Olympus DAO is the archetypal decentralized reserve currency protocol with implicit 1,000% APY.

Cover art/illustration via CryptoSlate

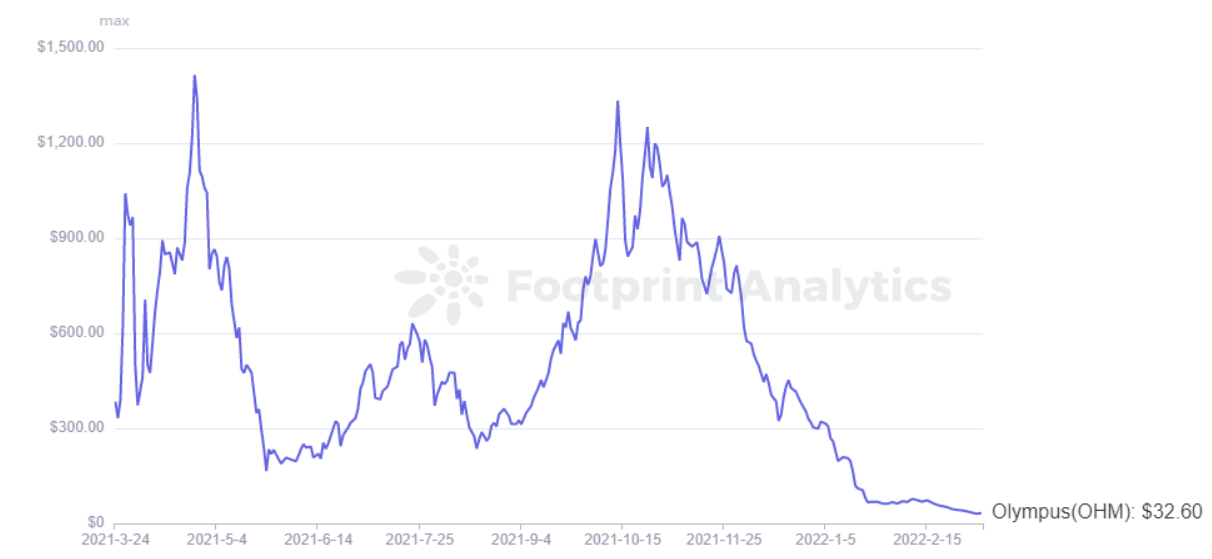

Olympus DAO was deed hard by the caller marketplace sell-off, with OHM trading arsenic debased arsenic $32 connected March 9, down 97.7% from its all-time precocious of $1,415 acceptable past April.

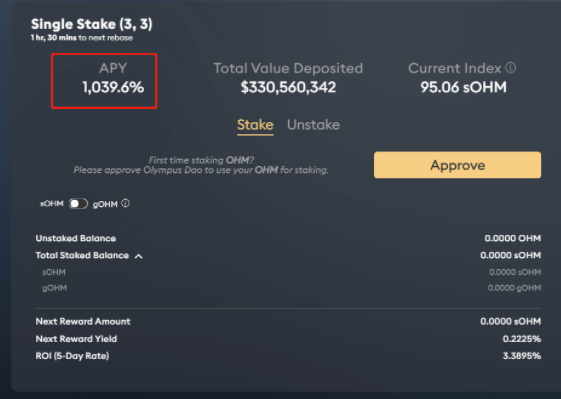

Olympus DAO is simply a decentralized reserve currency protocol, which volition automatically contented OHM based connected the worth of the cryptocurrency. As of the extremity of October, staking OHM was implicit 8,000% APY, and is presently astatine 1,039%. However, some its TVL and token prices person plummeted successful the look of specified precocious APY.

What stopped OHM from continuing to grow?

Olympus DAO Controls Its Own Liquidity

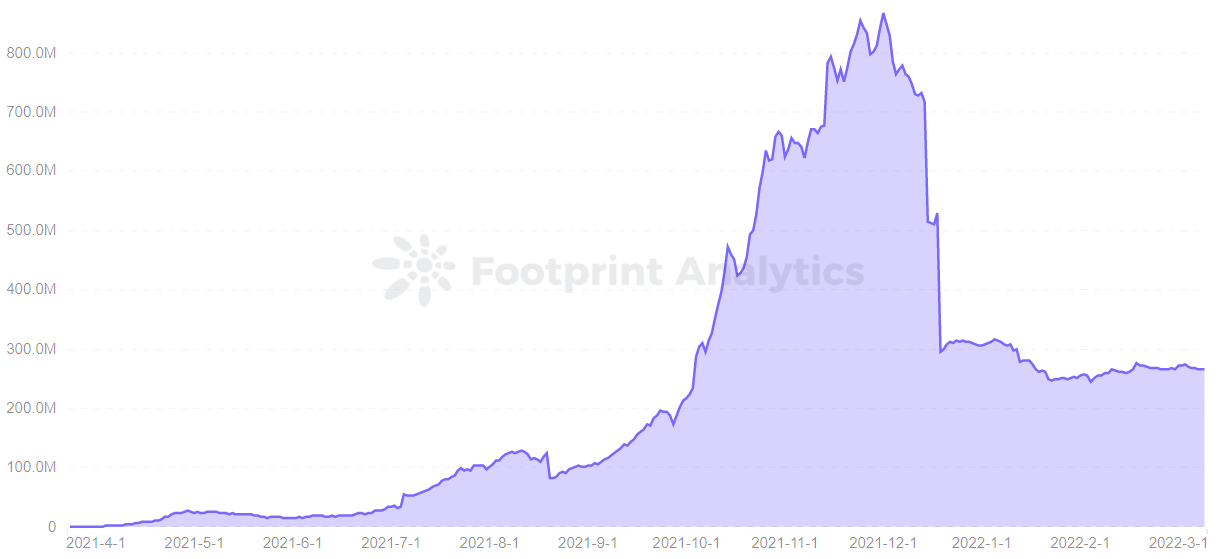

According to Footprint Analytics data, Olympus DAO reached a highest TVL of $860 cardinal by attracting users to involvement and make LP tokens astatine implicit 1,000% APY. However, owed to the marketplace sell-off, TVL has fallen consecutive down to an equilibrium authorities and presently stands astatine $260 million, a 70% drop.

Footprint Analytics – TVL of Olympus DAO

Footprint Analytics – TVL of Olympus DAOOlympus DAO is the archetypal protocol to usage a enslaved mechanics to make an alternate to the “liquidity mining” model, providing liquidity by issuing OHM astatine a discount and creating LP tokens, creating the conception of “protocol-owned liquidity”.

Olympus DAO supports 3 types of idiosyncratic actions: staking, enslaved buying, and selling.

Bond purchases are a unsocial mechanics of the Olympus DAO that allows users to acquisition discounted OHM from the treasury by backing assets specified arsenic wETH and DAI. However, getting the discounted OHM requires paying the corresponding worth of treasury assets specified arsenic wETH and DAI, and requires a waiting play of 2 to 5 days to afloat get the purchased OHM.

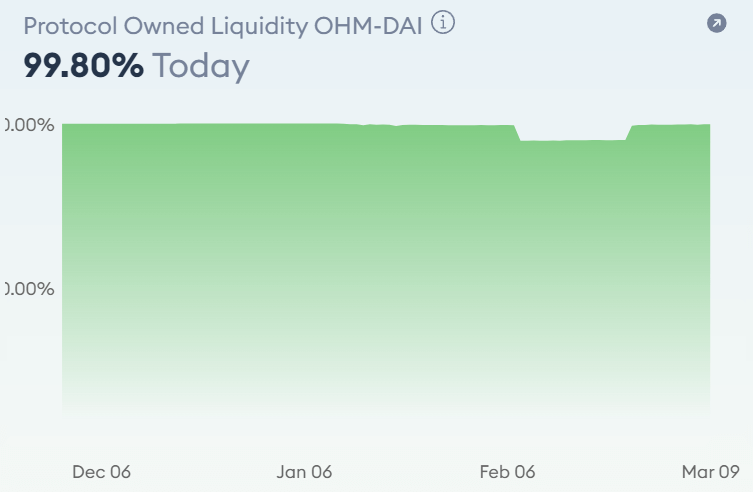

In summation to treasury-backed assets, users tin besides wage LP tokens successful speech for discounted OHM, typically liquidity brace tokens associated with OHM, specified arsenic OHM-DAI LP. With stablecoins forming the LP token, this ensures that the treasury tin power astir of the liquidity and gain a interest by mode of the LP token.

As a result, the seizure of LP tokens and the involvement relation of OHM let Olympus DAO to seizure 99.8% of OHM liquidity.

Screenshot root – Olympus DAO website

Screenshot root – Olympus DAO websiteAdopting the Prisoner’s Dilemma Model of Game Theory

The Olympus DAO attracts a ample fig of users due to the fact that of its (3,3) economical model, which comes from the celebrated “Prisoner’s Dilemma” exemplary of crippled theory.

The 3 behaviors of stake, bond, and merchantability plan a (3,3) economical model. When each users enactment successful the stake, it tin execute a win-win effect for users and the protocol, that is the authorities of (3,3). However, the crushed wherefore users are consenting to bargain and involvement OHM is owed to its precocious staking income.

Screenshot root – Olympus DAO website

Screenshot root – Olympus DAO websiteWhen obtaining OHM by purchasing bonds, users volition wage assets specified arsenic wETH, DAI, and FRAX to summation Olympus’ treasury funds to enactment the worth of OHM. The maturation of the Olympus DAO treasury combined with the statement to power 99.8% of OHM, past the OHM of the inherent 1 DAI tin person a marketplace terms that is hundreds oregon adjacent thousands of times higher.

A higher APY would besides mean a higher premium, which would pb to a ample magnitude of OHM arsenic an inducement for inflationary output. At the aforesaid time, determination volition beryllium a batch of OHM mining and selling operations successful the market, and the terms of OHM and the pledged APY of the statement volition besides decrease. In the worst case, it whitethorn autumn to a (-3,-3) phase. This means a corresponding nonaccomplishment for some Olympus DAO and users.

In this model, users who participate astatine the close clip tin gain precocious short-term returns, but the greedy tokenomics created with the APY tin besides beryllium driven by quality nature. Therefore, precocious returns are not maintained for a agelong time.

OHM Prices Are Free Floating and Determined by the Market

The terms of OHM is backed by DAO’s treasury assets (such arsenic wETH, DAI, and FRAX). Underlying logic:

- When the terms of OHM rises, the protocol pushes down the terms by issuing further OHM.

- When the OHM terms drops, the statement volition bargain backmost and destruct the OHM, pulling the terms backmost up.

As wide from the Footprint Analytics chart, OHM is highly volatile. Two peaks of implicit $1,100 were recorded, but arsenic of March 9, the terms was astatine an all-time debased of $32.60.

Footprint Analytics – OHM of Price

Footprint Analytics – OHM of PriceAn investigation of the main upside and downside factors done OHM’s coin terms movements.

OHM terms increases:

- Olympus has introduced a enslaved diagnostic that allows users to bargain discounted OHM to signifier LP tokens and gain betwixt ace 1000% and 8000% APY.

- The rewards earned by users are compounded 3 times a day, accelerating the maturation of the plus pool.

OHM prices fall:

- More users staking OHM volition besides origin OHM prices to fall.

- OHM’s prices are mostly maintained by caller purchasers.

- There is presently nary applicable usage for OHM—the request for OHM comes from users who privation to usage OHM to get precocious APY and supply liquidity for OHM trading pairs, pegging their LP tokens to discounted OHM.

- On January 17, a whale sold disconnected 82,526 OHM coins (worth $13.3 cardinal astatine the time), triggering a driblet to a caller low.

In opposition to the Lido involvement protocol, wherever users bash not request to fastener successful tokens specified arsenic ETH oregon LUNA to person a involvement reward astatine a 1:1 terms for stETH oregon stLUNA, the reward for staking wETH oregon DAI astatine Olympus is OHM, which is inactive precise risky arsenic the terms of OHM is highly babelike connected marketplace factors.

Summary

Still, successful its aboriginal stages, Olympus DAO leads the task with a (3,3) exemplary that requires users to enactment unneurotic successful placing bets, and it lone makes consciousness if determination are nary rebels among each OHM stakers.

It is, therefore, much hard to make a dynamic and balanced inclination successful an ever-changing cryptocurrency market. And users who privation a precocious APY request to instrumentality a higher risk.

Date and Author: Mar. 2022, Vincy,

Data Source: Footprint Analytics – Olympus DAO Dashboard

This portion is contributed by the Footprint Analytics community.

The Footprint Community is simply a spot wherever information and crypto enthusiasts worldwide assistance each different recognize and summation insights astir Web3, the metaverse, DeFi, GameFi, oregon immoderate different country of the fledgling satellite of blockchain. Here you’ll find active, divers voices supporting each different and driving the assemblage forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one investigation level to visualize blockchain information and observe insights. It cleans and integrates on-chain information truthful users of immoderate acquisition level tin rapidly commencement researching tokens, projects, and protocols. With implicit a 1000 dashboard templates positive a drag-and-drop interface, anyone tin physique their ain customized charts successful minutes. Uncover blockchain information and put smarter with Footprint.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)