The Bitcoin terms presently remains successful a susceptible position. Meanwhile, caller on-chain information suggests that Bitcoin whales are accumulating, but contrary to fashionable rumors, BlackRock isn’t among them. Meanwhile, analysts are divided connected whether the worst is down for Bitcoin’s price.

Whales Accumulate Bitcoin, But It’s Not BlackRock

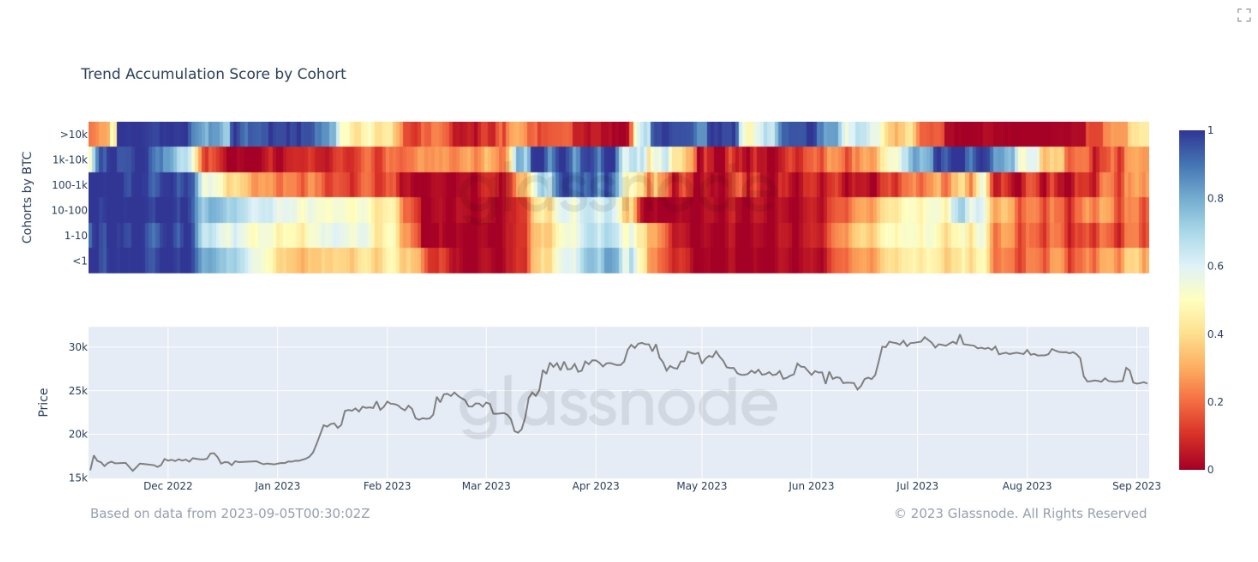

On-chain expert James V. Straten precocious highlighted a inclination successful the accumulation people by cohort chart. He remarked, “Seems similar highest Bitcoin organisation is down us, arsenic we tin spot a flimsy tick-up successful accumulation. This is the astir assertive accumulation since June/July for whales that person implicit 10k BTC.”

Bitcoin inclination accumulation people by cohort | Source: Twitter @jimmyvs24

Bitcoin inclination accumulation people by cohort | Source: Twitter @jimmyvs24However, the waters are muddied by rumors surrounding BlackRock’s involvement. Speculation has been rife that BlackRock has been suppressing Bitcoin prices to bargain cheap. But these claims are unfounded. “Many individuals don’t recognize that BlackRock would necessitate existent Bitcoin to backmost their Spot ETF. They mightiness person already purchased their Bitcoin months agone erstwhile prices were lower,” is simply a connection that’s been debunked.

The world is that BlackRock, being a fiscal behemoth managing people’s money, undergoes audits each 3 months. This means they can’t fell Bitcoin purchases from auditors. If they were to put successful Bitcoin, it would beryllium done an exchange-traded fund.

In fact, BlackRock has already shown involvement successful the abstraction by investing successful Bitcoin mining stocks and MicroStrategy arsenic a proxy. Remarkably, BlackRock is simply a large shareholder successful 4 retired of the 5 largest Bitcoin mining companies.

Is The Worst Behind For BTC Price?

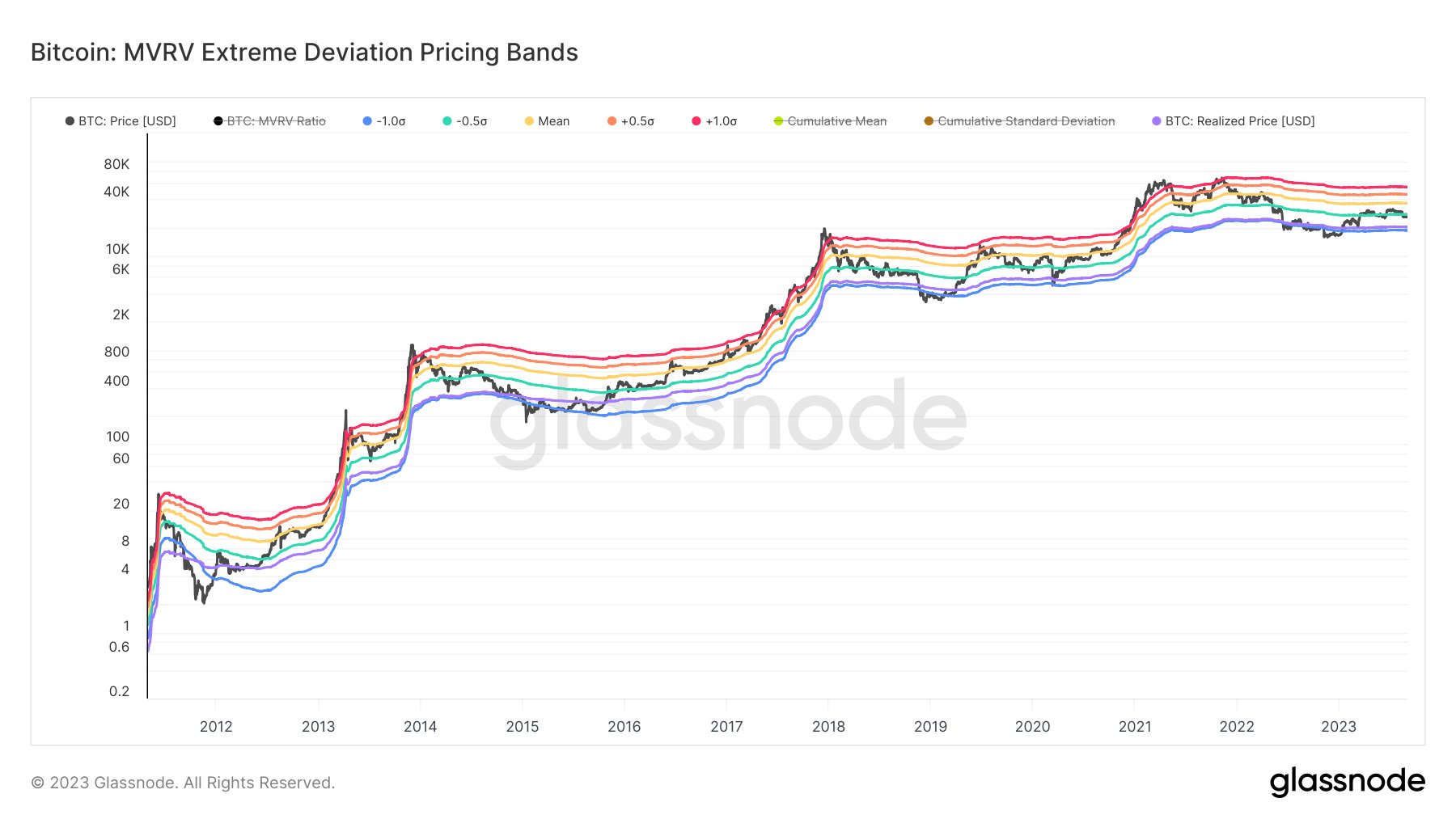

The Bitcoin terms trajectory remains a taxable of aggravated statement among analysts. Will Clemente, a salient fig successful the space, shared the illustration beneath and commented, “From a high-time-frame valuation perspective, Bitcoin’s presumption is intricate. While it’s not overheated comparative to humanities values, there’s a tangible hazard of retesting the lows akin to Q1 2020.”

Bitcoin MVRV Extreme Deviation Pricing Bands | Source: Twitter @WClementeIII

Bitcoin MVRV Extreme Deviation Pricing Bands | Source: Twitter @WClementeIIIHe further emphasized the prevailing marketplace apathy, pointing to the lowest aggregated trading measurement since 2020, the dwindling Google hunt trends for Bitcoin astatine multi twelvemonth lows and realized volatility, implied volatility, play Bollinger Bands each adjacent grounds lows.

Joe Burnett of Blockware Solutions chimed successful with a compelling observation, “A staggering 94.6% of each Bitcoin remained stationary successful the past 30 days. We acceptable a grounds precocious astatine August’s end, and this mightiness soon beryllium surpassed. Historically, carnivore markets reason erstwhile proviso dries up. A specified spark of request could ignite the adjacent explosive bull market.”

Crypto traders, too, are intimately monitoring cardinal levels. @DaanCrypto remarked the value of the $26K-26.1K scope arsenic it marks the daily, play and monthly open, precocious measurement node and play VWAP. Therefore, for bulls, it’s the enactment of action, and for bears, it’s the fortress to defend.

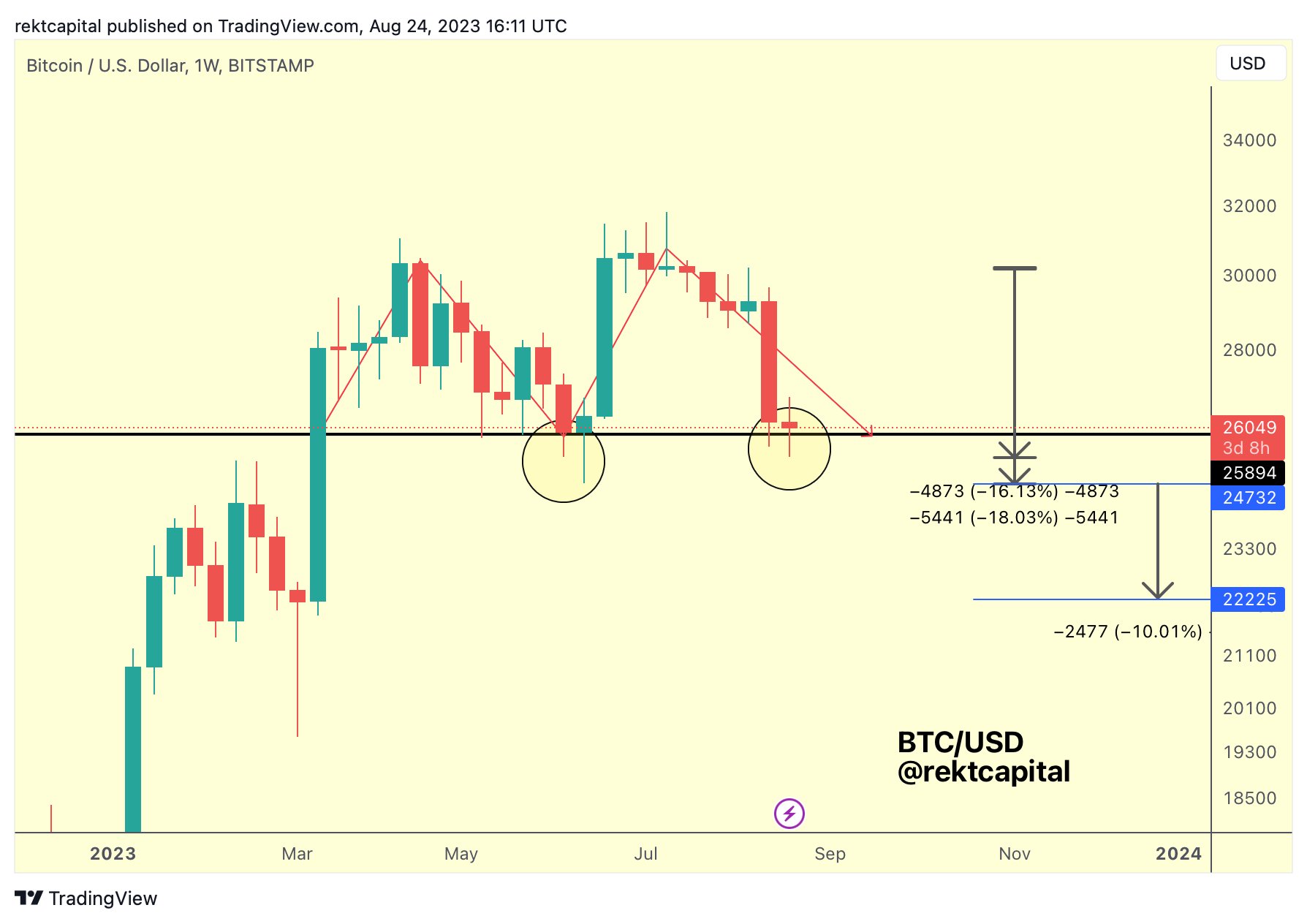

Rekt Capital, a well-regarded crypto analyst, has been intimately monitoring Bitcoin’s terms action, particularly successful narration to its measurement dynamics. He besides highlights the value of the $26,000 enactment level connected the play chart, pointing retired that Bitcoin’s terms has been hovering astir this people adjacent aft retracing astir of its gains from the erstwhile Grayscale rally.

However, the simultaneous diminution successful some buy-side and sell-side volumes is simply a origin for concern, suggesting a marketplace that’s presently directionless. “The declining sell-side measurement coupled with a lackluster purchaser measurement is concerning. Without a measurement breakout, neither from sellers nor buyers, the marketplace lacks momentum,” the expert states.

On the taxable of the double top, a traditionally bearish pattern, Rekt Capital indicated that a breach beneath the $26,000 people connected the play illustration could perchance nonstop BTC tumbling towards $22,000. However, helium besides hinted astatine a metallic lining: an inverse caput and shoulders signifier observed earlier this year. If Bitcoin approaches the $24,000 mark, which serves arsenic the neckline for this pattern, it could enactment arsenic a robust enactment and perchance awesome a bullish turnaround.

Bitcoin play treble apical | Source: Twitter @rektcapital

Bitcoin play treble apical | Source: Twitter @rektcapitalAt property time, BTC traded astatine $25,734.

BTC needs to regain $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC needs to regain $26,000, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Mike Doherty / Unsplash, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)