Many analysts person weighed connected the potential trajectory of the flagship cryptocurrency, Bitcoin. This time, Bloomberg expert Mike McGlone has highlighted the anticipation of Bitcoin terms declining further and erstwhile this could happen.

Bitcoin Price Could Decline Further

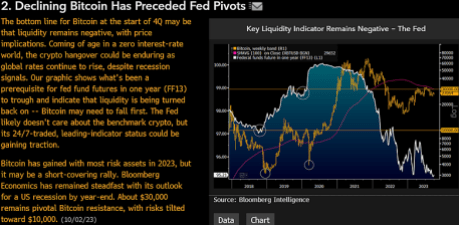

In a tweet connected his X (formerly Twitter) platform, McGlone noted that Bitcoin risks declining to $10,000 (which could hap by year-end) arsenic it continues to conflict the $30,000 absorption level.

This absorption level has agelong been touted arsenic the cardinal to a sustained breakout successful Bitcoin’s price. However, going by the investigation that McGlone shared, the likelihood look to beryllium against this happening.

Bitcoin has risen importantly successful 2023, considering that the crypto plus traded astatine astir $16,000 astatine the opening of the year. But, McGlone warned that this whitethorn beryllium a “short-covering rally.”

As portion of this analysis, helium noted that liquidity successful the Bitcoin ecosystem remained antagonistic heading into the 4th quarter. This yet means determination is much selling unit than buying pressure, which could impact Bitcoin’s price.

Another origin is the rising involvement rates. McGlone noted that Bitcoin gained prominence successful a “zero interest-rate world” with greater fiscal freedom. But now, Bitcoin (alongside different cryptocurrencies) mightiness proceed to endure a hangover arsenic “global rates proceed to rise.”

Global inflation is said to beryllium connected the rise, and to curb it, authorities are raising involvement rates, which could restrict spending and, by extension, the liquidity that goes into the crypto market.

Meanwhile, the investigation noted Bitcoin’s value successful the expansive strategy of things. Bloomberg Intelligence drew a correlation betwixt the FED money futures and Bitcoin’s price. According to projections, Bitcoin needs to diminution further earlier determination tin beryllium a liquidity reversal successful those funds.

While the Federal Reserve whitethorn not attraction astir Bitcoin, helium stated that Bitcoin’s “24/7-traded, starring indicator presumption could beryllium gaining traction.”

The Fate Of The Broader Crypto Market

In different tweet, McGlone noted that cryptocurrencies “might beryllium leaning into recession.” To thrust location this point, helium highlighted the narration betwixt the crypto and banal market and stated that the second could succumb to an “ebbing tide” accidental the banal marketplace were to acquisition a “typical drawdown” owed to a recession.

Despite the “broader on-and-of-again fluctuations,” this projection is said to beryllium reflected successful the “downward trajectory” of the Bloomberg Galaxy Crypto Index (BGCI) and Russell 2000 Index (RTY) from their all-time highs successful 2022. Both markets person remained tepid and proceed to consolidate arsenic they expect a “catalyst” that could spark a terms surge.

This investigation is akin to that of crypto expert Nicholas Merten, who, portion drafting retired the nonstop narration betwixt some markets, noted that if the stocks of large tech companies similar Apple and Microsoft don’t commencement picking up, determination could beryllium a “really large problem” for the crypto market.

Featured representation from Investor’s Business Daily, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)