The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

The Larger Macro Picture

Last night, Dylan shared an extensive thread connected Twitter covering the existent macro representation crossed stocks, bonds and volatility successful the market. In today’s Deep Dive, we’re expanding connected immoderate of those ideas and charts much in-depth arsenic these are immoderate of the much important marketplace dynamics that volition impact each markets successful 2022, bitcoin included.

The wide ethos of the thread and a thesis we’ve discussed galore times successful the Deep Dive is that we’re successful unprecedented times with implicit a decennary of antagonistic existent rates contributing to the everything bubble we’re successful today. The marketplace present has to look the 2nd bid effects.

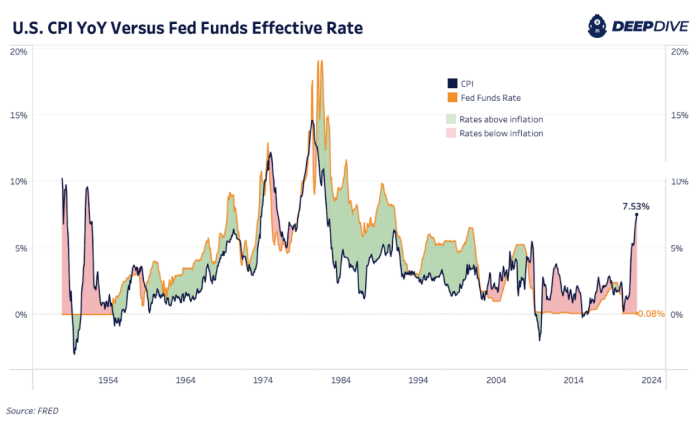

Official ostentation rates compared to the Fed funds complaint show highest ostentation successful decades.

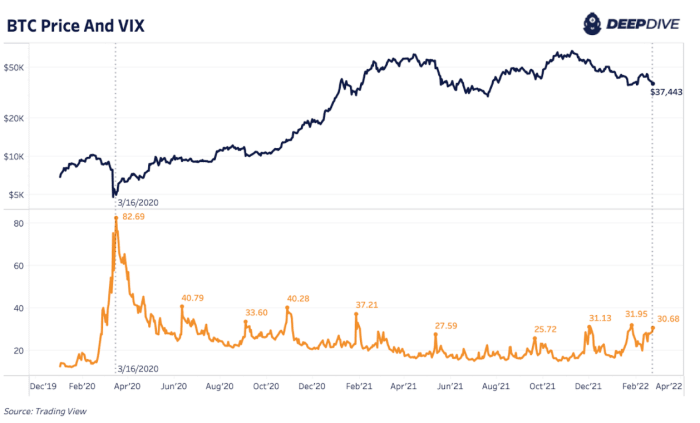

Second bid effects, specified arsenic higher periods of volatility, person been much predominant implicit the past fewer months. Higher volatility is simply a nonstop effect of little recognition marketplace liquidity. Looking backmost astatine an utmost play of volatility during March 2020, markets violently sell-off successful the look of a recognition unwinding. Like astir hazard assets, bitcoin is severely affected successful these higher periods of marketplace volatility and rising U.S. dollar spot arsenic told done the VIX relationship. We’re apt owed for much marketplace volatility going forward.

Bitcoin is affected successful higher periods of marketplace volatility and a rising U.S. dollar strength.

Yet successful the aftermath, this is the accidental for bitcoin. Is bitcoin a beneficiary of the monolithic recognition bubble astir the world? Undoubtedly. If recognition markets proceed to unwind volition the terms of bitcoin look headwinds? Almost assuredly.

"In the end, argumentation makers ever print. That is due to the fact that austerity causes much symptom than benefit, large restructurings hitch retired excessively overmuch wealthiness excessively fast, and transfers of wealthiness from haves to have-nots don’t hap successful capable size without revolutions." - Ray Dalio

Bitcoin is the reply to the decision of the semipermanent indebtedness cycle.

3 years ago

3 years ago

English (US)

English (US)