In 2022, ethereum has been successful a bearish trend. It has dropped 40% twelvemonth to date, acold much than the mean cryptocurrency. ETH has a agelong past of being 1 of the best-performing cryptocurrencies.

Since its instauration successful 2016, it has mostly outperformed Bitcoin, resulting successful a narrowing of the marketplace capitalization spread betwixt the 2 coins. However, this twelvemonth has deviated importantly from the semipermanent tendency. A cardinal inducement to bargain Ether has been removed from the marketplace owed to the waning of the NFT craze. ETH is present mostly utilized by traders, and request for the cryptocurrency is acold little than it was precocious past year.

Ethereum Price Swings

The marketplace has seen nary evident absorption successful the past 24 hours, arsenic a consolidation betwixt $2,500 enactment and $2,600 absorption continues. As a result, we tin expect a follow-up propulsion to either broadside aft ETH/USD breaks to either side.

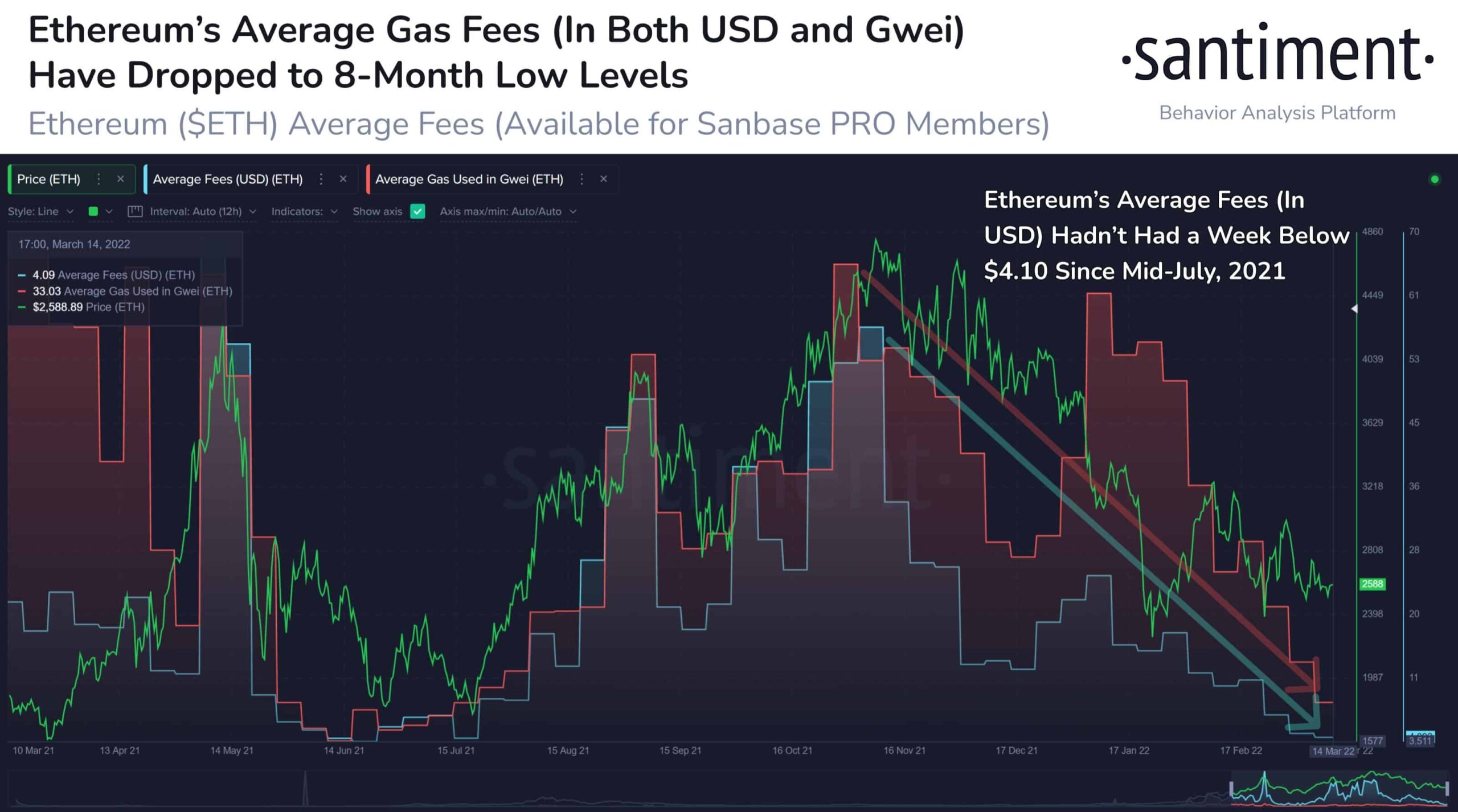

As a result, the Ethereum (ETH) blockchain continues to acquisition important changes. Santiment, an on-chain information source, revealed that the Ethereum (ETH) terms has dropped to an eight-month low, which is invited quality for ETH investors. According to Santiment:

Ethereum is bouncing rapidly astir the $2,560 level currently. In summation to the highly choky #SP500 correlation it has close present (even much than Bitcoin), it’s besides seeing 8-month debased fees close now. $ETH past had fees beneath $4.10 successful mid-July.

Over the past 24 hours, the marketplace has risen somewhat. As they some proceeded to consolidate, Bitcoin gained 0.38 and Ethereum gained 0.34. Price enactment successful the remainder of the marketplace has been similar.

Related Reading | Where Ethereum and Bitcoin Headed After Musk’s Tweet

Investors See Upside

On Monday, March 14, Bill Barhydt, CEO of crypto speech Arba, told CNBC that Ethereum has the imaginable to scope $30,000-$40,000.

Bill is becoming much enthusiastic arsenic a effect of the assorted usage cases and advances successful the Ethereum ecosystem. He said.

“Ethereum’s web effect is based connected this thought that it could go the world’s computers. It’s being utilized for stablecoins, NFTs (non-fungible tokens), defi (decentralized finance) … and gaming now.”

By the mediate of 2022, the Ethereum 2.0 update is projected to beryllium operational. He believes that aft the archetypal unreserved to stake, determination whitethorn beryllium a “sell-the-news effect.” However, helium is optimistic that if the wide state interest is reduced, ETH investors volition benefit. Bill stated,

“If the state fees and the transaction fees travel down, which is the committedness of the proof-of-stake, look out, due to the fact that present each of the impediments of those web effects are taken retired of the way. I think, you are talking perchance $30,000-$40,000 Ethereum”.

Whatever the rationale for Ethereum’s terms remaining successful the $2,500 range, determination are nary method reasons for it to amusement immoderate strength. ETH is beneath the 2022 Volume Point Of Control, continues beneath the bearish pennant, and is present beneath the 61.8 percent Fibonacci retracement of the all-time precocious to the trough of the beardown barroom connected the play illustration astatine $2,570, successful summation to the Ideal Bearish Ichimoku Breakout confirmation.

The Ethereum price’s downside risks are astir apt restricted to the $1,800 worth level successful June 2021 and July 2022.

Related Reading | Abra CEO Predicts Ethereum Could Reach $40,000 – But Some Fintech Analysts Don’t Agree

Featured representation from Pixabay, illustration from TradingView.com

3 years ago

3 years ago

English (US)

English (US)