After the Bitcoin terms reached a three-month debased of $24.835 past week, the bulls presently look to beryllium gaining the precocious manus again. The BTC terms has continued its upward inclination successful the past 24 hours and has risen by 1.6% to presently $26,795. At 1 point, BTC had already deed $27,203 earlier a corrective determination took place.

Why Is Bitcoin Up Today?

As always, 1 tin lone speculate astir the reasons wherefore the Bitcoin terms is rising. But acknowledgment to the filing by BlackRock, the world’s largest plus manager, for a Bitcoin Spot ETF successful the US, bullish sentiment has returned to the market. A Bitcoin Spot ETF is predicted to unfastened the flood gates for organization investors.

As NewsBTC reported, the past of the archetypal golden ETF successful the US successful 2004 could beryllium an indicator of the bullish interaction that the support of a spot ETF could have. The golden ETF has been instrumental successful the adoption of golden by institutions. Within 8 years of the archetypal ETF, the terms of golden much than quadrupled.

Basically, the US Securities and Exchange Commission has 240 days (about 8 months) to determine connected the application. However, David Attley, CEO of Bitcoin Magazine, asserted yesterday that helium had heard a compelling statement that the BlackRock Bitcoin ETF could beryllium approved soon (“days to weeks”).

This quality whitethorn person had arsenic affirmative an interaction connected the marketplace arsenic yesterday’s quality that Fidelity whitethorn besides soon use for a Bitcoin Spot ETF on the lines of BlackRock. Obviously, crypto Twitter has go overmuch much bullish arsenic a effect of the BlackRock news.

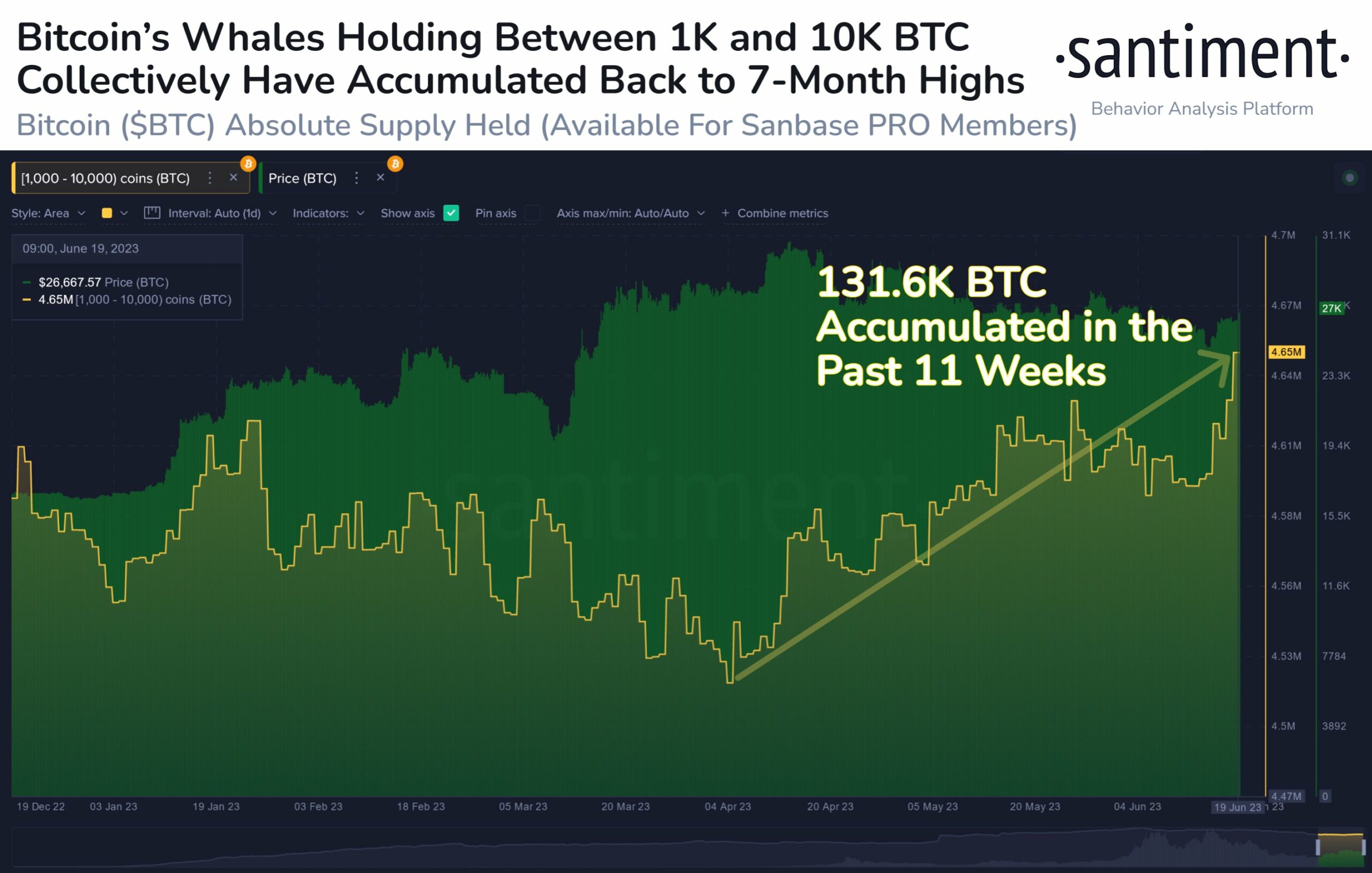

And ample investors successful BTC, alleged whales, person besides turned bullish connected the starring cryptocurrency for rather immoderate time. As reported by on-chain information analytics work Santiment, whales person been engaged implicit the past 2 months arsenic the assemblage watched the terms fall.

“Now backmost supra $27k erstwhile again, it’s acold from coincidence that wallets holding 1K to 10K $BTC person accumulated a combined $3.5B since the archetypal week of April,” Santiment states.

Whales buying portion the assemblage watches | Source: @santimentfeed

Whales buying portion the assemblage watches | Source: @santimentfeedIntraday trader @52Skew makes a akin reflection with respect to BTC perp CVD buckets & delta orders: “Whales mostly driving terms still, longs aped connected this bounce, shorts inactive twaping connected each bounce.”

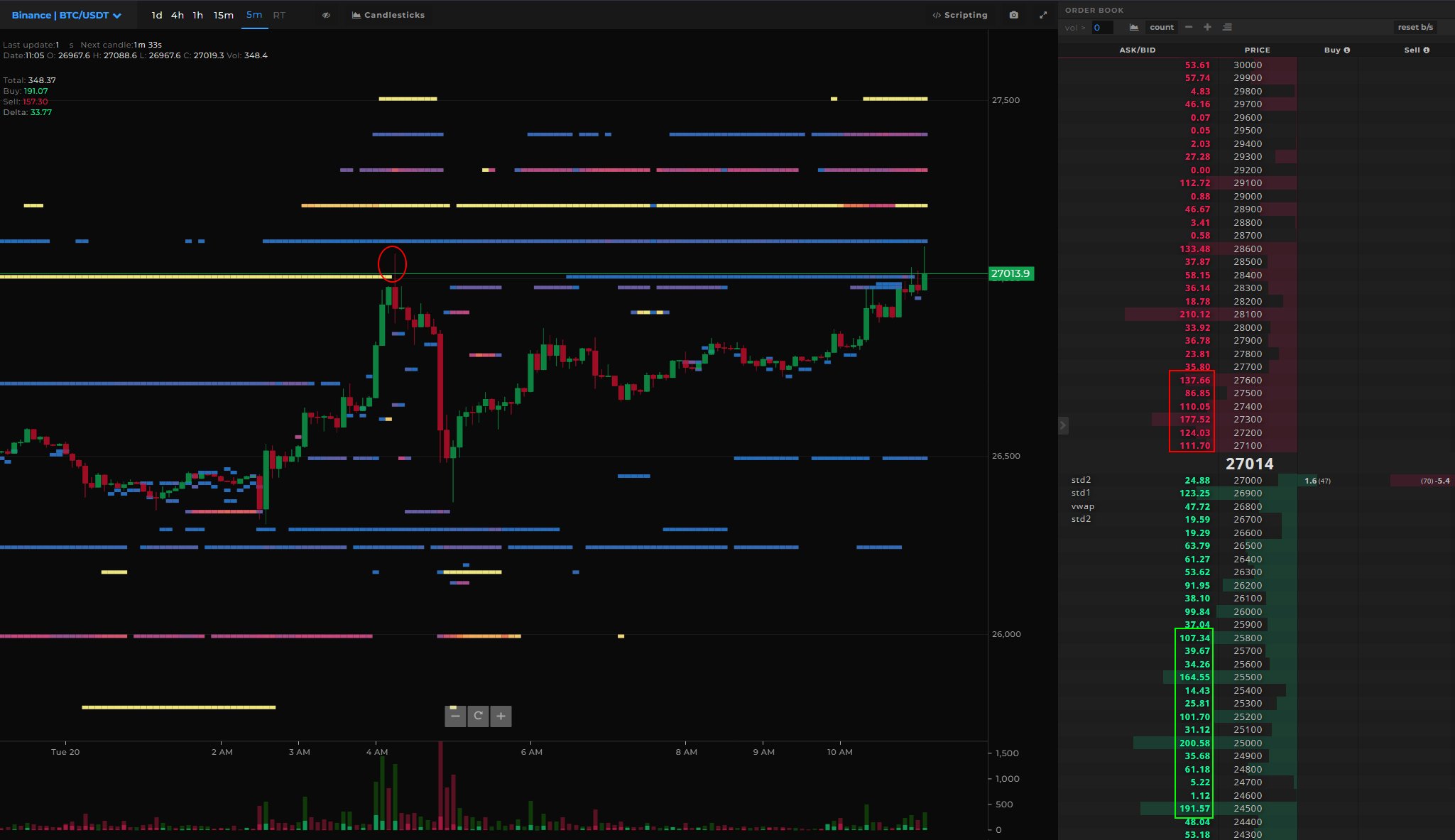

Moreover, the trader observed successful the past fewer hours that determination was a batch of request successful the spot marketplace connected Binance, the largest crypto exchange. According to him, spot buying is simply a motion of a sustained rally, truthful ideally spot buying needs to persist.

BTC Binance Spot | Source. Twitter @52Skew

BTC Binance Spot | Source. Twitter @52SkewIn presumption of the Binance unfastened involvement and funding, Skew states that galore shorts are chasing the terms aft the longs were squeezed earlier.

Outlook For H2 2023

Another bullish interaction connected the marketplace could beryllium the method illustration outlook for the 2nd fractional of the year. As Aksel Kibar, Chartered Market Technician (CMT), writes via Twitter, BTC could beryllium connected the verge of a breakout from the correction that has been taking spot since mid-April:

Looks similar we person a valid downward sloping transmission connected $BTCUSD with the precocious bound acting arsenic short-term absorption astatine 27K. Breakout from the transmission tin implicit the existing pullback to the larger standard H&S bottommost reversal.

Breakout from channel? | Source: Twitter @TechCharts

Breakout from channel? | Source: Twitter @TechChartsAt property time, the Bitcoin terms saw a flimsy correctional determination and was trading astatine $26,795.

Featured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)