Stablecoins are the existent occurrence communicative successful crypto. In the past six years, Stablecoins person softly go indispensable. Since 2019, radical person utilized stablecoins to determination $264.5 trillion crossed 18 cardinal successful transactions. Why? Stablecoins fto you clasp wealth onchain without having to interest astir volatility, making them the easiest mode to store worth and transact successful the crypto economy.

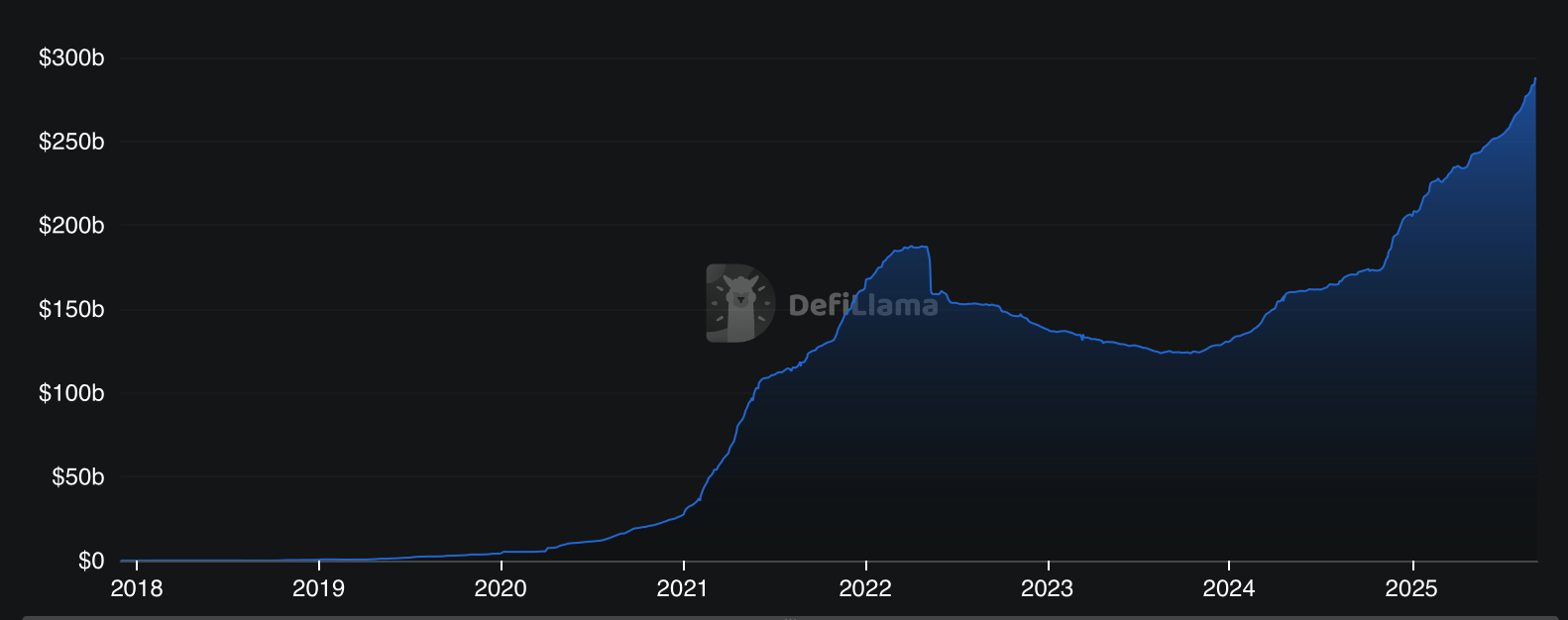

Total marketplace headdress of stablecoins is implicit $280 cardinal Source: Defillama

Why are Stablecoins fashionable close now?

We’re seeing a unreserved of companies launching stablecoins successful the U.S. due to the fact that issuers yet gained clarity with the passing of the GENIUS Act successful July 2025. For the archetypal time, the U.S. authorities intelligibly defined who tin contented stablecoins, what counts arsenic a “payment stablecoin,” and what obligations issuers person to consumers.

Since the GENIUS Act passed, MetaMask rolled retired mUSD, Stripe launched a payments-focused concatenation called Tempo, Circle announced their purpose-built stablecoin payments L1, Arc Network, and there’s been a spree of acquisitions. Stablecoin infrastructure companies similar Iron are getting snapped up, and accepted concern firms similar Stripe are spending heavy to bargain crypto companies (Privy and Bridge) whose products they tin fold into their existing offerings.

In addition, chains are launching their ain stablecoins arsenic a mode to seizure much gross from the output they generate. MegaETH has its autochthonal stablecoin, USDm. Hyperliquid launched USDH, which sparked a bidding war with Paxos, Agora, Sky, and Frax each vying to get involved.

At this rate, it’s casual to ideate a satellite wherever each superior institution successful crypto yet issues its ain stablecoin. Which raises the evident question: bash we request more?

Why we request much Stablecoins:

1. Financial inclusion: Even arsenic the fig of unbanked radical falls, implicit 1.3 billion stay without entree to banking, mostly successful places with unstable currencies. Stablecoins supply 24/7 entree to wealth online, without borders. If companies similar PayPal propulsion stablecoins straight to existing customers, they could onboard much radical to usage the planetary wealth rails of crypto.

2. Currency diversity: In the existent world, we don’t person 1 currency. We person dollars, euros, yen. The aforesaid should beryllium existent onchain. If everything settles successful dollars, the full crypto system becomes babelike connected U.S. monetary policy. More stablecoins means little over-reliance connected a azygous standard.

3. Risk mitigation: Right present stablecoin markets are concentrated into the hands of a fewer large players. With much stablecoins, attraction hazard decreases. If 1 issuer faces technical, regulatory, oregon solvency issues, users would person alternatives to pivot to without destabilizing the broader ecosystem. More issuers mean much redundancy, making the strategy safer.

Stablecoins are softly rewriting the rules of planetary finance. They springiness anyone, anywhere, entree to wealth that moves instantly, crossed borders, with incentives aligned to users alternatively than banks. The much competition, the better. If crypto transforms the planetary economy, it won’t beryllium due to the fact that of speculation. It volition beryllium due to the fact that of stablecoins.

1 month ago

1 month ago

English (US)

English (US)