This is an sentiment editorial by Wilbrrr Wrong, a Bitcoin pleb and economical past enthusiast.

In this article, I picture my acquisition successful utilizing bitcoin-collateralized loans, of the benignant offered by Holdhodl oregon Unchained Capital. I employed these loans during the bull tally of 2020-2021, utilizing immoderate wide rules of thumb, nevertheless precocious I've made a survey which shows that they could beryllium utilized with greater information if a much systematic attack is enactment successful place.

I'll marque the caveat astatine the outset that my signifier whitethorn good beryllium criticized arsenic failing to “stay humble.” Certainly galore pundits would counsel against these ideas, for illustration successful this “Once Bitten” episode with Andy Edstrom.

I've had a longstanding involvement successful the usage of humble amounts of leverage successful fiscal strategies, and these ideas are presented solely to papers my experience, and however it could person been improved.

Motivations

The archetypal information for this strategy came from the fantabulous publication “When Money Dies,” which details the step-by-step process of however Germany spiraled into hyperinflation successful 1920-1923. One striking communicative from this play is that galore Germans became rich, portion the currency and state were going done hell. These investors took retired deutschmark loans, and utilized them to bargain hard assets similar existent estate. Then aft 1 to 2 years, they would wage disconnected their loans with deutschmarks that had go astir worthless, and they would inactive beryllium successful possession of the existent happening — a house, for example.

The 2nd information came from reasoning astir Treasury absorption strategies. Managing a bitcoin stack seems analogous to the issues that Saudi Arabia faces, with their lipid resources. In peculiar — they person a invaluable resource, and they person expenses. They privation to usage their resources to maximize their purchasing power, and physique wealthiness for the future. Of course, Saudi Arabia has different geopolitical considerations arsenic well, but successful general, this is the contented faced by immoderate household bureau oregon wealthiness manager.

Previous Experience

I utilized the “deutschmark loan” strategy to bully effect successful the bull marketplace of 2020-2021, nevertheless I was not systematic. I went with subjective judgement for erstwhile to instrumentality retired loans, and however to size them. I had the wide guiding principles:

- When initiating a caller loan, effort to support full portfolio loan-to-value astatine 20%. In different words, effort to support the USD worth of the indebtedness publication astatine 20% of the USD worth of the bitcoin that I had allocated to this strategy. In this case, I would beryllium capable to withstand a 50% drawdown successful BTC price.

- Try not to sell. I had beauteous good drank the Kool-Aid that BTC would scope $200,000-plus, and I didn’t privation to get shaken out.

All loans were bitcoin collateralized loans, of the benignant offered by Hodlhodl oregon Unchained Capital. A main diagnostic of these loans is that they get liquidated if the bitcoin backing the loans falls successful worth — fundamentally a borderline loan. For example: if you instrumentality retired a $50,000 loan, past you request to over-collateralize, and enactment up $100,000 worthy of bitcoin. If the worth of the bitcoin falls to $70,000, past you’re required to station further BTC, oregon your collateral volition beryllium liquidated.

I did reasonably good with these ideas. I survived the Elon/dogecoin drawdown, and held connected for the Q4 2021 bull run. But past I held connected excessively agelong successful the 2022 Federal Reserve-induced carnivore market. Following this experience, I decided to survey whether a much systematic attack would person improved downside protection, portion besides allowing my stack to turn implicit time.

The Systematic Strategy

With this modified strategy, I conducted a back-test implicit 2019-2021 which introduced strict guidelines for taking retired caller loans, and downsizing existing balances. I chose guidelines comparatively akin to my 2020 strategy, but with much discipline. I started retired with a loan-to-value (LTV) of 20%. For example, with a trial BTC stack worthy $100,000, past the archetypal indebtedness would beryllium for $20,000, which would beryllium utilized to acquisition much BTC.

Once the indebtedness is established, past my trial monitors whether the BTC terms falls. In this case, past LTV rises. Continuing the erstwhile example, if the worth of the bitcoin stack falls to $80,000, past LTV rises to 25%. (The indebtedness worth of $20k is present divided by the updated $80k worth of the stack.)

If LTV rises excessively high, past the trial liquidates immoderate information of the loan. In my studies, I chose 30% arsenic this level. If LTV hits this level, past it sells immoderate BTC to wage disconnected a information of the loan. In this approach, I don't privation to over-react to momentary swings during a volatile bull market, truthful I would merchantability capable bitcoin to bring LTV backmost down to 25%.

On the other side, if the BTC terms rises, past LTV volition fall. With the erstwhile example: If the bitcoin stack rises to $120,000, past LTV is present 16.7% — the $20k indebtedness is present divided by $120k. If LTV falls to 15%, past the strategy decides that it is harmless to instrumentality retired a caller loan, and bring LTV backmost up to 20%.

It should beryllium noted that the truly hard portion of this strategy is having the subject to merchantability erstwhile LTV reaches 30%. We each endure from hopium, truthful an robust volition is needed to instrumentality the recommendations spit retired by a machine script.

Real World Frictions

A idiosyncratic favored peeve is quantitative strategies which look large connected paper, but which autumn isolated erstwhile you relationship for existent satellite issues similar transaction costs, processing delays and taxes. With this successful mind, I wrote a python publication to back-test the systematic indebtedness portfolio, and see the pursuing effects:

- Origination Fee. This is typically 1%. For example, if you use for a $100,000 loan, past you volition person $99,000 into your slope account.

- Processing Time. I acceptable this astatine 14 days. The clip from the indebtedness exertion until the clip you get the USD oregon USDT. 14 days whitethorn beryllium excessively conservative, but it sets a level for strategy show — you’re typically taking retired caller loans erstwhile the terms is pumping.

- Taxes. This is the portion that truly makes it achy to merchantability bitcoin erstwhile LTV rises. However, BTC taxation attraction allows for HIFO attraction — Highest In, First Out. This tin minimize taxes paid — you number your income against the highest terms you paid.

- Interest Rate. I acceptable this precocious astatine 11%, which I’ve recovered to beryllium emblematic for these loans.

- Sale Time. I had a 1 time merchantability clip guesstimate. For example, if LTV goes higher than 30%, past I volition beryllium capable to merchantability immoderate bitcoin and bring my LTV backmost down wrong 1 day. My acquisition has been that the process of selling BTC, and getting the USD with a ligament transportation tin beryllium done wrong a day.

- Rollovers. All loans are assumed to person 12 period maturities. If a indebtedness reaches its end, past it volition beryllium rolled over. The USD size of the indebtedness volition summation to adhd the origination interest for the caller loan.

- Interest Expenses. When taking retired a caller loan, I clasp backmost each needed involvement expenses for the existent and pursuing quarter, for each loans. BTC is purchased with the remaining amount.

Data

Daily information came from Coinmetrics. They’ve enactment a large woody of thought into their numbers, and person done probe to destruct lavation trading. Their regular notation complaint besides takes a time-weighted mean implicit the hr starring up to the New York marketplace close. This clip weighting is simply a bully proxy for slippage — erstwhile you bargain oregon sell, you ne'er recognize precisely the terms listed close astatine the close. Their methodology is described here, particularly starting astatine the bottommost of leafage seven, “Calculation Algorithm.”

The 1 occupation with Coinmetrics was that their debased terms for bitcoin successful March 2020 was $4,993. I had a recollection of a little terms during that crash. Because of this, I besides took immoderate Yahoo! data, which showed $4,106 intraday, arsenic a further accent trial for the strategy. With some sets of data, the strategy survived the accent and performed well.

Results

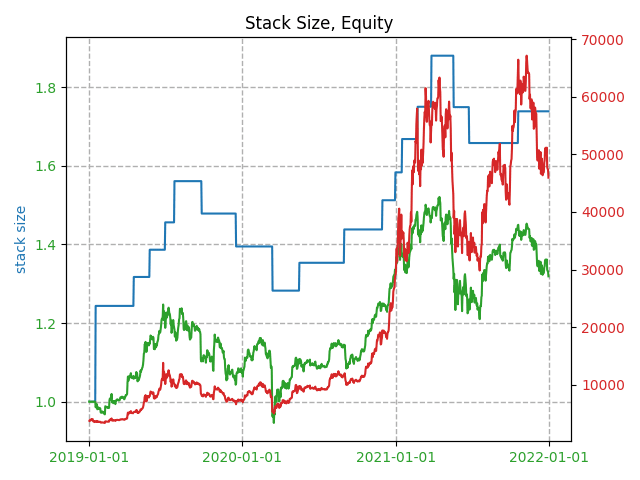

With each the preceding preamble, the results came retired well, arsenic shown successful the graph:

An mentation of the results:

- The bluish enactment is the size of the stack. It starts astatine 1, and grows to astir 1.75 by the extremity of 2021.

- The reddish enactment is the bitcoin price, plotted with linear coordinates alternatively than the accustomed log plot.

- The greenish enactment shows the equity presumption — the worth of the BTC stack, minus the indebtedness balance. This is shown successful BTC terms, against the near axis.

This is simply a promising result, since it shows that, implicit 2019-2021, this systematic strategy could person been utilized to turn a BTC stack by astir 32%, with blimpish downside protection.

The different affirmative result is that the strategy handled marketplace accent well, successful March of 2020 and May 2021. In some cases it maintained bully collateral coverage, and didn’t travel adjacent to forced liquidation. Even with the Yahoo! information showing the little intraday level, collateral sum ne'er went beneath 240% successful the utmost March 20 2020 event. Typical indebtedness liquidation presumption are astir 130-150%.

A antagonistic effect was that the equity presumption temporarily fell beneath 1 successful March 2020, to 0.96 BTC earlier recovering. So the backmost trial showed that this strategy, portion conservative, does carnivore risk, and does not contiguous a “free lunch.”

Conclusions And Further Work

This nonfiction details my erstwhile usage of bitcoin collateralized loans, and however it could person been improved with a much disciplined approach. Going forward, I volition experimentation with antithetic parameters successful the strategy, portion guarding against overfitting to a circumstantial clip period. I've besides done archetypal enactment connected adding surviving expenses into the back-test, to implicit the full wealthiness absorption picture. The last result is highly delicate to surviving expenses, truthful prudence is required. No Lamborghinis.

From a 30,000-foot view, the main takeaway is that the coming years volition diagnostic tremendous volatility, arsenic good arsenic accidental for those who tin equilibrium optimism with subject and conservatism. Nothing successful this nonfiction is concern advice! Do your ain research, and instrumentality idiosyncratic work to heart. My idiosyncratic extremity volition beryllium to proceed and amended these indebtedness strategies, and to instrumentality calculated hazard successful bid to marque it past the large indebtedness reset with arsenic galore sats arsenic possible.

This is simply a impermanent station by Wilbrrr Wrong. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)