The Bitcoin terms is lingering conscionable nether $19,000 astatine the clip of writing, not acold from the section debased of $18,300. When the Consumer Price Index (CPI) and Producer Price Index (PPI) information was released past week, the BTC terms plunged to conscionable that terms level.

Bitcoin lingering nether $19.000. Source: TradingView

Bitcoin lingering nether $19.000. Source: TradingViewUnexpectedly for many, a precise speedy rebound happened, catching shorters disconnected guard. With November 02 – erstwhile the FED meets again – successful mind, the Bitcoin terms doesn’t person overmuch country to autumn beneath that level astatine the moment. Moreover, a look astatine the on-chain suggests different clang is imaginable successful the abbreviated term, though determination are affirmative signals arsenic well.

According to CryptoQuant, a carnivore marketplace awesome appears erstwhile the realized terms of each semipermanent holders (blue line) goes supra the realized terms of each coins bought (red line) and erstwhile the BTC terms falls beneath the realized terms of semipermanent holders and the realized terms of each coins.

Bitcoin’s downside potential. Source: CryptoQuant

Bitcoin’s downside potential. Source: CryptoQuantBased connected this analysis, the investigation concludes that the Bitcoin terms has been successful a carnivore marketplace for 124 days. In this respect, the driblet from $6,000 to $3,000 is comparable to the terms diminution from $30,000 to $18.00, arsenic the percent diminution successful the past carnivore marketplace from $6,000 to $3,000 was 50%.

That being said, the bottommost whitethorn not person been seen yet:

The driblet from $30.7k to $18.2k was 41%. A 50% driblet from $30.7k would enactment BTC astatine $15k (-18% from the existent price). Similar to the $14.7k delta price.

Contradictory On-Chain Data For Bitcoin

With Santiment, different large on-chain investigation work stated that the Bitcoin marketplace needs to ideally spot accumulation astatine the moment, portion tiny traders stay bearish and dispersed doom and gloom.

However, contradictory information is showing up successful this regard. Thus, Bitcoin’s tiny to mid-sized addresses (with 0.1 to 10 BTC) person precocious reached an all-time precocious of 15.9% of disposable supply. At the aforesaid time, whales with 100 to 10,000 BTC person recorded a 3-year debased of 45.6% of supply.

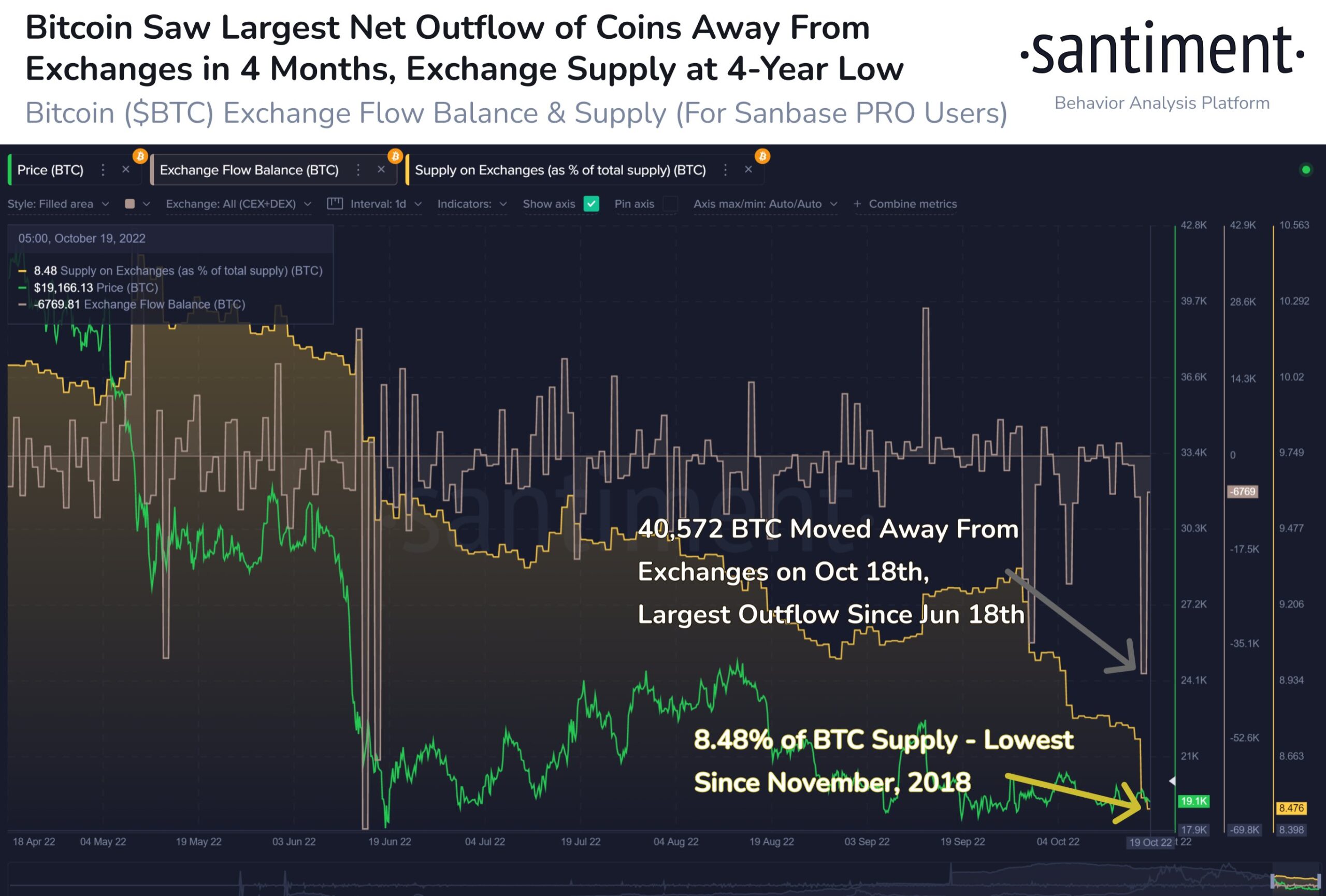

On the bullish side, Bitcoin experienced a monolithic outflow of coins from exchanges connected October 18. Santiment recorded the largest regular measurement successful 4 months, amounting to 40,572 BTC. With this, the proviso of coins connected each exchanges has dropped to 8.48%. This means that the hazard of a aboriginal sell-off has decreased astatine slightest somewhat.

Bitcoin speech proviso astatine a 4-year low. Source: Twitter

Bitcoin speech proviso astatine a 4-year low. Source: TwitterBullish information is besides reported by the 3rd large on-chain information supplier Glassnode. Bitcoin supply which has not moved successful the past 6 months is approaching an all-time low. It presently stands astatine 18.12% of circulating proviso oregon astir 3.485 cardinal BTC. Glassnode writes:

Historically, precise debased volumes of mobile proviso typically hap aft prolonged carnivore markets.

Jim Bianco, President of Bianco Research LLC, precocious quoted an aged trader’s adage, “Never abbreviated a dull market,” which whitethorn use much than ever to the Bitcoin market.

According to his analysis, the realized volatility meaning the backwardation oregon existent volatility is astatine a 2-year debased and is signaling 1 of the lowest levels of each time.

Markets bottommost connected apathy, not excitement. BTC and ETH person apathy. The S&P 500 is astir the opposite, arsenic prices determination astir similar a video game. This mightiness besides beryllium different motion of the TradFi/Crypto choky narration breaking. If so, this is long-run bullish for crypto.

Diverging volatility could truthful beryllium a motion of this displacement and yet trigger a semipermanent affirmative trend.

3 years ago

3 years ago

English (US)

English (US)