Bitcoin (BTC) saw a important resurgence implicit the past fewer hours aft hitting the lowest terms since June 21 astatine $28,641 yesterday. At property time, BTC has experienced a 3.7% hike from its low. In fact, BTC adjacent brushed past the $30,000 mark, indicating a important displacement successful marketplace sentiment. So, the question begs.

Why Is Bitcoin Up Today?

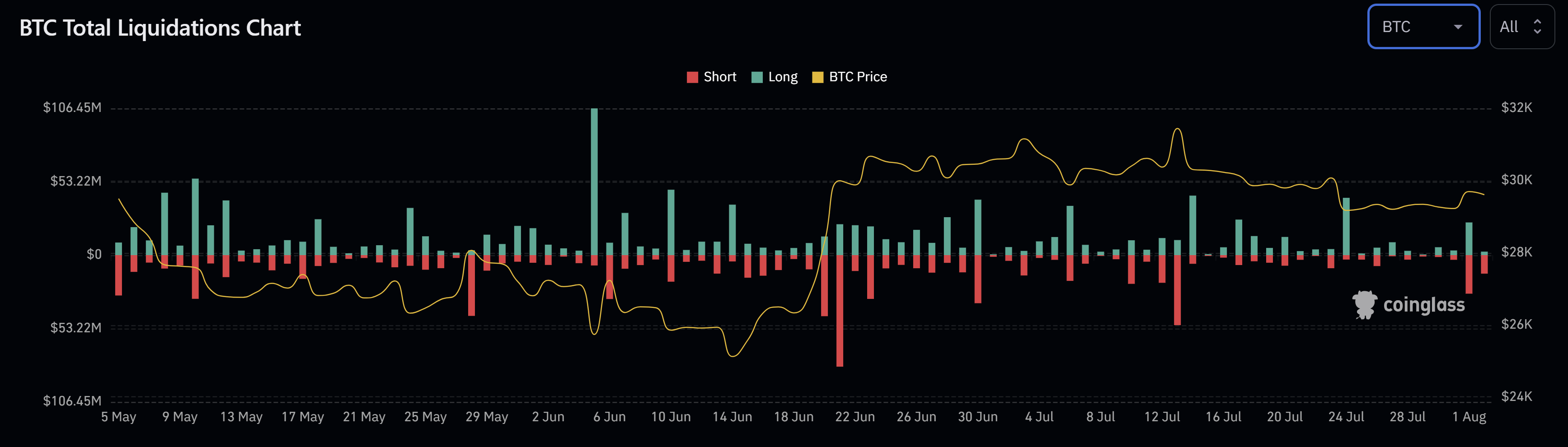

“The full abbreviated build-up of the past mates days conscionable got wiped,” tweeted expert Byzantine General. Data from Coinglass backs this assertion and shows that BTC abbreviated positions amounting to $27.8 cardinal were liquidated yesterday, followed by an further $13.45 cardinal today. This accounts for the astir important abbreviated liquidation since July 14, undeniably playing a important relation successful the existent terms movement.

BTC full liquidations | Source: Coinglass

BTC full liquidations | Source: CoinglassBut possibly the astir influential crushed for the abrupt displacement successful marketplace sentiment was MicroStrategy’s caller announcement. The institution stated that it volition behaviour banal income worthy $750 million. After the announcement, the Bitcoin assemblage was abuzz with speculation that Michael Saylor mightiness marque additional, gigantic BTC purchases.

“As with anterior programs, we whitethorn usage the proceeds for wide firm purposes, which see the acquisition of Bitcoin arsenic good arsenic the repurchase oregon repayment of our outstanding debt,” said Andrew Kang, MicroStrategy’s CFO during a caller net call. While it remains unclear if the full proceeds volition beryllium funneled into Bitcoin, the likelihood of a important chunk is certain. Directly aft this announcement, Bitcoin surged by 1.6% wrong 1 hour.

On-chain investigation steadfast Santiment tweeted: “Bitcoin has breached backmost supra $30k erstwhile again, with assistance from the galore traders who capitulated during the past week of terms declines. Volume is rising to footwear disconnected August, & this intelligence absorption transverse whitethorn displacement sentiment positive.”

The illustration shared by the steadfast shows that yesterday trading measurement picked up steam again, rising to the highest level since six weeks. Also, the lowest magnitude of nett / nonaccomplishment taking successful 7 months indicates a capitulation event.

Bitcoin sentiment displacement | Source: Twitter @santimentfeed

Bitcoin sentiment displacement | Source: Twitter @santimentfeedAnalyst @52Skew added that the Bitcoin connected the Binance spot marketplace experienced a “real spot demand” which helium wanted to spot for a beardown terms reaction. “Note the bounds bid partition that pushed up price; emblematic with PvP conditions to unit bounds chasing. Marked notable liquidity connected the orderbook,” the expert stated.

What’s Next?

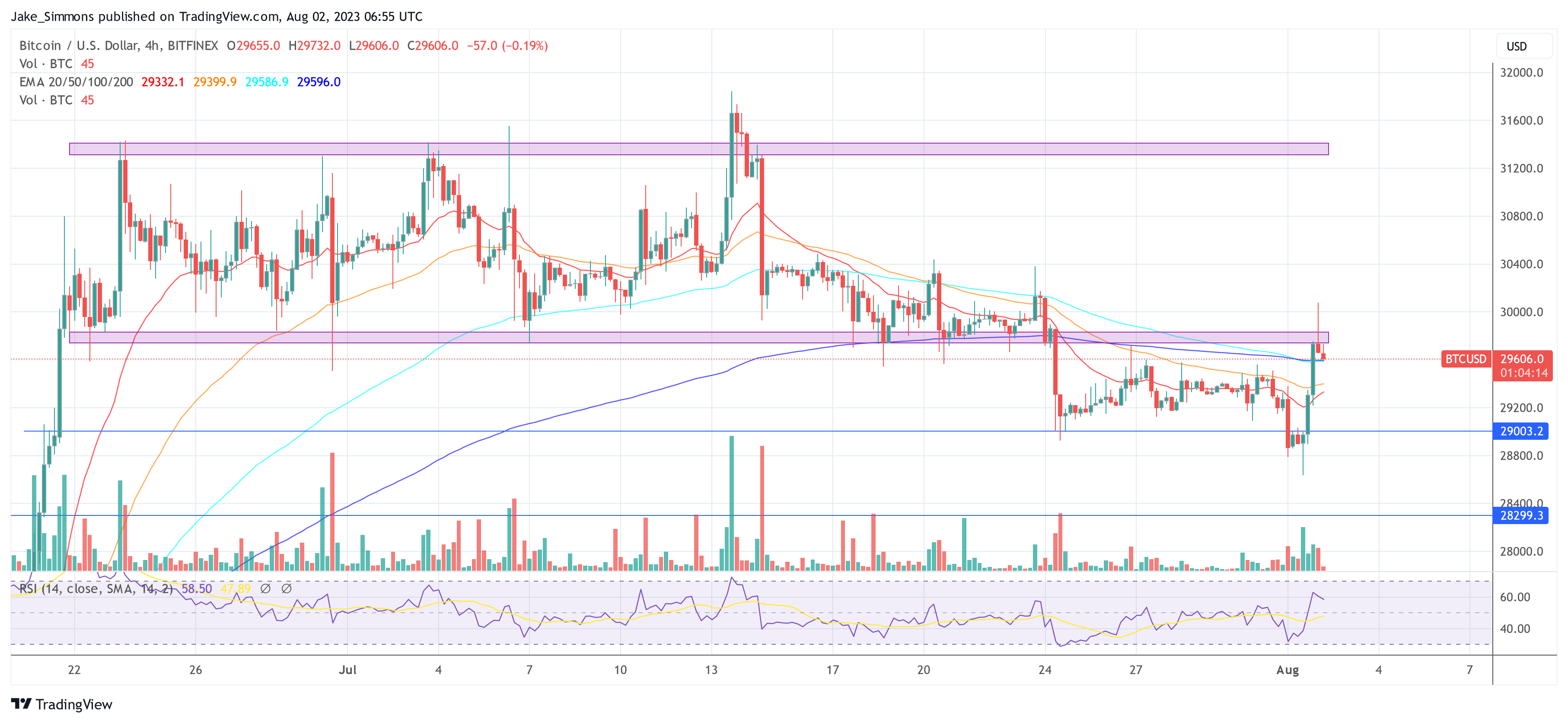

However, helium besides cautioned that the 4-hour illustration is truthful acold looking similar a classical Swing Failure Pattern (SFP) into a higher time-frame enactment / resistance. The Swing Failure Pattern, oregon SFP, is simply a benignant of reversal signifier wherever traders people stop-losses supra a cardinal plaything debased oregon beneath a cardinal plaything precocious to manipulate the terms absorption by generating capable liquidity.

Bitcoin SFP pattern? | Source: Twitter @52Skew

Bitcoin SFP pattern? | Source: Twitter @52SkewNevertheless, the marketplace appears to beryllium brimming with anticipation. As per @DaanCrypto: “If terms starts ranging present I’d look for different expanse of the lows and consolidation there. $28.5 & 29.5K are the areas of interest.” Meanwhile, a interruption supra the absorption portion astatine the monthly and play unfastened betwixt $29,236 and $29,300 would validate a bullish script wherever the terms targets $30,000.

BTC terms investigation | Source: Twitter @DaanCrypto

BTC terms investigation | Source: Twitter @DaanCryptoAt property time, BTC wasn’t capable to reclaim the reddish absorption portion and was trading astatine $29,606.

BTC terms beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.com

BTC terms beneath cardinal resistance, 4-hour illustration | Source BTCUSD connected TradingView.comFeatured representation from Kanchanara /Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)