Investors volition beryllium focused connected the U.S. cardinal slope this Wednesday arsenic Federal Reserve policymakers are expected to rise the benchmark involvement complaint aggressively. The apical U.S. banal indexes saw important losses astatine the extremity of the week, and the Nasdaq composite saw its worst four-month starting show since 1971. Crypto markets person had a unsmooth week arsenic well, arsenic the crypto system has shed 8.99% against the U.S. dollar since April 25, dropping from $1.967 trillion to $1.79 trillion.

Fed Expected to Raise Benchmark Interest Rate Aggressively, Dutch Bank ING Predicts a 50bp Hike and a QE Tightening Announcement

A fig of fiscal institutions, analysts, and economists expect the Federal Open Market Committee (FOMC) volition rise involvement rates adjacent week successful an assertive manner. Reuters’ authors Lindsay Dunsmuir and Ann Saphir reported connected Friday that determination whitethorn beryllium “big Fed complaint hikes ahead” and the authors besides mention 2 reports that assertion “hot ostentation is peaking.”

“U.S. Federal Reserve policymakers look acceptable to present a bid of assertive involvement complaint hikes astatine slightest until the summertime to woody with blistery ostentation and surging labour costs, adjacent arsenic 2 reports Friday showed tentative signs some whitethorn beryllium cresting,” the study explains.

A study written by James Knightley, the main planetary economist astatine ING says: “For now, our basal lawsuit remains that the Fed volition travel up adjacent week’s 50bp hike with 50bp increases successful June and July earlier switching to 25bp arsenic quantitative tightening gets up to speed. We spot the Fed funds complaint peaking astatine 3% successful aboriginal 2023.”

A study written by James Knightley, the main planetary economist astatine ING says: “For now, our basal lawsuit remains that the Fed volition travel up adjacent week’s 50bp hike with 50bp increases successful June and July earlier switching to 25bp arsenic quantitative tightening gets up to speed. We spot the Fed funds complaint peaking astatine 3% successful aboriginal 2023.”In summation to the Reuters report, the Dutch multinational banking and fiscal services corp ING Group believes a large hike volition travel this Wednesday. In the report, ING expects the FOMC and Fed Chair Jerome Powell to denote a 50 ground constituent rise. ING’s study says that “inflation worries outweigh impermanent GDP dip.”

“The Federal Reserve is wide expected to rise its argumentation complaint by 50 ground points adjacent Wednesday arsenic 8%+ ostentation and a choky labour marketplace trump the astonishment 1Q GDP contraction attributed to impermanent commercialized and inventory challenges,” ING Group’s study published connected April 28 notes. While 50bp is simply a ample raise, ING besides believes the Fed volition uncover a tightening program erstwhile it comes to the cardinal bank’s monthly enslaved purchases.

“We volition besides beryllium looking for the Fed to formally denote quantitative tightening connected Wednesday,” ING’s study details.

Wall Street Takes a Beating, Gold Reaps Macroeconomic Benefits

Meanwhile, erstwhile Wall Street closed the time connected Friday, each the large U.S. banal indexes had suffered from a humor bath during the intraday trading sessions. Nasdaq, the Dow Jones Industrial Average, S&P 500, and NYSE each dropped importantly earlier the commencement of the weekend. Reports amusement that the Nasdaq composite saw its worst four-month start successful implicit 50 years and S&P 500 dropped similar a rock connected Friday arsenic well.

“By the extremity of trading connected Friday, the selloff had gotten worse and we were staring astatine the worst commencement to a twelvemonth since the Great Depression,” Barron’s writer Ben Levisohn wrote.

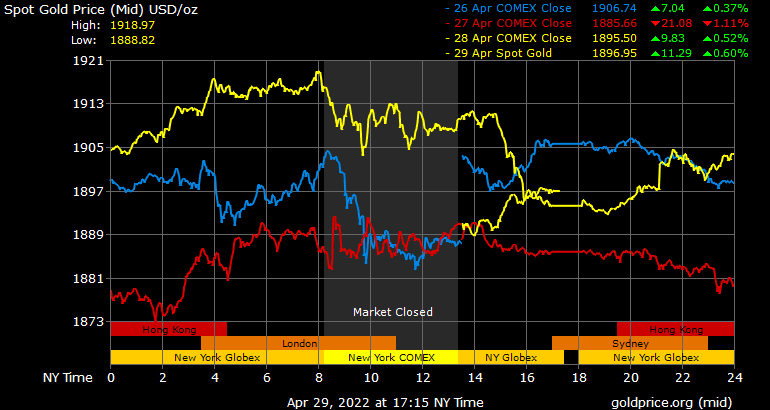

Friday’s golden prices saw a emergence aft equities and crypto markets took a beating.

Friday’s golden prices saw a emergence aft equities and crypto markets took a beating.Gold reaped the benefits from the tempest astatine the extremity of the week and the precious metallic saw a steady summation against the U.S. dollar heading into the play arsenic well. On Saturday, an ounce of good golden is up 0.08% and 6.47% implicit the past six months. Presently, an ounce of good golden is exchanging hands for $1,896 per unit. Trends forecaster Gerald Celente believes arsenic agelong arsenic ostentation rises, precious metals volition follow.

“The higher ostentation rises, the higher safe-haven assets golden and metallic rise. And, erstwhile the Banksters rise involvement rates, it volition bring down Wall Street and Main Street precise hard… and the harder they fall, the higher precious metallic prices volition rise,” Celente tweeted connected Saturday.

Fear Gives ‘Bear Market Vibes of 2018,’ Bitfinex Market Analysts Say Crypto Buyers Remain connected the Sidelines

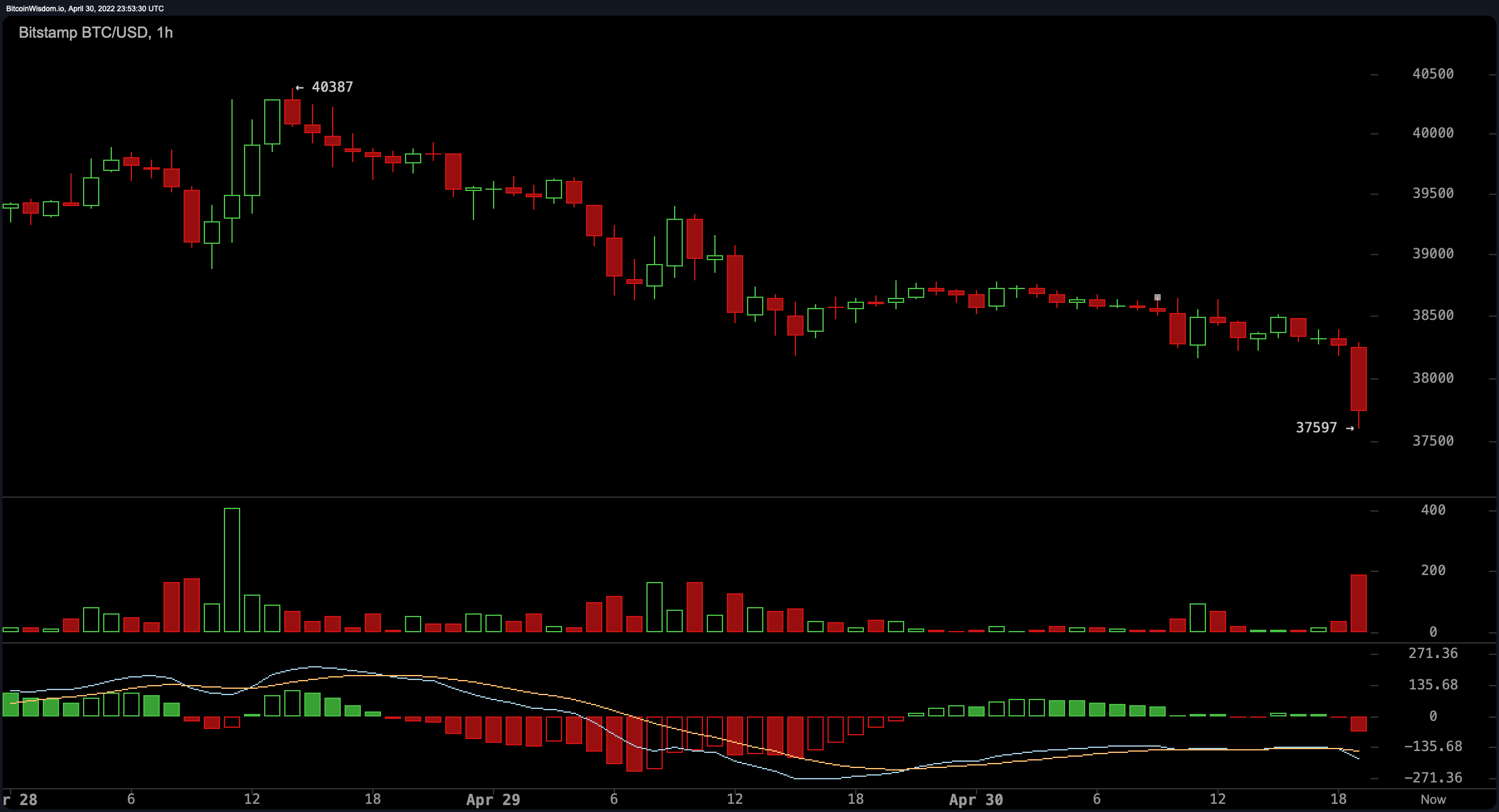

The crypto system suffered arsenic good this week and markets were correlated with equities markets. The CEO and laminitis of eightglobal.com Michaël van de Poppe tweeted astir the fearfulness successful crypto markets connected Saturday. “The magnitude of fearfulness successful the markets presently owed to the upcoming FED gathering is comparable to the carnivore marketplace vibes successful 2018,” the Eightglobal laminitis said. “That tells a batch for the markets and Bitcoin.” On Saturday evening (ET) astir 7:25 p.m., bitcoin (BTC) dropped beneath the $38K people to $37,597 per unit.

BTC/USD 1-Hour illustration connected April 30, 2022.

BTC/USD 1-Hour illustration connected April 30, 2022.Since April 25, 2022, the full crypto economy’s nett worth slipped from $1.967 trillion to today’s $1.79 trillion. While the crypto system mislaid 8.99% since past it has mislaid 1.2% during the past 24 hours. Bitcoin (BTC) has shed 4.9% this week and ethereum (ETH) has mislaid 7.6% against the U.S. dollar during the past 7 days. In a enactment sent to Bitcoin.com News connected Friday, Bitfinex marketplace analysts explained that “bitcoin is successful range-bound trading arsenic buyers stay connected the sidelines.”

“The time trading fervour symptomatic of lockdown – which saw alleged meme stocks pump to unearthly valuations – already seems similar a happening of the past,” the analysts added. “Robinhood has chopped unit amid a driblet successful revenues arsenic a bearish sentiment takes clasp successful the banal market. Still, it is absorbing to enactment that the percent of the bitcoin proviso dormant for a twelvemonth oregon much made caller all-time highs this month, according to information from on-chain analytics steadfast Glassnode.”

Tags successful this story

Ann Saphir, Bank Rate, Ben Levisohn, Bitfinex marketplace analysts, Central Bank, Crypto, Crypto markets, dow jones, Fed Chair Jerome Powell, Fed policymakers, FOMC, Gerald Celente, gold, Great Depression, inflation, ing, ING Group, interest complaint hikes, James Knightley, Lindsay Dunsmuir, Michaël van de Poppe, nasdaq, NYSE, Rate Hike, S&P 500, Trends forecaster

What bash you deliberation astir the outlook concerning planetary markets similar gold, crypto, and stocks? Do you deliberation the Federal Reserve volition rise the benchmark complaint by 50bp? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)