David Lawant, Head of Research astatine FalconX, a integer assets premier brokerage with trading, financing, and custody for starring fiscal institutions, recently offered an analysis connected X (formerly Twitter) regarding the evolving relation of Bitcoin halvings successful marketplace dynamics. This investigation challenges the accepted presumption that halvings straight and importantly impact Bitcoin’s price, alternatively highlighting a broader economical and strategical discourse that mightiness beryllium influencing capitalist perceptions and marketplace behaviour much profoundly.

The Miner’s Diminishing Impact On Bitcoin Price

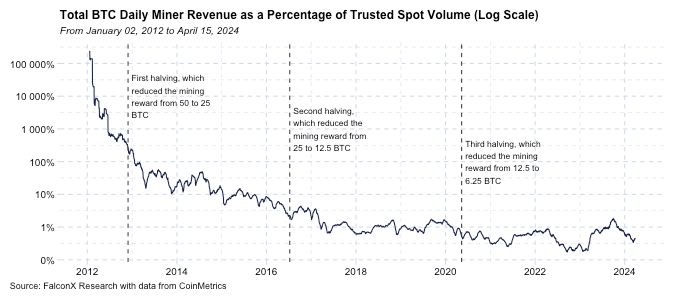

Lawant begins by addressing the changing interaction of Bitcoin miners connected marketplace prices. He presents a elaborate illustration comparing the full mining gross to the Bitcoin spot traded measurement from 2012 onwards, intelligibly marking the dates of the 3 previous halvings. This information reveals a important shift: “The astir important illustration for comprehending halving dynamics is the 1 below, not the terms chart. It illustrates the proportionality of full mining gross compared to BTC spot traded measurement since 2012, with the 3 halving dates marked.”

Bitcoin Halving effects implicit clip | Source: X @dlawant

Bitcoin Halving effects implicit clip | Source: X @dlawantIn 2012, full mining gross was multiples of the regular traded volume, highlighting a clip erstwhile miners’ decisions to merchantability could person important impacts connected the market. By 2016, this fig was inactive a notable double-digit percent of regular measurement but has since declined. Lawant emphasizes, “While miners stay integral to the Bitcoin ecosystem, their power connected terms enactment has notably waned.”

He elaborates that this simplification is partially owed to the expanding diversification of Bitcoin holders and the increasing sophistication of fiscal instruments wrong the cryptocurrency market. Furthermore, not each mining gross is instantly impacted by halving events—miners whitethorn take to clasp onto their rewards alternatively than sell, affecting the nonstop interaction of reduced artifact rewards connected supply.

Lawant connects the timing of halvings to broader economical cycles, proposing that halvings bash not hap successful isolation but alongside important monetary argumentation shifts. This juxtaposition increases the communicative interaction of halvings, arsenic they underscore Bitcoin’s attributes of scarcity and decentralization during periods erstwhile accepted monetary systems are nether stress.

“Bitcoin halving events thin to hap during captious monetary policy turning points, truthful the communicative acceptable is conscionable excessively cleanable to presume they cannot power prices,” Lawant observes. This connection suggests a intelligence and strategical magnitude wherever the perceived worth of Bitcoin’s scarcity becomes much pronounced.

The investigation past shifts towards the macroeconomic situation influencing Bitcoin’s appeal. Lawant references the 2020 treatment by capitalist Paul Tudor Jones who labeled the economical clime arsenic “The Great Monetary Inflation,” a play marked by assertive monetary enlargement by cardinal banks. Lawant argues, “I’d reason that this was a much important origin successful the 2020-2021 bull tally than the nonstop travel interaction from the halving,” pointing retired that macroeconomic factors whitethorn person had a much important power connected Bitcoin’s terms than the halving itself.

Future Prospects: Macroeconomics Over Mechanics

Looking towards the future, Lawant speculates that arsenic the satellite enters a caller signifier of economical uncertainty and imaginable monetary reform, macroeconomic factors volition progressively dictate Bitcoin’s terms movements alternatively than the mechanical aspects of halvings.

“Now successful 2024, the concerns halfway astir the aftermath of the fiscal/monetary policies that person been successful spot for decades but are getting turbocharged successful a satellite that is precise antithetic from 4 years ago. […] We are perchance entering a caller limb of this macroeconomic cycle, and macro is becoming a much captious origin successful BTC terms action,” helium concludes.

This position suggests that portion the nonstop terms interaction of Bitcoin halvings whitethorn diminish, the broader economical discourse volition apt item Bitcoin’s cardinal properties—immutability and a fixed proviso cap—as important anchors for its worth proposition successful a rapidly evolving economical landscape.

At property time, BTC traded astatine $62,873.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)