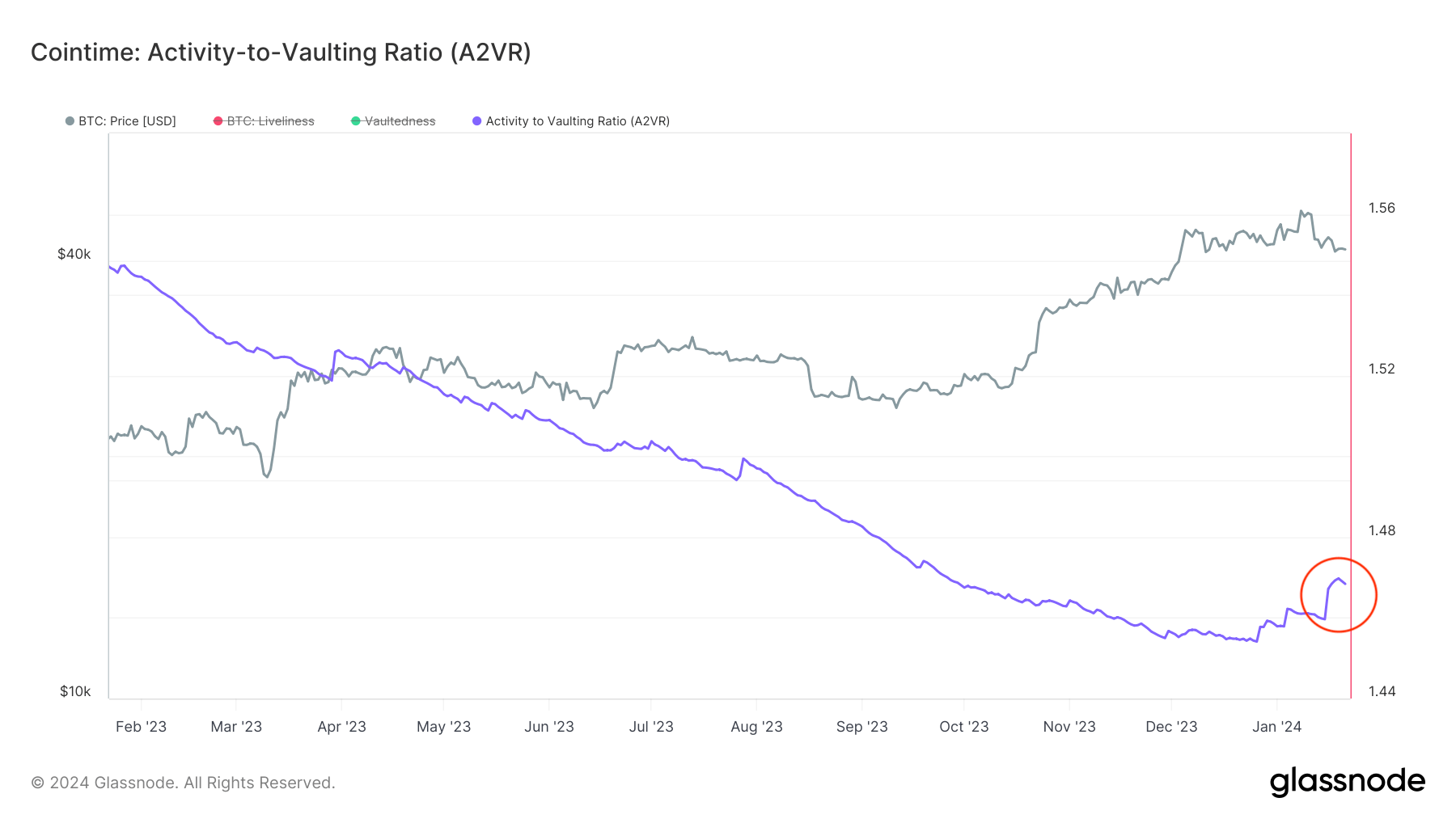

CryptoSlate’s investigation of on-chain metrics archetypal brought connected successful Glassnode’s Cointime Economics probe insubstantial shows however this affected the activity-to-vaulting ratio (A2VR). The A2VR metric assesses the equilibrium betwixt Bitcoin’s progressive and inactive proviso by comparing liveliness with vaultedness. It provides penetration into the behaviour of Bitcoin holders, indicating whether the inclination is towards holding oregon trading the asset.

The yearlong downtrend successful A2VR was breached successful precocious December past year.

Graph showing the activity-to-vaulting ratio (A2VR) from Jan. 19, 2022, to Jan. 22, 2024 (Source: Glassnode)

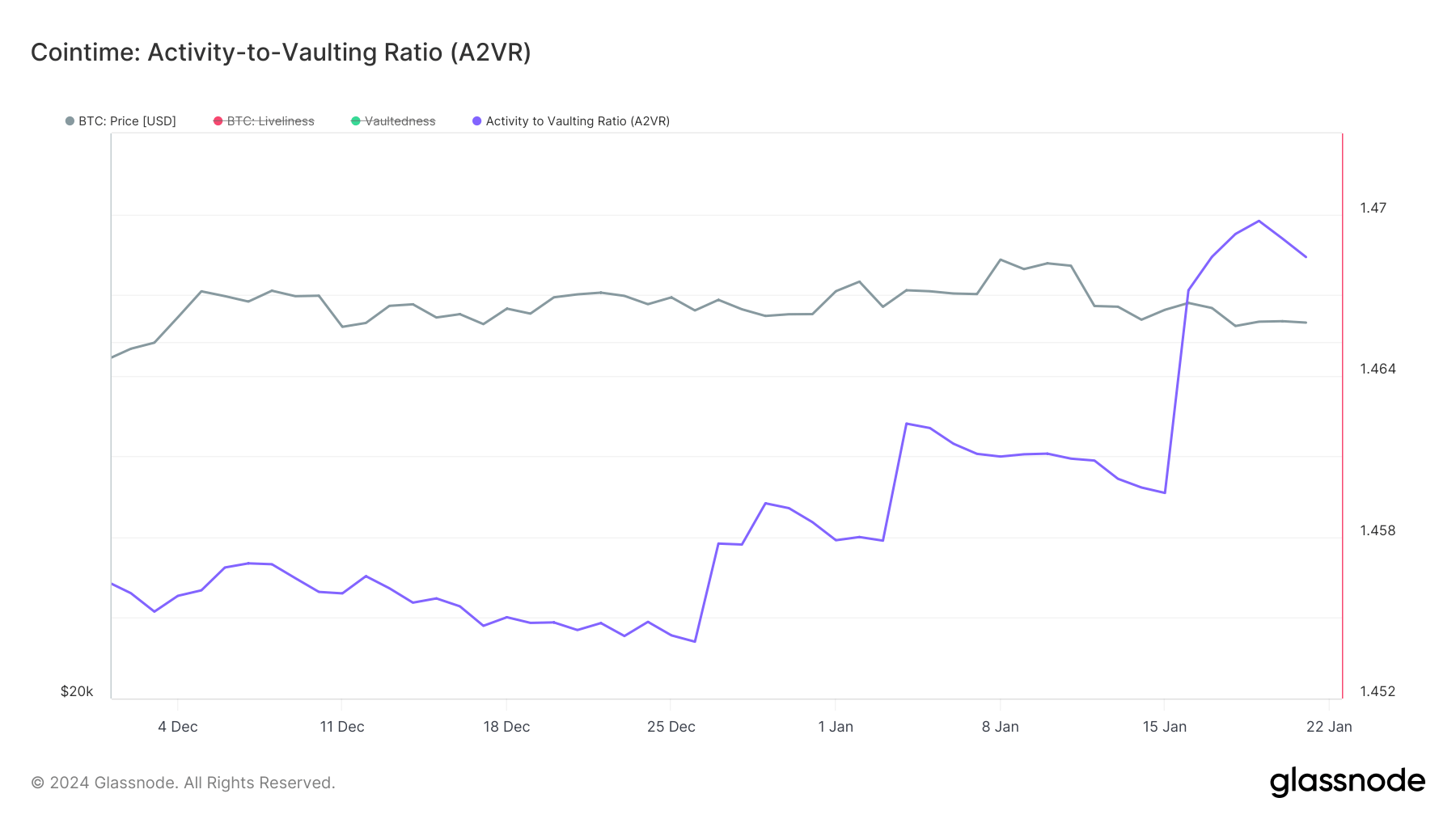

Graph showing the activity-to-vaulting ratio (A2VR) from Jan. 19, 2022, to Jan. 22, 2024 (Source: Glassnode)Between Dec. 26, 2023, and Jan. 19, 2024, determination was a notable summation successful A2VR from 1.4541 to 1.4697. This displacement from holding to accrued trading oregon liquidation of older coins was apt influenced by the market’s anticipation and consequent absorption to the volatility introduced by the motorboat of spot Bitcoin ETFs successful the U.S.

The decrease successful Bitcoin terms post-ETF motorboat and the uptrend successful A2VR suggest a short-term bearish sentiment. Yet, the caller increases successful A2VR hint astatine a displacement towards much progressive trading, with the steepness of the uptrends post-ETF motorboat indicating imaginable for further marketplace volatility.

Graph showing the activity-to-vaulting ratio (A2VR) from Dec. 2, 2022, to Jan. 22, 2024 (Source: Glassnode)

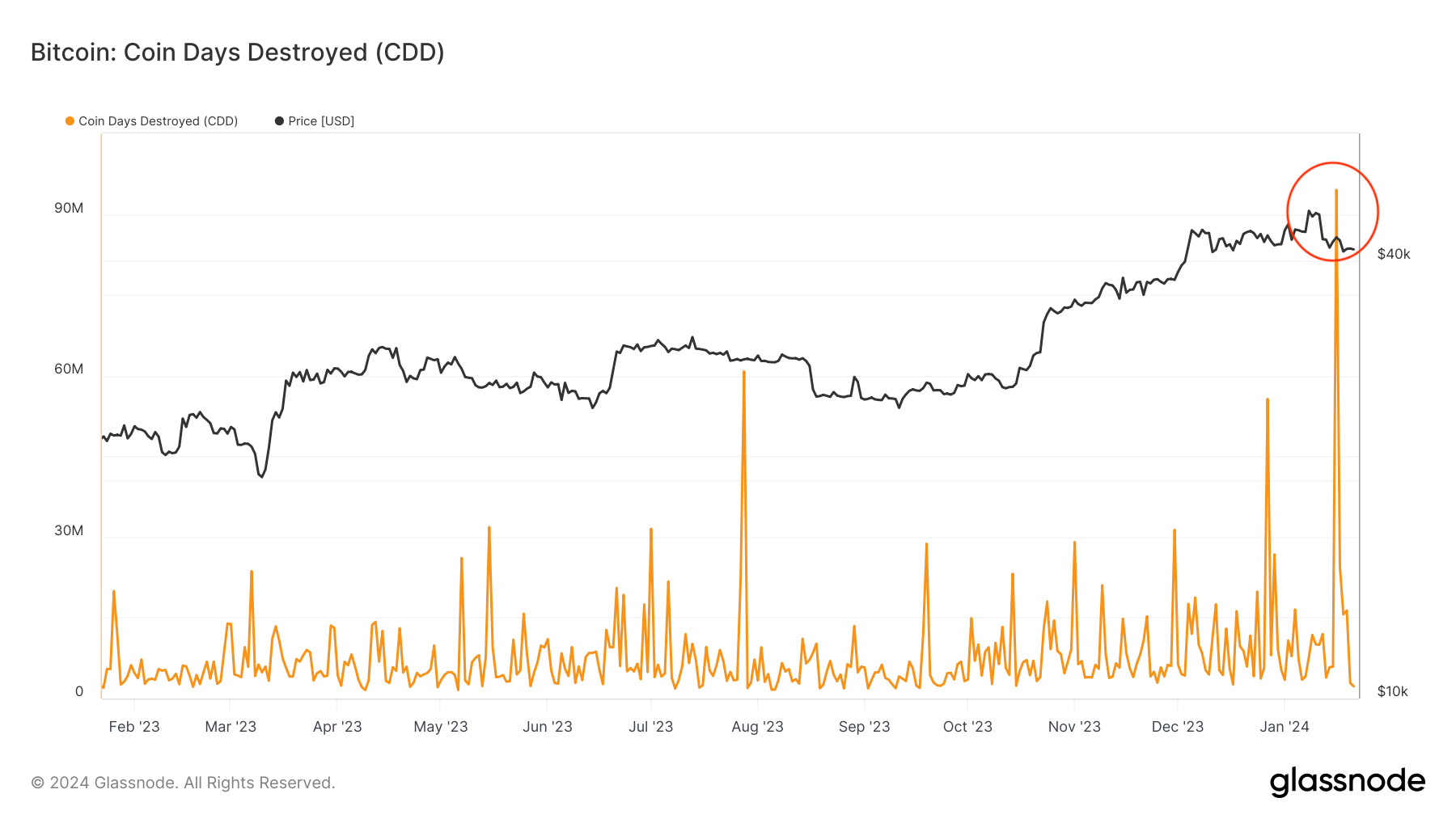

Graph showing the activity-to-vaulting ratio (A2VR) from Dec. 2, 2022, to Jan. 22, 2024 (Source: Glassnode)Coin Days Destroyed (CDD) is different precocious metric from Cointime Economics that provides much discourse for A2VR. CDD measures the sum of Bitcoin transaction volumes multiplied by the fig of days since those coins were past spent.

A precocious CDD worth indicates that ample amounts of aged Bitcoins are moving, which often signifies semipermanent holders transferring oregon selling their holdings. Between Jan. 14 and Jan. 15, CDD accrued dramatically from 5.91 cardinal to 94.5 million, reaching the highest level since February 2022. This important question of older, antecedently dormant Bitcoins aligns with an uptrend successful A2VR, signaling a displacement from inactivity to enactment successful the market.

Graph showing the coin days destroyed (CDD) from Jan. 19, 2022, to Jan. 22, 2024 (Source: Glassnode)

Graph showing the coin days destroyed (CDD) from Jan. 19, 2022, to Jan. 22, 2024 (Source: Glassnode)High CDD values during a play of expanding A2VR suggest that semipermanent holders, antecedently contributing to inactivity, are transitioning towards much progressive trading. This tin beryllium a captious indicator of marketplace sentiment, reflecting the behaviour of typically much blimpish investors.

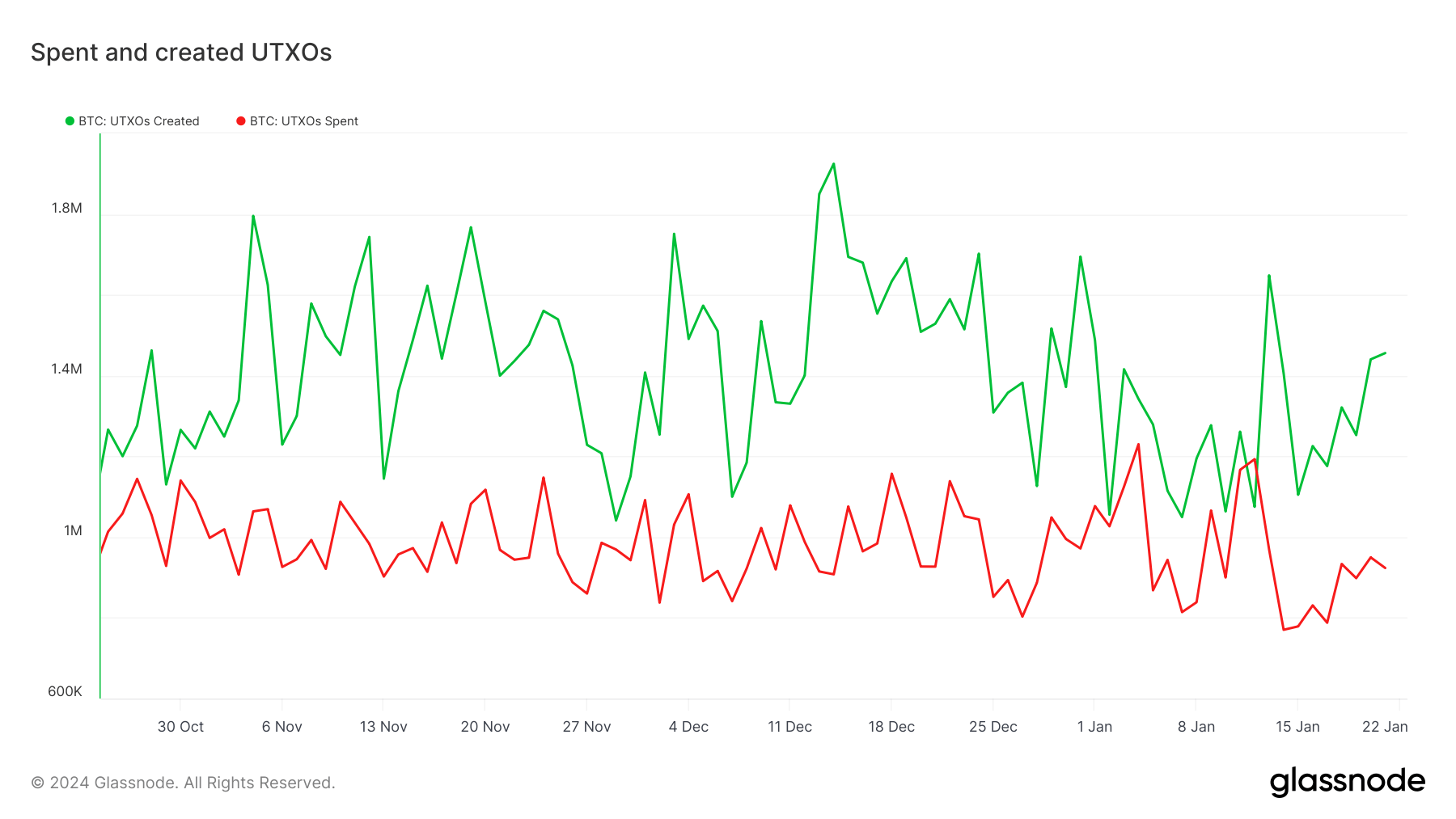

Despite these changes, determination hasn’t been a important summation successful speech flows oregon successful the fig of spent and created UTXOs. This suggests that portion older Bitcoins are being moved, these movements are not translating into a wide summation successful transactional volume. This could hap if large, aged transactions are executed, destroying galore coin days without creating a corresponding surge successful transactional activity.

Graph showing the fig of created (green) and spent (red) Bitcoin UTXOs from Oct. 25, 2022, to Jan. 21, 2024 (Source: Glassnode)

Graph showing the fig of created (green) and spent (red) Bitcoin UTXOs from Oct. 25, 2022, to Jan. 21, 2024 (Source: Glassnode)The discrepancies betwixt CDD, A2VR, and different metrics similar speech flows and UTXOs are apt owed to activities related to the issuance and trading of spot Bitcoin ETFs.

Authorized Participants (APs) are typically ample fiscal institutions liable for creating and redeeming shares of the ETF. When they get Bitcoin for ETFs, they usually bash truthful done Over-The-Counter (OTC) desks to minimize marketplace impact.

OTC transactions bash not look straight connected nationalist speech data, thereby not affecting disposable speech inflows oregon outflows. However, these transactions inactive impact the question of ample amounts of Bitcoin, which tin importantly lend to Coin Days Destroyed if the Bitcoins acquired person been dormant for a agelong time.

APs acquiring Bitcoin done OTC desks for ETFs tin importantly interaction CDD without affecting speech flows, arsenic these transactions bash not look successful nationalist speech data. Similarly, the modulation of investments from GBTC to ETFs involves large, on-chain movements that interaction CDD but whitethorn not importantly change UTXO counts oregon exchange-based travel metrics.

Grayscale’s GBTC has been a fashionable organization conveyance for Bitcoin exposure. With the motorboat of spot Bitcoin ETFs, GBTC saw massive outflows arsenic galore investors chose to determination their investments from GBTC to these caller ETFs owed to little fees. This modulation could impact the merchantability oregon redemption of GBTC shares and the corresponding acquisition of ETF shares.

The question from GBTC to ETFs could pb to on-chain transactions arsenic Bitcoin holdings are reshuffled betwixt assorted fiscal products. These movements, peculiarly if involving long-held BTC successful Grayscale’s reserves, could lend to accrued CDD. However, since these transactions mightiness beryllium managed internally oregon done OTC trades, they wouldn’t needfully pb to noticeable changes successful UTXO counts oregon exchange-based travel metrics.

While ETFs’ instauration and redemption mechanisms deficiency transparency, on-chain metrics similar CDD and A2VR inactive connection insights into their effects and magnitude. Understanding these metrics is important for comprehending the market’s effect to caller fiscal products and the behaviour of organization and semipermanent investors.

The station Why is truthful overmuch aged and hodled Bitcoin connected the determination but UTXOs and exchanges stay unaffected? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)