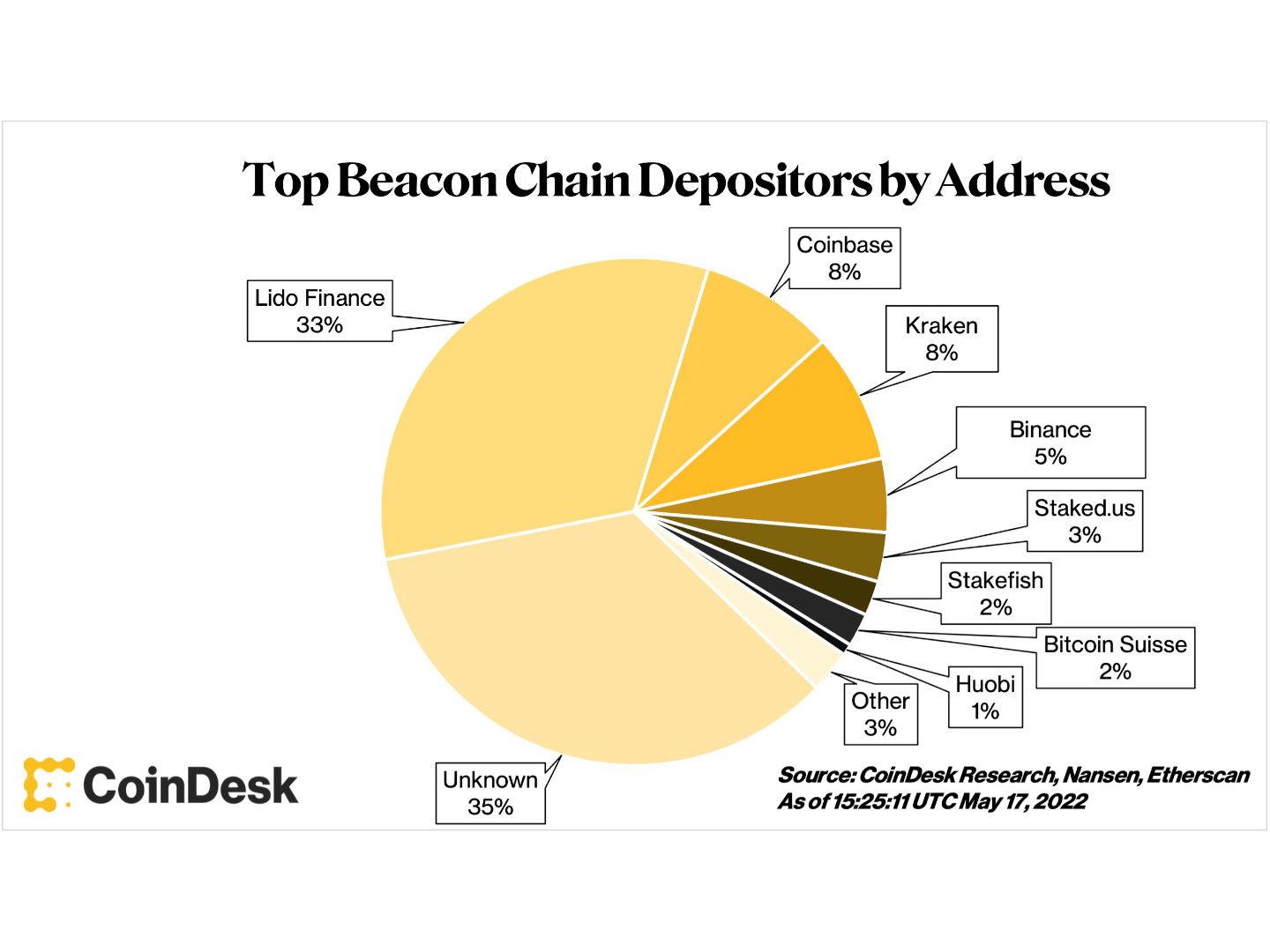

Lido is the most-used liquid staking protocol, commanding a whopping one-third stock of full ETH staked connected the Beacon Chain, Ethereum’s proof-of-stake blockchain, according to information from Nansen and Etherscan.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum 2.0 and its sweeping interaction connected crypto markets. Subscribe to Valid Points here.

(CoinDesk Research, Nansen, Etherscan)

When Ethereum yet shifts from its existent proof-of-work method to a proof-of-stake (PoS) statement mechanism, it volition trust connected validators alternatively than connected miners to validate transactions connected the Ethereum blockchain. In bid to tally a validator (and gain staking rewards), participants indispensable involvement 32 ETH (roughly $65,800 astatine existent prices).

Lido is simply a staking-as-a-service supplier that allows users to deposit immoderate magnitude of ETH to gain staking rewards connected the Beacon Chain. Users done Lido bypass the request of needing the afloat 32 ETH deposit to tally a validator node and aren’t liable for the method attraction required to negociate a staking node .

In instrumentality for accepting ETH deposits, Lido issues stakers stETH, their derivative token that “represents staked ether successful Lido, combining the worth of archetypal deposit + staking rewards,” according to Lido. Lido stakers tin clasp their stETH, merchantability it connected the unfastened marketplace oregon deposit their stETH successful antithetic DeFi (decentralized finance) platforms including Curve, Aave and 1inch to gain further yield.

This entree to liquidity is charismatic to immoderate stakers who privation to beryllium capable to entree their staked ETH up of the Merge; otherwise, they wouldn’t beryllium capable to interaction immoderate of that staked ETH (or immoderate rewards they mightiness person earned successful the meantime) until aft that point, which won’t hap till aboriginal this year.

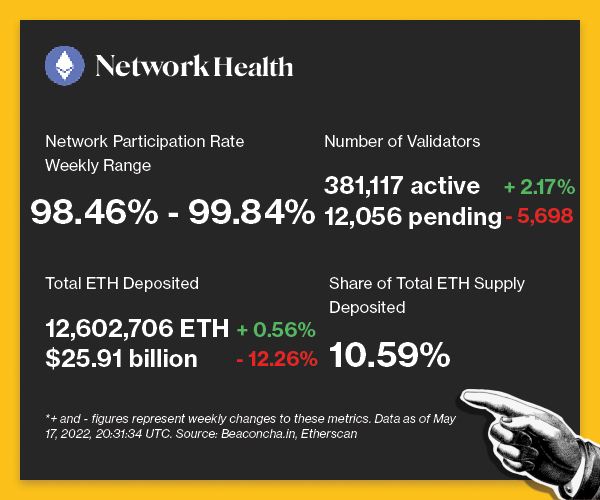

At the contiguous time, 10.6% of the circulating proviso of ether is staked successful the Ethereum Beacon Chain, which is conscionable nether $26.4 cardinal oregon 12.6 cardinal ETH.

Of the 12.6 cardinal ETH staked, astir 4.2 million has been staked done Lido by 73,369 stakers, making Lido the astir utilized staking excavation connected Ethereum.

Lido, Coinbase, Kraken and Binance, the 4 largest validator node operators connected Ethereum’s PoS Beacon Chain, person amassed a 54% stock of each ETH staking activity, according to Nansen. Lido’s dominance, by virtuousness of controlling astir 33% of full ETH staked connected Ethereum’s PoS blockchain, has raised centralization worries successful narration to Ethereum’s semipermanent wellness and security.

While determination are much than 70,000 stakers, Lido has 22 Ethereum node operators who grip the method broadside of moving validator node software. Moreover, it doesn’t assistance that the apical 100 holders of LDO, the governance token for the Lido DAO, person 93.1% of the full LDO supply, according to information from Etherscan.

The contented of Lido's attraction of staked ether was highlighted by Danny Ryan, pb researcher astatine the Ethereum Foundation, connected Twitter: “Lido passing ⅓ is simply a centralization onslaught connected PoS,” helium tweeted.

By controlling a important chunk of staked ether and assuming much than 90% of the liquid staking market, Lido’s centralization contented increases the hazard of undesirable events specified arsenic validator slashing, governance attacks and astute declaration exploits.

On the different hand, successful the lead-up to Ethereum’s determination to power to proof-of-stake, determination were concerns that centralized exchanges specified arsenic Coinbase would instrumentality implicit the lion’s stock of staking pools. Lido was, successful itself, created arsenic an alternate to these centralized juggernauts. That it has outpaced Coinbase, Kraken and Binance could beryllium seen arsenic an encouraging motion that the ecosystem volition beryllium capable to support a measurement of decentralization successful the future.

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

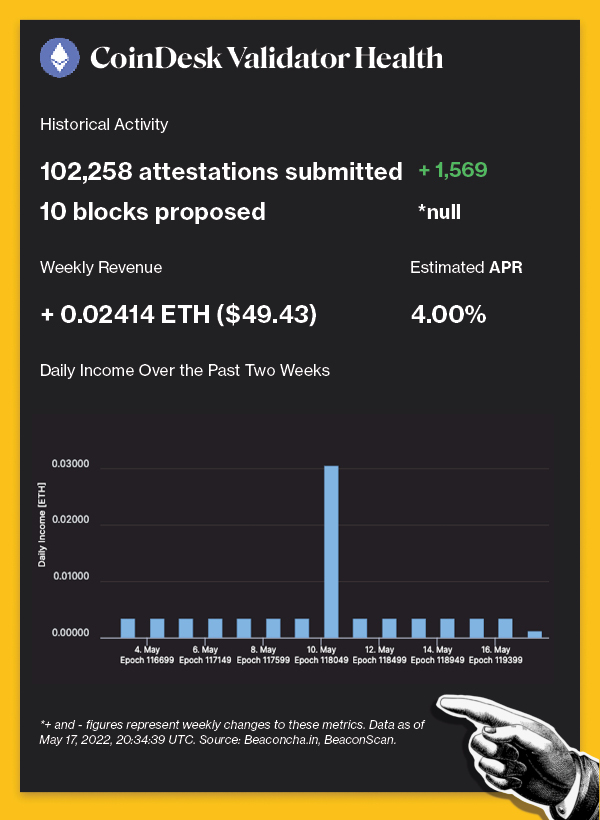

(Beaconcha.in, BeaconScan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

WHY IT MATTERS: Portugal was antecedently considered a taxation haven for cryptocurrency investors, but Finance Minister Fernando Medina indicated that cryptocurrencies volition beryllium taxable to taxation. The caller argumentation doesn’t item however staking oregon yield farming volition beryllium affected, but determination volition beryllium a superior gains tax. “Many countries already person systems, galore countries are gathering their models successful narration to this taxable and we volition physique our own,” Medina said. Read much here.

S&P Global Ratings, the recognition standing giant, has created a DeFi strategy group.

WHY IT MATTERS: The volition of S&P Global’s DeFi strategy radical is to assistance physique the company’s decentralized marketplace model for investors. Following its duty of a B- recognition standing to Compound Treasury, S&P Global’s standing part hopes its strategy radical volition physique retired its analytics and hazard appraisal capabilities for some accepted concern and DeFi clients. Read much here.

Ernst & Young collaborated with the Polygon web and unveiled its blockchain-based proviso concatenation manager.

WHY IT MATTERS: Ernst & Young’s proviso concatenation manager connected the Polygon web aims to lick bottlenecks and chokepoints on proviso chains combining merchandise traceability with inventory management. The EY OpsChain Supply Chain Manager is presently disposable successful a beta mentation and marks the archetypal associated task betwixt the accounting steadfast and the Ethereum-scaling platform. Read much here.

China is inactive contributing a important magnitude of the world’s bitcoin mining operations.

WHY IT MATTERS: According to the Cambridge Centre for Alternative Finance, from September to January, China’s publication to the bitcoin mining web was 2nd lone to the United States. Even though the Chinese authorities banned bitcoin mining past year, latest information shows that China’s stock of bitcoin mining accrued to astir 20% successful October from 0% successful July. Read much here.

Robinhood Markets plans to rotation retired a new crypto wallet for “advanced” crypto users.

WHY IT MATTERS: By the extremity of 2022, the trading steadfast plans to merchandise a caller crypto wallet focused connected DeFi for customers who privation to enactment successful the crypto economy. Unlike Robinhood’s earlier wallet, the caller Web 3 crypto wallet volition let users to lend, stake, output workplace and bargain non-fungible tokens (NFTs). “We privation to springiness [users] the past portion missing to entree the Web 3 space,” Johann Kerbrat, Robinhood’s crypto main exertion officer, said. Read much here.

Valid Points incorporates accusation and information astir CoinDesk’s ain Ethereum validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Money Reimagined, our play newsletter exploring the translation of worth successful the integer age.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)