Unlike Bitcoin, the Ethereum terms has struggled to clasp up, and adjacent aft the crypto marketplace recovery, the terms remains beneath $4,000, which is simply a large intelligence level. Given this, it seems that the cryptocurrency is acceptable to adjacent the period of October successful the red, losing astir 5% of its worth already this month. However, with the period of November rapidly rolling by, the Ethereum terms mightiness beryllium successful for a bounce, arsenic November has historically been greenish for the market.

November Could Hold The Key For Ethereum Price

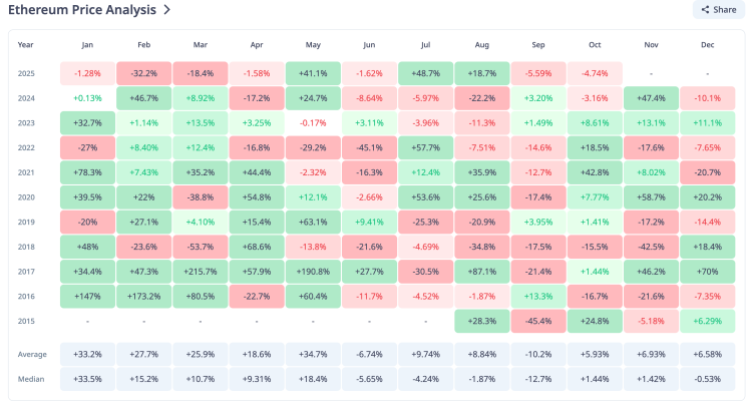

Looking astatine the historical price data for Ethereum connected the CryptoRank website, determination seems to beryllium a equilibrium betwixt years erstwhile the period was reddish and years erstwhile it was green. In a decade, determination person been 5 years wherever the Ethereum terms has seen gains successful November and 5 years wherever determination person been losses.

However, determination seems to beryllium a alternatively bullish pattern: the years erstwhile the period was greenish saw double-digit gains, yet resulting successful higher gains than losses. As a result, the mean instrumentality for the period is 6.93%, and the median return, portion low, besides remains affirmative astatine 1.42%.

Given the information that determination is nary wide inclination to pinpoint wherever the terms is headed, the bears and the bulls look to person adjacent chances. But if it does crook retired to beryllium successful the green, it is apt that the Ethereum terms volition witnesser a double-digit surge. Such a determination would assistance it wide the $4,000 absorption with momentum.

Source: CryptoRank

Source: CryptoRankQ4 Still Has Potential

Quarterly returns for the Ethereum terms person not precisely been the champion successful the past 4th of the year, but that has not changed the information that the altcoin tends to execute rather well overall. There is besides the inclination of Q4 ending successful the greenish if the erstwhile Q2 and Q3 were successful the green, which is the lawsuit close now.

In Q2 of 2025, the Ethereum terms ended with an mean affirmative instrumentality of 36.5% and successful Q3, it followed with a 66.7% return, the highest truthful far. With October trending low, determination is already a 4.83% diminution this year, but with much than 2 months to go, there is inactive clip for things to change.

Only 1 twelvemonth successful past has the Ethereum terms closed Q4 successful the reddish aft Q2 and Q3 ended successful the green, and that was 9 years agone successful 2016. Since then, the inclination has ever seen the ETH terms continuing the rally. This was the lawsuit backmost successful 2017, and past again successful 2020 and 2021.

Since then, this inclination has not returned, and 2025 is the archetypal clip successful 4 years that the Ethereum terms has ended some Q2 and Q3 successful the green. If the historical performance holds, the Ethereum terms could spot an mean of a 50% increase, oregon adjacent double, similar it did backmost successful 2017 and 2020, earlier the twelvemonth is over.

Featured representation from Dall.E, illustration from TradingView.com

3 hours ago

3 hours ago

English (US)

English (US)