The upcoming $3 cardinal successful Bitcoin (BTC) monthly options expiration connected Sep. 29 could beryllium pivotal for the $26,000 enactment level.

BTC terms faces superior headwinds

On 1 side, Bitcoin's designation successful China appears to beryllium strengthening, pursuing a judicial study from a Shanghai Court that acknowledged integer currencies arsenic unsocial and non-replicable.

Conversely, Bitcoin's spot exchange trading volumes person dwindled to a five-year low, according to on-chain analytics steadfast CryptoQuant. Analyst Caue Oliveira pointed retired that a important origin down this diminution successful trading enactment is the increasing fearfulness surrounding the macroeconomic outlook.

Despite the summation successful semipermanent holders, the reduced trading measurement poses a hazard successful presumption of unexpected volatility. This means that terms swings resulting from liquidations successful derivative contracts could perchance origin structural marketplace harm if determination aren't capable progressive participants.

Furthermore, determination is increasing unease among accepted fiscal institutions erstwhile it comes to handling crypto-related payments.

JPMorgan Chase, the largest slope successful North America, is reportedly prohibiting transfers "related to crypto assets" wrong its retail division, Chase. The stated rationale is to support against imaginable engagement successful fraudulent oregon scam activities.

JPMorgan Chase, the largest slope successful North America, is reportedly prohibiting transfers "related to crypto assets" wrong its retail division, Chase. The stated rationale is to support against imaginable engagement successful fraudulent oregon scam activities.

Lastly, Bitcoin holders are feeling apprehensive arsenic the Dollar Strength Index (DXY), a measurement of the dollar's spot against different currencies, reached 106 connected Sep. 26, its highest level successful 10 months.

Historically, this scale exhibits an inverse correlation with risk-on assets, tending to emergence erstwhile investors question information successful currency positions.

Bitcoin bulls excessively optimistic?

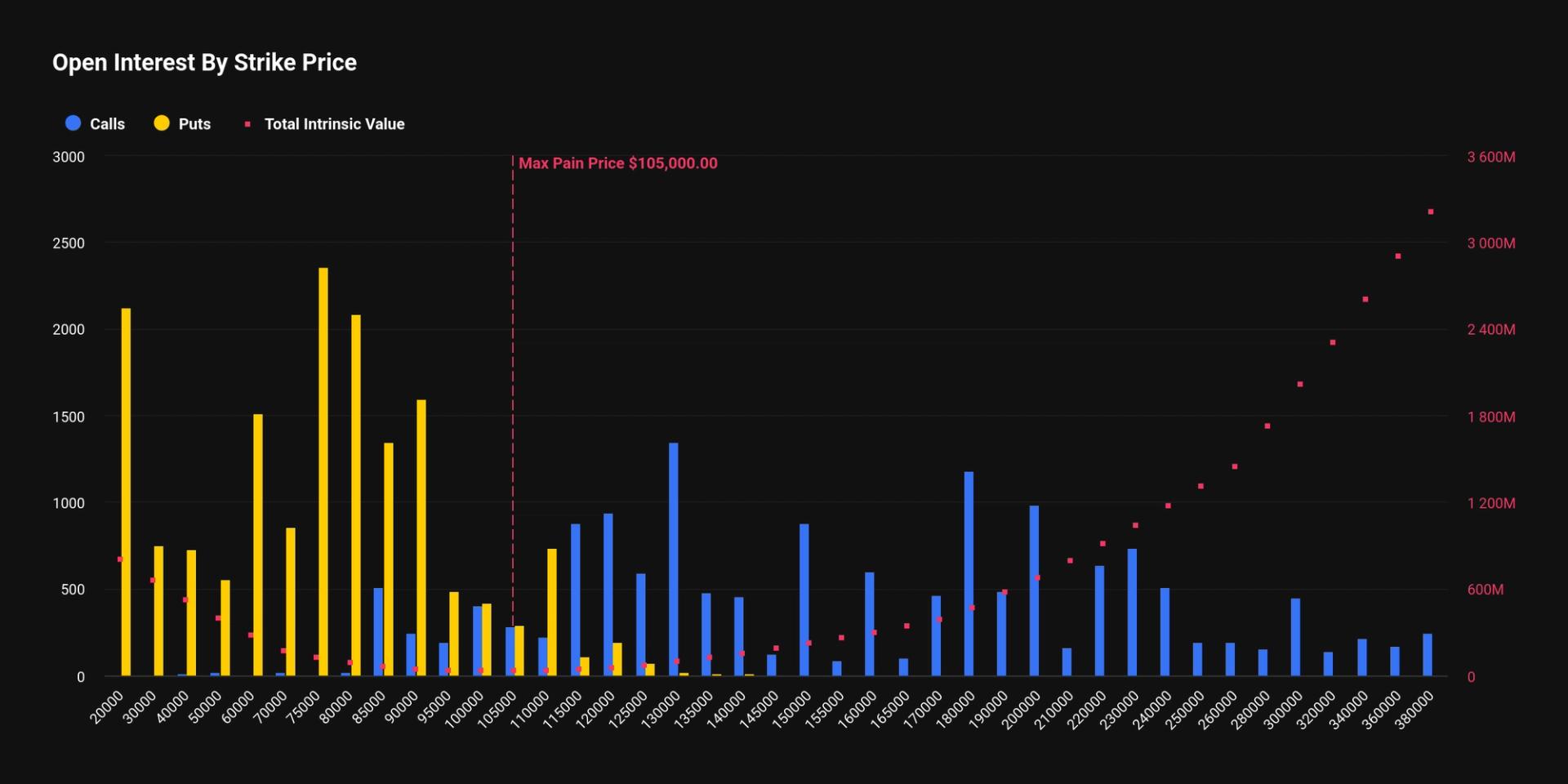

The unfastened involvement for the Sep. 29 options expiration presently stands astatine $3 billion. However, it is expected that the last magnitude volition beryllium little owed to bullish expectations of Bitcoin's terms reaching $27,000 oregon higher.

The unsuccessful effort to interruption supra $27,200 connected Sep. 19 whitethorn person contributed to overconfidence among Bitcoin investors.

The 0.58 put-to-call ratio reflects the imbalance betwixt the $1.9 cardinal successful telephone (buy) unfastened involvement and the $1.1 cardinal successful enactment (sell) options.

However, if Bitcoin’s terms remains adjacent $26,300 astatine 8:00 americium UTC connected Aug. 25, lone $120 cardinal worthy of the telephone (buy) options volition beryllium available. This quality happens due to the fact that the close to bargain Bitcoin astatine $27,000 oregon $28,000 is useless if BTC terms is beneath this level connected expiry.

Bitcoin bears oculus sub-$26,000 for max nett potentia

Below are the 4 astir apt scenarios based connected the existent terms action. The fig of options contracts disposable connected Sep. 29 for telephone (buy) and enactment (sell) instruments varies depending connected the expiry price. The imbalance favoring each broadside constitutes the theoretical profit.

This crude estimation disregards much analyzable concern strategies. For instance, a trader could person sold a telephone option, efficaciously gaining antagonistic vulnerability to Bitcoin supra a circumstantial price. Unfortunately, there’s nary casual mode to estimation this effect.

- Between $25,000 and $26,000: 1,400 calls vs. 19,300 puts. The nett effect favors the enactment instruments by $430 million.

- Between $26,000 and $27,000: 6,200 calls vs. 12,600 puts. The nett effect favors the enactment instruments by $170 million.

- Between $27,000 and $27,500: 9,900 calls vs. 10,100 puts. The nett effect is balanced betwixt telephone and enactment options.

- Between $27,500 and $28,000: 12,000 calls vs. 8,900 puts. The nett effect favors the telephone instruments by $85 million.

It's worthy noting that for the bulls to level the playing tract up of the monthly expiration, they request to execute a 3.2% terms summation from $26,200. In contrast, the bears lone request a humble 1% correction beneath $26,000 to summation a $430 cardinal vantage connected Sep. 29.

Related: Crypto bills could beryllium delayed arsenic galore hole for US gov’t shutdown

Given that Bitcoin traded beneath the $26,000 enactment level betwixt Sep. 1 and Sep. 11, it wouldn't beryllium astonishing if this level were breached again arsenic the options expiration approaches. Moreover, capitalist sentiment is becoming progressively risk-averse arsenic evidenced by the S&P 500 dropping to its lowest level since June.

Consequently, unless determination is important quality oregon an lawsuit that powerfully favors Bitcoin bulls, the likelihood of BTC pric breaking beneath $26,000 by Sep. 29 remains high.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)