Later this twelvemonth 13 cardinal ETH volition beryllium unlocked erstwhile Ethereum moves implicit to proof-of-stake leaving proof-of-work behind. Will this origin a merchantability the quality event?

Cover art/illustration via CryptoSlate

It has been confirmed that the Ethereum Consensus Layer volition beryllium launched arsenic soon arsenic August 2022.

After years of delays, “the Merge” is yet here. However, determination is immoderate interest implicit what volition hap to the terms of Ethereum (ETH) erstwhile proof-of-work is turned off.

Currently, implicit 13 cardinal ETH is staked successful ETH 2.0, and determination are concerns that this $26 cardinal worthy of ETH volition flood the marketplace pursuing the Merge arsenic investors unstake and merchantability the news.

Self-proclaimed DeFi pedagogue and subordinate of DeFi Omega Korpi broke down the imaginable interaction of The Merge and the resulting unlocking of millions of ETH.

Staked ETH won’t beryllium unlocked immediately

Korpi pointed retired that “the Merge won’t alteration withdrawals,” arsenic that is “planned for different Ethereum upgrade” slated to hap aft astir six months to 1 year. Korpi explained further that:

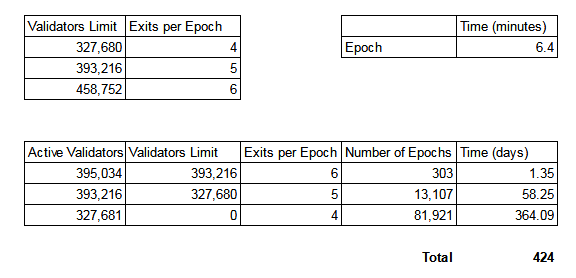

“To retreat $ETH, a validator indispensable exit the progressive validator acceptable but determination is simply a bounds to however galore validators tin exit per epoch.

There are presently 395k validators (active + pending). If nary caller ones are acceptable up (highly unlikely), it volition instrumentality 424 days for each of them to exit.”

Source: Twitter

Source: TwitterUnlocked ETH volition beryllium released slowly

Korpi elaborated that adjacent with withdrawals enabled:

“there volition beryllium an exit queue which whitethorn instrumentality much than a twelvemonth successful the worst-case script oregon respective months successful a much realistic one. The merchandise volition beryllium slow.”

Korpi’s last constituent regarding The Merge is that astir users who person staked ETH with validators are astir apt ETH-maximalists and are not funny successful selling astatine existent prices.

Liquid staking

Further, determination are already ways for ETH stakers to entree liquidity from their staked tokens. For investors who are not moving their validator nodes, it is communal to person tokens specified arsenic bETH successful instrumentality for staking ETH with a validator.

These bETH tokens are tradeable connected the unfastened market, frankincense releasing liquidity. Therefore, those investors who are not already a portion of the validator infrastructure bash not request The Merge to hap to entree their liquidity successful astir cases.

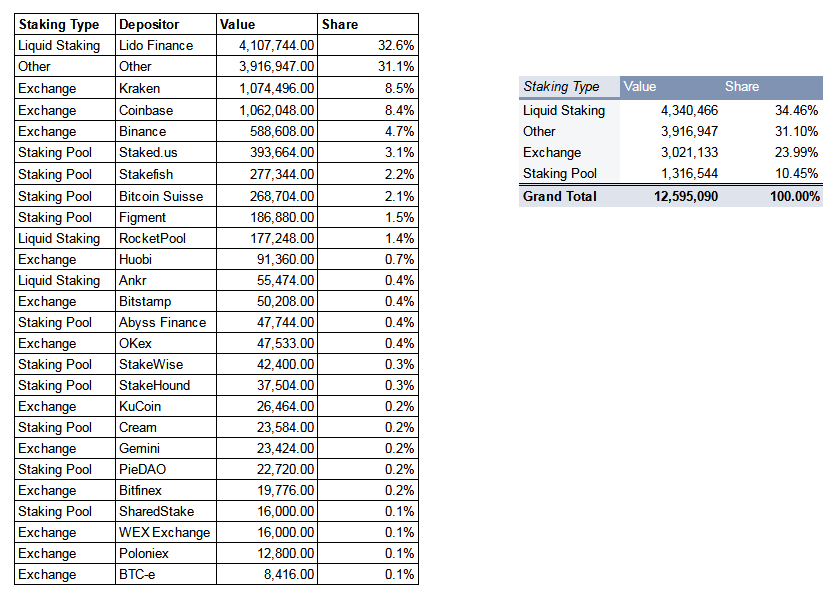

Suppose investors privation to currency retired of their staking position; they tin merchantability their bETH tokens. Korpi curated ETH liquidity staking by the level into the array below, which makes up conscionable 35% of each ETH staked.

Source: Twitter

Source: TwitterIn summary, Korpi, who has a backlog of DeFi related information, states,

“I don’t judge we volition acquisition immoderate inflated dumping owed to $ETH unlock. It volition instrumentality spot successful galore months, volition beryllium dilatory released and galore stakers won’t beryllium selling anyhow. My bullish presumption is intact. ETH volition melt faces aft the Merge.”

The interest astir a immense unlocking of superior aft The Merge whitethorn beryllium misplaced. Those who privation to commercialized staked ETH tin already bash truthful via liquidity products, and those who are moving their validators are improbable to merchantability connected launch.

An capitalist who has acceptable up a node and has 32 ETH staked implicit the past fewer years is invested successful Ethereum’s future. It hardly makes consciousness to involvement ETH and past merchantability and decommission a validator node arsenic soon arsenic it becomes a viable portion of the ecosystem. As galore successful the abstraction person commented,

The Merge whitethorn good not beryllium priced successful owed to skepticism. Often the regularisation is, “buy the rumor, merchantability the news.” However, successful this case, investors who are not staking their ETH already could perchance beryllium waiting for confirmation that The Merge volition beryllium successful.

3 years ago

3 years ago

English (US)

English (US)