In caller discussions surrounding Bitcoin (BTC) and its imaginable aboriginal terms trajectory, crypto-enthusiasts and analysts alike are uncovering caller correlations to dissect. Most notably, a correlation with the EURUSD brace (the euro against the US dollar) has travel into the spotlight owed to a Twitter thread by esteemed expert Josh Olszewicz.

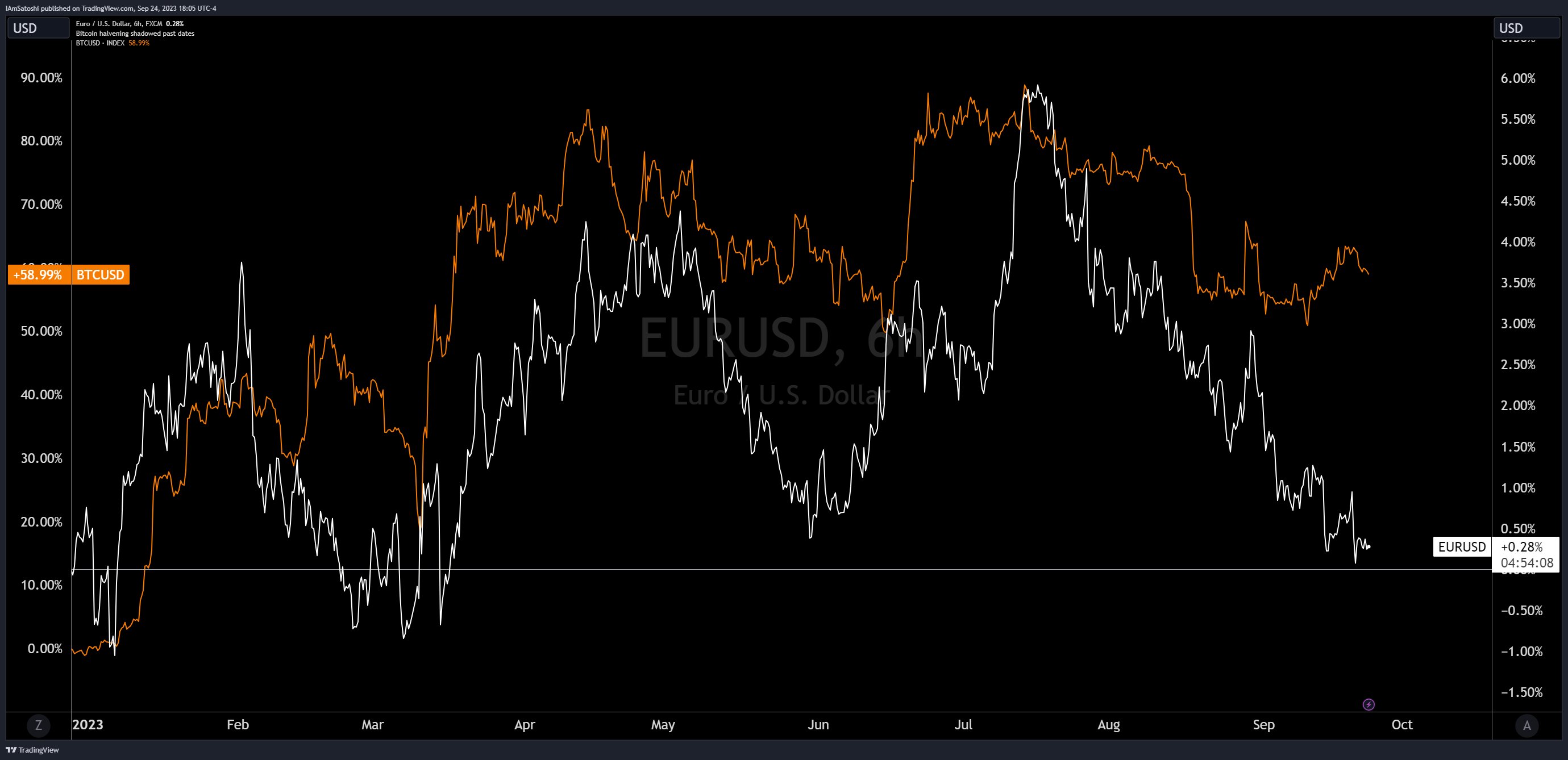

Olszewicz begins by mounting the stage, drafting attraction to the wide acknowledged inverse correlation betwixt Bitcoin and the DXY (US Dollar Index). He notes, “Most are alert of the beardown historical BTC-DXY inverse correlation. DXY is simply a USD scale against a handbasket of currencies which has a EURUSD weighting of astir 58%. So the BTC-EURUSD correlation should besides beryllium comparatively high.”

Will Bitcoin Price Follow EURUSD?

What’s intriguing present is the reflection Olszewicz makes astir the BTC-EURUSD correlation successful the play pursuing the pandemic and the past Bitcoin halving. He mentions that the “post-pandemic (post-halving) EURUSD brace has led BTC successful some the bullish and bearish absorption by anyplace from a period to a afloat year.”

Bitcoin vs. EURUSD | Source: X @CarpeNoctom

Bitcoin vs. EURUSD | Source: X @CarpeNoctomThis pattern, if it continues to persist, mightiness spell immoderate bearish tendencies for Bitcoin. Olszewicz goes connected to suggest that, “If this narration continues to hold, BTC should interruption down towards the BTFP debased of $20k.” This connection is simply a important one, indicating a imaginable important driblet from its existent position, each based connected the question patterns of the EURUSD.

Further supporting this projection, helium highlights a method signifier observed successful some BTC and EURUSD, stating, “the EURUSD has completed a bearish H&S, akin to BTC, providing method substance for further downside.” A ‘bearish H&S’ refers to the bearish ‘head and shoulders’ pattern, a illustration enactment that predicts a bullish-to-bearish inclination reversal.

However, it’s not each gloom and doom. Olszewicz does supply a glimmer of anticipation for Bitcoin bulls. He posits, “If you’re bullish connected BTC here, you’re either hoping this narration weakens/breaks, oregon the EURUSD begins to fortify alternatively of continuing to weaken.”

BTC’s Second High Does Not Fit

Olszewicz besides touches upon immoderate “tin foil” speculations, discussing however the BTC-EURUSD correlation had been seemingly disrupted during Bitcoin’s 2nd precocious successful November 2022. He suggests that the continued autumn of EURUSD did not instantly interaction Bitcoin’s bullish trend, speculating that actions from large crypto players similar 3AC, FTX/Alameda, and the Anchor BTC reserve mightiness person played a role.

He states, “It is some imaginable and apt that the comic concern down the scenes by 3AC & FTX/Alameda, arsenic good arsenic the Anchor BTC reserve, helped hold the inevitable bearish inclination by astir a year.”

Bitcoin EURUSD | Source: X @CarpeNoctom

Bitcoin EURUSD | Source: X @CarpeNoctomWhile correlations tin supply insight, they are by nary means a warrant of aboriginal marketplace movements. Investors should workout caution and behaviour their ain probe erstwhile making concern decisions. Rose Premium Signals added, “interesting reflection astir the BTC-EURUSD correlation. It’s indispensable to see aggregate factors successful crypto analysis. The narration could so evolve, impacting BTC’s aboriginal movements.”

At property time, BTC stood astatine $26,180.

Bitcoin terms falls , 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms falls , 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)