According to information from trading steadfast Webull, astir 70% of Grayscale GBTC holders apt stay successful profit. The mean shares were purchased astatine $27.82, immoderate 20% beneath the existent terms arsenic of property time.

The Webull data shows the authorities of the spot the time earlier its conversion to a spot Bitcoin ETF and indicates that 70% of investors had a outgo scope betwixt the $18.84 and $27.24 range.

Grayscale holders successful profit

Grayscale holders successful profitIn presumption of distributions, the archetypal attraction of shareholders appears to beryllium positioned betwixt $33 and $40. With the terms astatine $34.9 arsenic of property time, it volition beryllium absorbing to spot whether the bottommost of this scope acts arsenic a enactment for the terms amid continued outflows.

The 2nd attraction is overmuch lower, betwixt $18 and $21. This radical volition stay profitable until the GBTC terms falls different 39%.

Should the terms autumn to this level and its assets nether absorption spot an equivalent decline, we’d witnesser a further 230,000 BTC deed the OTC desks, worthy astir $8.9 cardinal arsenic of property time.

Such a driblet would permission Grayscale with astir 350,000 BTC, which astatine a 1.5% absorption interest would inactive make approximately $200 cardinal successful revenue if Bitcoin retained a worth of astir $39,000. This underlines the deficiency of unit connected Grayscale to little fees on with the seemingly limitless imaginable for Grayscale investors to instrumentality profits. With fewer inflows into the ETF, the percent of investors successful nett is precise high.

Thus, determination is surely an statement to beryllium made that Grayscale’s unit connected Bitcoin’s terms done profit-taking could beryllium arsenic terrible arsenic a near-40 % drawdown. For bears successful the audience, a 40% driblet for Bitcoin close present would instrumentality it to May 2023 lows of astir $23,000.

Potentially 100% of Grayscale investors successful nett astatine conversion.

Since its conversion, the ETF has seen considerable outflows totaling astir $3.5 billion. Its assets nether absorption person besides fallen to $22.1 cardinal (552,681 BTC) from a year-to-date precocious of $29 cardinal (623,390 BTC) connected Jan. 10. In dollar terms, its AUM all-time precocious was really further back, aligning with the apical of the 2021 bull marketplace astatine a staggering $44 cardinal (651k BTC.)

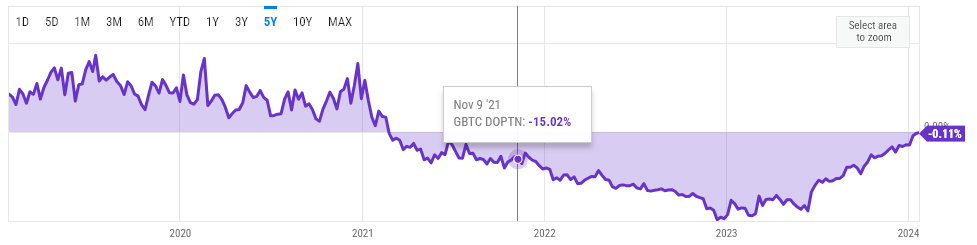

Interestingly, adjacent astatine the apical of the market, concerns astir the trust’s constitution resulted successful it trading astatine a 15% discount to its nett plus worth (NAV), representing a terms apical of astir $58,000 alternatively of the spot terms of $69,000. This discount continued to summation until the commencement of 2023, reaching -47% astatine its lowest.

GBTC discount/premium chart

GBTC discount/premium chartThrough the exertion and eventual occurrence of its conversion to a spot Bitcoin ETF, the discount has each but disappeared to a specified -0.11% arsenic of Jan. 23.

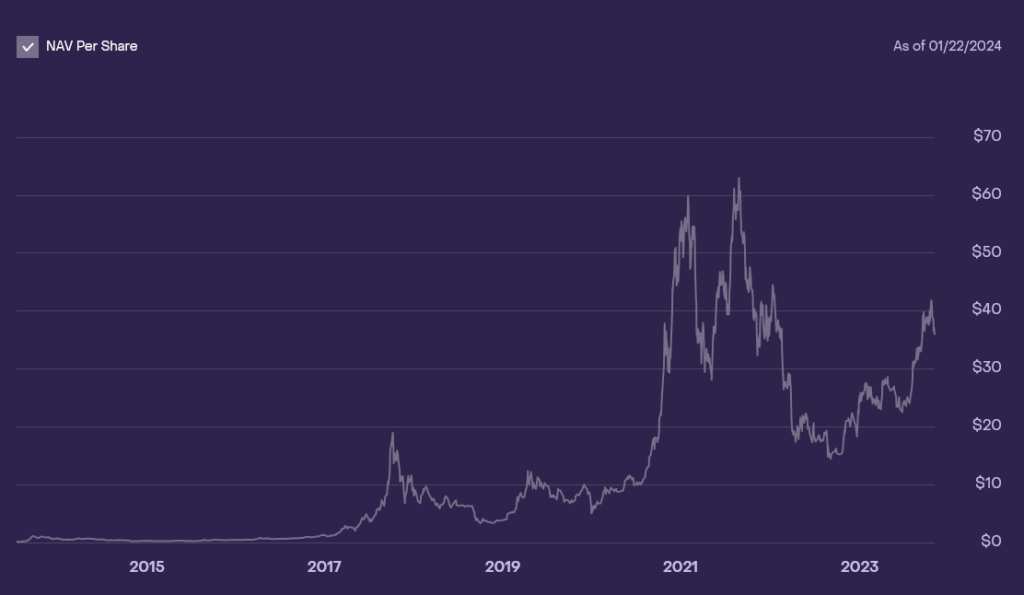

Interestingly, the presumption outgo organisation illustration from Webull supra indicates that each investors who bought astir $40.53 exited the spot earlier its conversion. Compared with the illustration beneath of the humanities NAV price, GBTC mostly traded supra $40.53 for astir 12 months betwixt May 2021 and Jan. 2022. However, Webull information suggest that erstwhile the spot closed connected Jan. 10, its past time earlier its conversion to an ETF, 100% of shares were profitable.

GBTC NAV implicit time

GBTC NAV implicit timeThe TradingView illustration beneath supports this claim, arsenic it closed retired astatine its highest terms successful 17 months. What is much astonishing is the fig of investors who had already exited the money aft having entered astatine higher prices passim 2021.

GBTC TradingView chart

GBTC TradingView chartFollowing the revelation that overmuch of the outflows from GBTC were a effect of FTX liquidations, galore successful the Bitcoin assemblage were buoyed by the imaginable of the ETF outflows slowing down. However, a further 17,000 BTC was sent to Coinbase Prime today, Jan. 23, with nett outflows of astir 15,000 BTC, valued astatine astir $600 million.

grayscale outflows (source: Arkham Intelligence)

grayscale outflows (source: Arkham Intelligence)The precocious fig of investors successful profitable positions puts the ETF successful a precarious presumption for further outflows. Yet, the interaction this volition person connected the spot Bitcoin terms volition lone beryllium seen with time. Trades betwixt the ETF issuers and its trading counterparty, Coinbase, hap implicit the counter. (OTC), frankincense having a constricted effect connected the underlying Bitcoin terms directly.

Still, this is lone existent arsenic agelong arsenic determination are buyers acceptable to get Bitcoin. Should the OTC liquidity adust out, the terms interaction could beryllium monumental. However, fixed the organization request for Bitcoin, I cannot ideate investors similar Michael Saylor turning down the accidental to get immoderate inexpensive Bitcoin.

The station Why astir Grayscale investors whitethorn stay successful nett if GBTC falls further 20% to $27 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)