Charles Edwards, laminitis of the Bitcoin and integer plus hedge money Capriole Investments, published a elaborate introspection of Bitcoin’s existent marketplace signifier suggesting a bullish trajectory, perchance reaching the $100,000 mark. The investigation hinges connected the recognition of a Wyckoff ‘Sign of Strength’ (SOS), a conception derived from the century-old Wyckoff Method that studies proviso and request dynamics to forecast terms movements.

Understanding The Wyckoff ‘SOS’: Bitcoin To $100,000?

The Wyckoff Method, developed by Richard D. Wyckoff, is simply a model for knowing marketplace structures and predicting aboriginal terms movements done the investigation of terms action, volume, and time. The ‘Sign of Strength’ (SOS) wrong this methodology signifies a constituent wherever the marketplace shows grounds of request overpowering supply, indicating a beardown bullish outlook.

Edwards’s reflection of an SOS signifier successful Bitcoin’s caller terms movements suggests that the marketplace is astatine a pivotal point, wherever sustained upward momentum is highly probable. In Capriole’s latest newsletter, Edwards offered a precise depiction of Bitcoin’s marketplace behavior, highlighting a play of volatility and consolidation successful the $60,000 to $70,000 range.

This signifier was anticipated by the hedge fund. Currently, arsenic Bitcoin ventures supra its past cycle’s all-time highs, it aligns with the predicted zig-zag SOS structure. Edwards elucidates, “It would not beryllium astonishing to spot a liquidity drawback astatine / into all-time highs […] All consolidation supra the Monthly level astatine $56K is highly bullish. It would beryllium uncommon (but not impossible) for terms to proceed successful a consecutive enactment up.”

The “zig-zag” signifier besides perfectly aligns with the halving cycle arsenic BTC tends to consolidate “both months either broadside of the Halving.” Edwards added that “the realities of a overmuch little proviso maturation complaint + unlocked pent up tradfi request volition past kick-in and motorboat 12 months of historically the champion risk-reward play for Bitcoin.”

From a method perspective, Bitcoin’s foray into terms find territory supra $70,000 is devoid of important absorption levels. This opens a pathway to intelligence and Fibonacci hold levels, with Edwards pinpointing $100,000 arsenic the adjacent large intelligence resistance.

The 1.618 Fibonacci hold from the 2021 precocious to the 2022 debased is noted astatine $101,750, serving arsenic a method marker for imaginable resistance. Edwards reflects connected capitalist sentiment, stating, “You tin besides ideate rather a fewer investors would beryllium blessed seeing six-digit Bitcoin and taking nett successful that zone,” acknowledging the intelligence interaction of specified milestones.

Bitcoin terms investigation | Source: Capriole Investments

Bitcoin terms investigation | Source: Capriole InvestmentsBTC Fundamentals Support The Bull Case

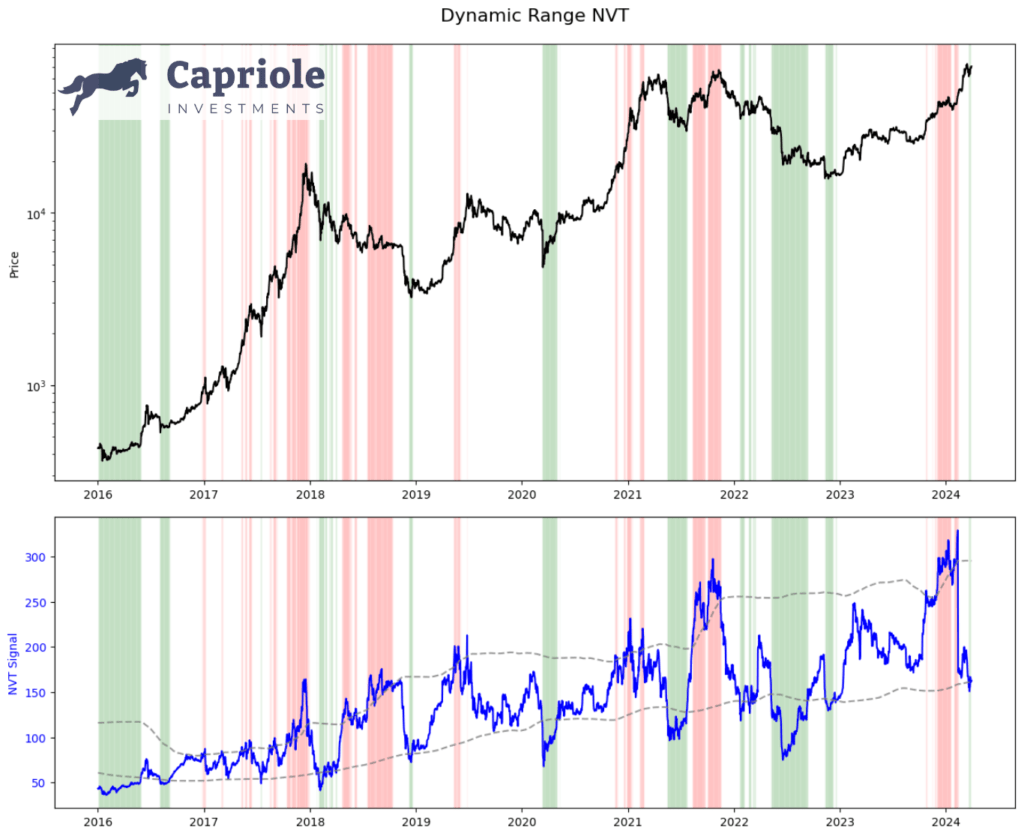

Edwards besides delves into the value of fundamentals, underscoring their relation successful providing a bullish backdrop for Bitcoin. The instauration of the Dynamic Range NVT (DRNVT), a unsocial metric to Capriole, indicates that Bitcoin is presently undervalued. Edwards describes DRNVT arsenic “Bitcoin’s ‘PE Ratio'”, which assesses the network’s worth by comparing on-chain transaction throughput to marketplace capitalization.

The existent DRNVT readings suggest an charismatic concern opportunity, fixed Bitcoin’s undervaluation astatine all-time terms highs. “What’s fascinating astatine this constituent of the rhythm is that DRNVT is presently successful a worth zone. With terms astatine each clip highs, this is simply a promising and antithetic speechmaking for the accidental that lies up successful 2024. It’s thing we didn’t spot successful 2016 nor 2020,” Edwards remarked.

Bitcoin Dynamic Range NVT | Source: Capriole Investments

Bitcoin Dynamic Range NVT | Source: Capriole InvestmentsWith some method indicators and cardinal investigation signaling a bullish aboriginal for Bitcoin, the anticipation surrounding the upcoming Halving lawsuit adds further momentum to the affirmative outlook. Despite the anticipation of volatility and consolidation successful the abbreviated term, Edwards confidently states, “probabilities are starting to skew to the upside erstwhile again.”

At property time, BTC traded astatine $69,981.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)