Many investors disregard BNB arsenic simply "the Binance coin," but that designation fails to admit its broader worth unlocks. While BNB was initially launched arsenic the autochthonal token of the Binance Chain (now the BNB Smart Chain), and its aboriginal token burns were tied to Binance’s quarterly profits, BNB is evolving into a decentralized plus with aggregate usage cases and reasons for economical value.

While BNB whitethorn bask immoderate worth accrual from the enlargement of Binance, its token proviso exemplary and the improvement of the BNB Chain connection 2 autarkic sources of value. First, BNB serves arsenic a store of worth done quarterly and fixed-ratio BNB burning mechanisms. Second, it powers astute declaration functionality via the BNB Smart Chain, which has go a increasing hub for DeFi and gaming applications.

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Deflationary store of value

BNB’s pain mechanics differentiates it from astir each different cryptocurrency. Let’s comparison BNB to BTC, ETH and SOL:

BTC: Inflationary, but with a capped supply.

ETH: Inflationary oregon deflationary, owed to unpredictable pain rates tied to web activity.

SOL: Inflationary, starting astatine 8% and decreasing implicit time.

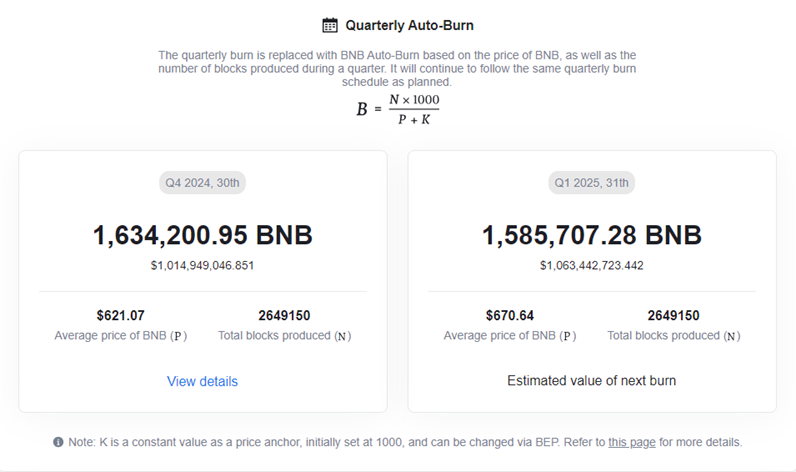

BNB’s pain process is unique; it removes tokens from circulation based connected the fig of blocks produced and mean terms each quarter, arsenic good arsenic having a fixed ratio of the state fees accumulated successful each block. Nearly 60 cardinal BNB (~$35 cardinal astatine existent prices) has been burned truthful far, reducing the circulating proviso to 142 million. The past quarterly pain unsocial wiped $1 cardinal worthy of BNB from beingness — a 4.6% annualized deflation rate!

Bitcoin presently commands the astir attraction arsenic a store of worth plus due to the fact that of its archetypal mover advantage, marketplace headdress and a robust, decentralized web of miners. Any alteration successful the Bitcoin codification (i.e., changing the people supply) would request to beryllium agreed upon by the bulk of the network, which would beryllium exceedingly hard with bitcoin's level of decentralization. Investors should enactment that the BNB pain has already been modified from its archetypal whitepaper truthful determination is nary warrant it won’t beryllium changed further. This is the tradeoff with an assertive token burning strategy.

Source: bnbburn.info

BNB Chain – a modular L1 ecosystem

BNB’s adjacent improvement is the BNB One Chain Initiative, which aims to unify a multichain ecosystem built for Web3 interoperability:

BNB Smart Chain (BSC): A fast, low-cost, EVM-compatible DeFi hub.

BNB Greenfield: A decentralized retention web for real-time, monetizable data.

opBNB: An ultra-low-fee (sub-$0.0001 per transaction) high-throughput rollup, built for on-chain gaming and high-demand dApps.

With respective headwinds facing Ethereum (namely furniture 2 fragmentation and inflationary concerns), BNB’s One Chain Initiative provides a viable alternate to developers and web3 applications.

Now, it isn’t each rainbows and butterflies with BNB. Investors should inactive see the hazard that their decentralization propulsion is lone a selling stunt, arsenic good arsenic the ongoing regulatory battles implicit Binance’s know-your-customer (KYC) argumentation and different issues.

With Richard Teng present astatine the helm of the exchange, Binance and BNB’s adjacent section volition apt beryllium focused connected compliance and moving with regulators/exchanges to summation entree for the BNB token. With BNB mostly unavailable connected U.S. exchanges, the token has inactive achieved a ~$100B marketplace cap with planetary enactment alone. As U.S. crypto regulations ease, BNB’s re-entry into U.S. markets could beryllium a important catalyst for further growth.

Disclosures:

Osprey Funds manages the Osprey BNB Chain Trust (OBNB), a single-asset Trust providing vulnerability to BNB and publically quoted connected the OTCQX Market. Investors tin larn much and work the Trust prospectus astatine ospreyfunds.io. Matt does not ain immoderate BNB oregon OBNB.

7 months ago

7 months ago

English (US)

English (US)