A quant has explained however this bearish divergence successful Bitcoin on-chain information tin pb to a short-term correction successful the price.

Bitcoin Short-Term Holder SOPR Has Been Slowing Down Despite Price Going Up

As explained by an expert successful a CryptoQuant post, a spread has been forming successful the purchasing powerfulness of short-term holders and the BTC price. The applicable indicator present is the “Spent Output Profit Ratio” (SOPR), which tells america whether investors successful the Bitcoin marketplace are selling their coins astatine a nett oregon astatine a nonaccomplishment close now.

When the worth of this metric is greater than 1, it means the wide marketplace is realizing immoderate magnitude of nett currently. On the different hand, values beneath the threshold suggest the mean holder is seeing immoderate nonaccomplishment astatine the moment. Naturally, the indicator astatine precisely adjacent to 1 implies the investors are conscionable breaking-even connected their investment.

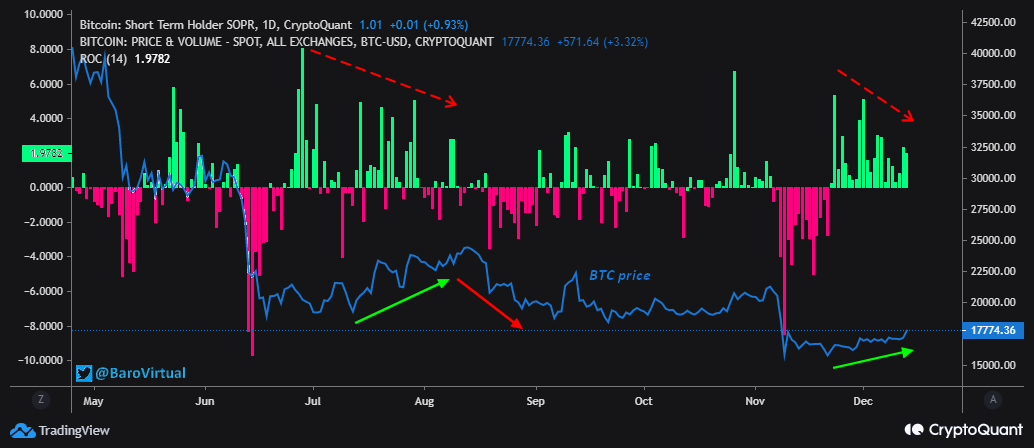

The “short-term holder” (STH) radical is simply a Bitcoin cohort that includes each investors who bought their coins little than 155 days ago. The STH SOPR frankincense measures the nett ratio of selling being done by these holders. To decently measure the behaviour of this group, the expert is utilizing a “rate of change” (ROC) oscillator for the indicator. Here is simply a illustration comparing this momentum oscillator with the BTC terms implicit the past fewer months:

As the supra graph shows, the ROC of the Bitcoin STH SOPR had been successful heavy reddish erstwhile the FTX crash took place, suggesting that these investors capitulated during it and realized a ample magnitude of loss. However, arsenic the BTC terms has dilatory improved from the lows, the ROC has go green. This implies that the STHs who bought during the lows person been selling for profits, starring to a rising SOPR.

Bitcoin has continued to spot an uptrend recently, but strangely, the STH SOPR ROC has been dropping off. This could beryllium a motion that not galore STHs were capable to bargain during these lows, hinting that their purchasing powerfulness is debased astatine the moment. If they had been buying done this rally, they would person continued to harvest much and much profits arsenic the terms goes up, but that has intelligibly not been the case.

Such a divergence besides formed successful the alleviation rally seen earlier successful the carnivore market, arsenic the quant has marked successful the chart. “Last time, this concern led to a bearish correction,” notes the analyst. “If this alignment repeats, past this time, Bitcoin whitethorn close to the $16,500-$17,000 range.”

At the clip of writing, Bitcoin’s terms floats astir $17,700, up 5% successful the past week.

3 years ago

3 years ago

English (US)

English (US)