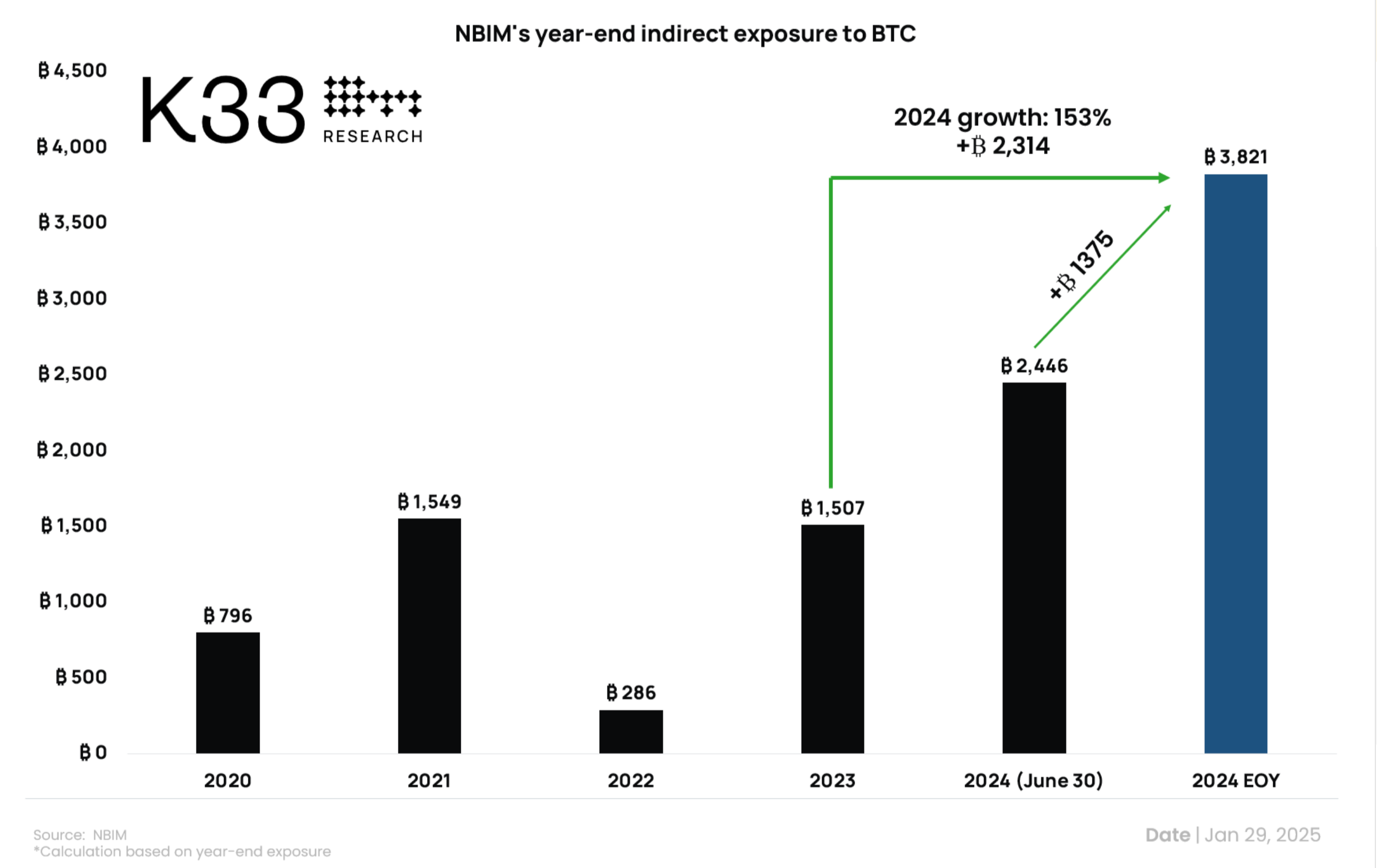

The world’s largest sovereign wealthiness fund, Norway’s Norges Bank Investment Management (NBIM), has amassed $356.7 cardinal successful indirect bitcoin (BTC) exposure, according to K33 Research. At the extremity of 2024, the money indirectly held 3,821 BTC, reflecting a 153% year-over-year summation from 1,507 BTC, according to K33. The information item the fund’s evolving indirect bitcoin exposure, increasing from conscionable 796 BTC successful in 2020.

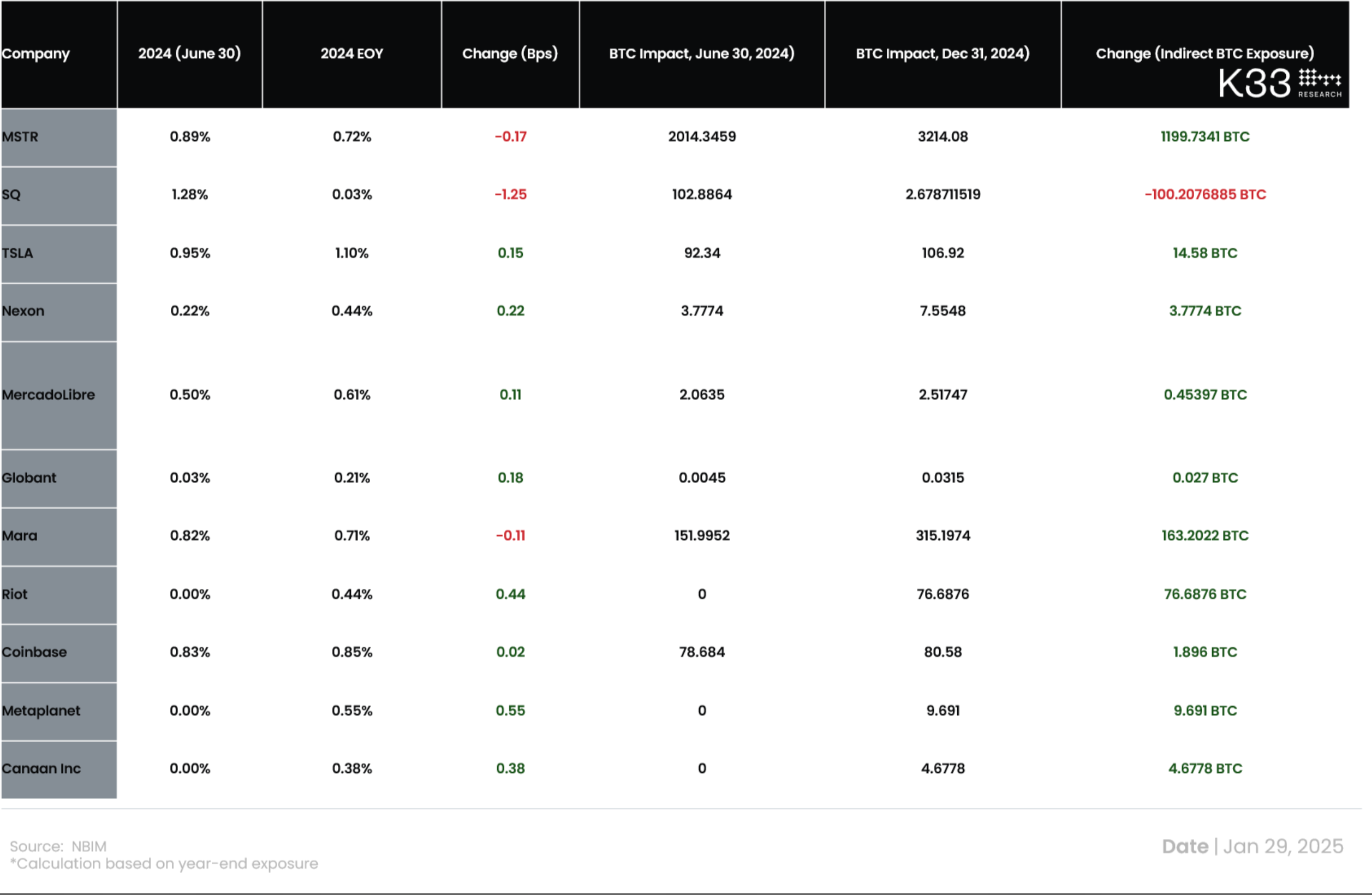

NBIM besides maintains stakes successful a fig of crypto-related nationalist companies. As of year-end 2024, its holdings included a 0.72% involvement successful MicroStrategy (MSTR), equivalent of $500 million, 1.1% of Tesla (TSLA) and investments successful Coinbase (COIN), Metaplanet (3350) and MARA Holdings (MARA).

NBIM, which invests gross from Norway’s lipid and state resources and is officially known arsenic the Government Pension Fund Global, reported record yearly nett of $222.4 billion, driven chiefly by the artificial quality (AI) boom. K33 expert Vetle Lunde makes the constituent that NBIM's indirect bitcoin vulnerability is apt a effect of sector-weighted portfolios. As crypto proxies admit successful value, their portfolio weightings increase.

NBIM declined to comment.

7 months ago

7 months ago

English (US)

English (US)