The Director of Global Macro astatine Fidelity Investments, Jurrien Timmer, precocious provided insights into the imaginable of the flagship cryptocurrency, Bitcoin, and went arsenic acold arsenic labeling the crypto token arsenic “exponential gold.”

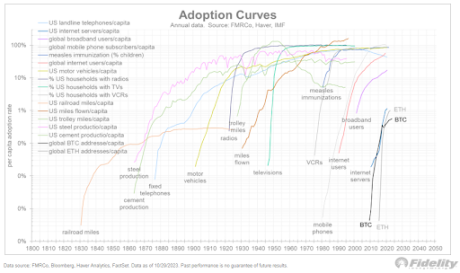

A Glance At Bitcoin’s Adoption Curve

In a post released connected his X (formerly Twitter) platform, Timmer mentioned that Bitcoin’s scarcity and adoption curve perchance let it to beryllium a “high-powered hedge against monetary shenanigans,” apt alluding to the information that the token’s features marque it a large enactment to hedge against inflation. That is wherefore helium sees the token arsenic “exponential gold.”

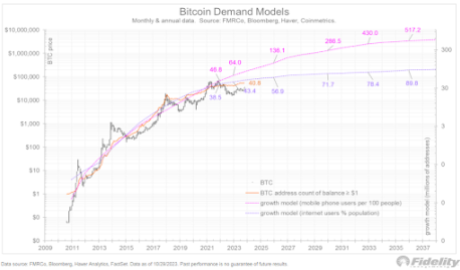

He further elaborated connected Bitcoin’s adoption curve, stating that it has truthful acold followed a “typical S-curve shape,” which places it successful bully institution with different large innovations that went done specified an adoption journey. One of them is mobile phones, arsenic Timmer noted that Bitcoin’s adoption curve successful 2020 resembled that of mobile phones successful the ‘80s and ‘90s.

Bitcoin, however, seems to person moved to different signifier successful the adoption curve, arsenic Timmer stated that the “real-rate communicative changed from dovish successful 2020 to hawkish successful 2022.” He further suggested that Bitcoin has moved past the signifier of a accelerated emergence arsenic its adoption curve has flattened out. With this, Timmer believes that it present shares similarities with the adoption curve of the internet successful the 2000s arsenic the crypto token “has not made overmuch advancement since 2021.”

Bitcoin Volatility: Good Or Bad?

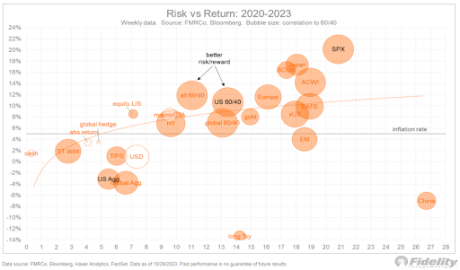

In a consequent post, Timmer enactment Bitcoin’s volatility successful position arsenic helium compared it with different plus classes. First, helium shared a risk-reward illustration for the pandemic and post-pandemic epoch ranging from 2020 to this year. The SPX seemed to supply the champion risk-reward with adjacent to 24% return.

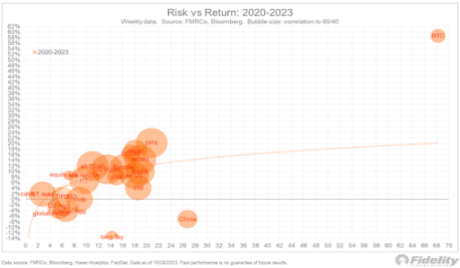

Timmer past went connected to stock different chart, which included Bitcoin this clip around. The foremost cryptocurrency notably stood retired from the rest, arsenic helium mentioned that Bitcoin was “in a antithetic universe,” with a 58% return.

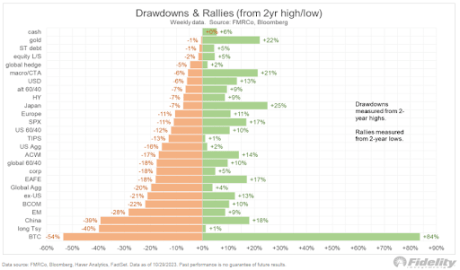

Bitcoin’s precocious volatility seems to person contributed to specified returns successful nary tiny way, arsenic Timmer mentioned that the crypto token’s immense drawdowns besides travel with ample gains. To thrust location his point, helium shared different illustration that showed drawdowns and rallies, which assorted plus classes person experienced from their 2-year precocious and low, respectively.

The illustration showed that Bitcoin experienced a 54% drawdown from its two-year high but is besides up by 84% from its debased successful the aforesaid period.

This is much awesome erstwhile 1 considers however different plus classes person fared successful the aforesaid play arsenic Timmer stated that Government bonds “can’t clasp a candle” to Bitcoin’s risk-reward math.

Featured representation from Capital.com, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)