Crypto expert Bull Theory has explained wherefore the Bitcoin terms has been crashing recently. The expert pointed retired that Wall Street traders were liable for the terms declines, indicating that these trading desks were manipulating the marketplace for their ain benefit.

Analyst Explains Why The Bitcoin Price Is Crashing

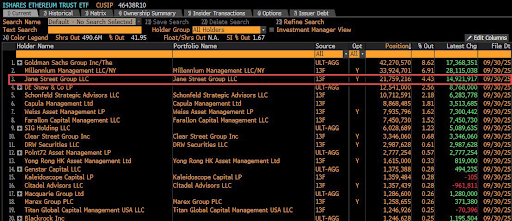

In an X post, Bull Theory blamed Jane Street for the Bitcoin price’s changeless clang astatine 10 a.m. ET erstwhile the U.S. marketplace opens. The expert pointed retired that BTC erased 16 hours of gains successful conscionable 20 minutes aft the U.S. marketplace opened. This has notably been happening since aboriginal November, erstwhile the flagship crypto fell beneath $100,000. Meanwhile, a akin terms enactment besides played retired successful the 2nd and 3rd quarters of this year.

Bull Theory noted that different analyst, Zerohedge, has claimed that Jane Street is astir apt the entity liable for this Bitcoin terms crash. The expert stated that the illustration shows a signifier that is excessively accordant to ignore, with a cleanable wipeout wrong an hr of the marketplace opening, followed by a dilatory recovery. He added that this is classical high-frequency execution and that it fits Jane Street’s profile.

Source: Chart from Bull Theory connected X

Source: Chart from Bull Theory connected XBull Theory stated that Jane Street is 1 of the largest high-frequency trading firms successful the satellite and that they person the velocity and liquidity to determination markets for a fewer minutes. The expert claimed that their behaviour is simple: dump BTC astatine the marketplace open, propulsion the Bitcoin terms into liquidity pockets, and past re-enter astatine a little price.

By doing this, the expert claimed that Jane Street has accumulated billions successful BTC. The trading steadfast is said to clasp $2.5 cardinal worthy of BlackRock’s Bitcoin ETF, which is its 5th-largest position. Bull Theory added that this means astir of the dump successful the Bitcoin terms isn’t owed to macro weakness but manipulation by this entity. He expects that BTC volition proceed its upward momentum erstwhile these large players are done buying.

Bitcoin At Risk Of A Decline Post-FOMC

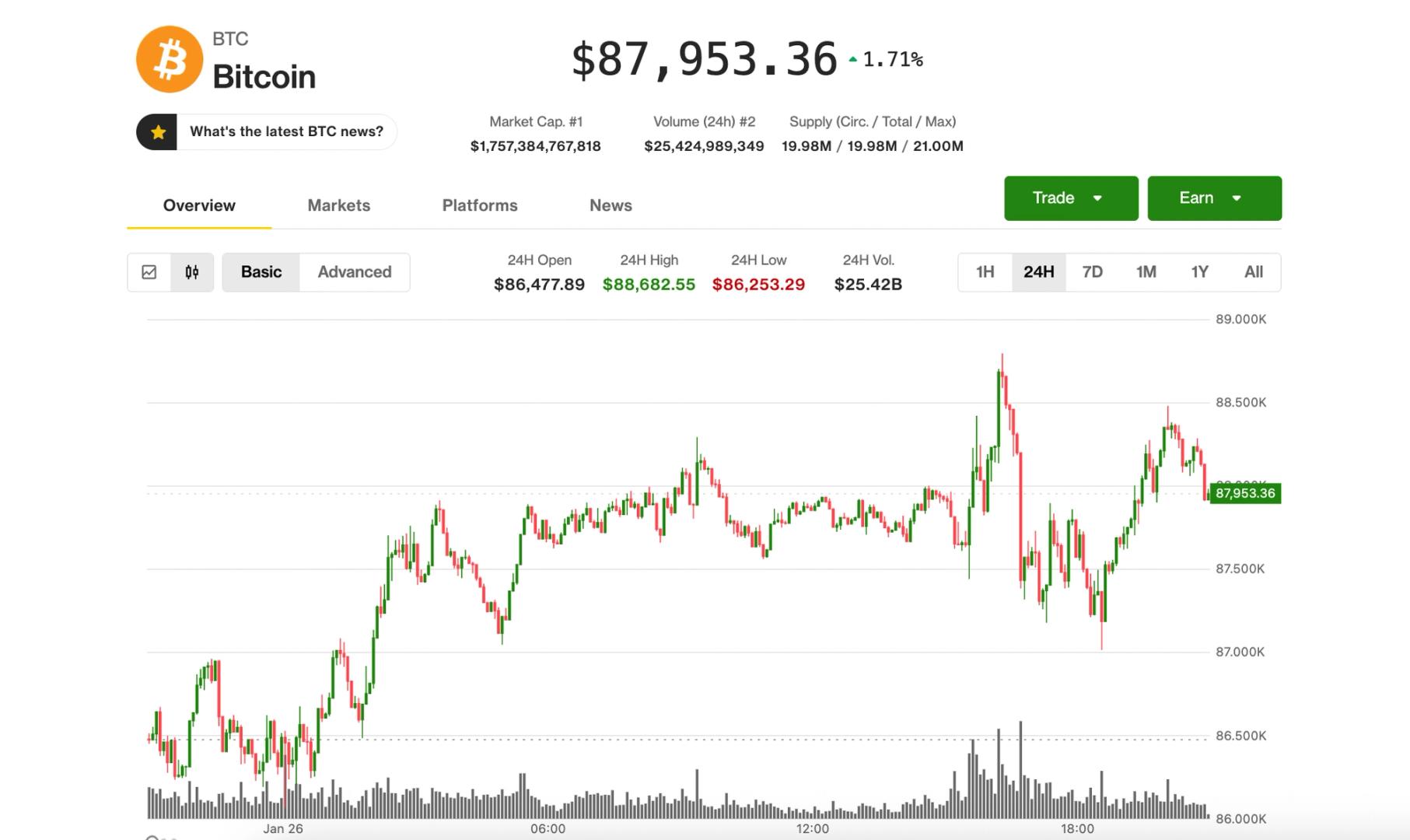

Crypto expert Ali Martinez indicated that the Bitcoin terms was astatine hazard of a important diminution pursuing today’s FOMC meeting. He pointed retired that BTC has consistently reacted negatively to FOMC meetings, with six retired of 7 meetings this twelvemonth starring to corrections for the flagship crypto.

The Bitcoin terms had rallied to arsenic precocious arsenic $94,500 yesterday successful anticipation of a 3rd complaint chopped this twelvemonth from the Fed. According to CME FedWatch, determination is presently a 90% accidental that the Fed volition little rates by 25 ground points (bps). A CryptoQuant report noted however these complaint cuts person turned retired to beryllium a ‘sell the news’ lawsuit connected the 2 occasions the Fed lowered rates this year, with the probability of this terms enactment playing retired again.

At the clip of writing, the Bitcoin terms is trading astatine astir $92,600, down successful the past 24 hours, according to data from CoinMarketCap.

Featured representation from Pixabay, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)