XRP is up 25% since Sept. 16 and is starring the apical 100 cryptocurrencies.

On Sept. 20, XRP deed $0.4249 to station a 15-week high. Off the backmost of this performance, societal media chatter is brimming with speech of a instrumentality to “the bully times.”

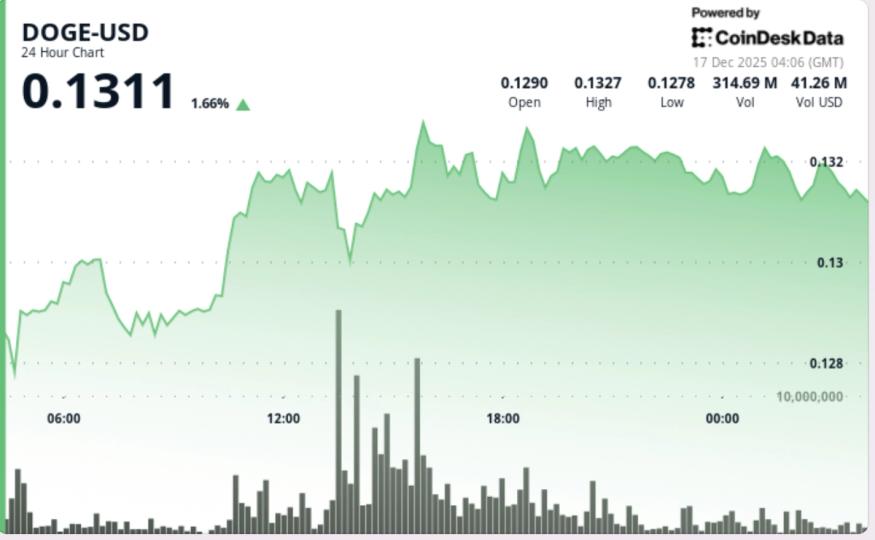

Source: XRPUSDT connected TradingView.com

Source: XRPUSDT connected TradingView.comBehind the tally is simply a drawstring of affirmative developments, including the anticipation that the ongoing SEC suit volition end.

The SEC suit whitethorn travel to an extremity soon

In December 2020, the U.S. securities regulator brought ineligible enactment against Ripple, its CEO, Brad Garlinghouse, and its Chair, Chris Larsen, connected charges of selling unregistered securities.

It was alleged the defendants had sold $1.3 billion successful XRP without due registration, truthful infringing “long-standing protections.”

Although this is not the archetypal clip the SEC has instigated akin actions against cryptocurrency companies, Ripple was the archetypal to basal its crushed and actively support its position.

After astir 2 years of discovery, the statement is that the SEC’s actions had harmed investors. In addition, galore allegations against elder SEC officials, including a struggle of involvement with erstwhile Director William Hinman, formed uncertainty connected the legitimacy of the suit and the impartiality of the regulator.

General Partner astatine Orca Capital Jeff Sekinger precocious drew attraction to some parties agreeing to expedite the lawsuit, which would necessitate Judge Torres to marque a telephone connected whether XRP is simply a information oregon not — efficaciously ending the case.

In April 2021, the CEO of the Japanese fiscal steadfast SBI, Yoshitaka Kitao, said Ripple would spell nationalist erstwhile the SEC suit is concluded – a determination supported by some Garlinghouse and Larsen.

XRP adoption continues arsenic ODL income surge

On Sept. 21, 2022, Ripple announced the enlargement of its concern with the Philipines-based I-Remit.

The steadfast already uses Ripple’s On-Demand Liquidity(ODL) work to supply cross-border outgo solutions. However, from today, I-Remit volition grow its usage of ODL to see interior treasury management. I-Remit President Harris D. Jacildo said:

“We’re excited for this adjacent section of our good established concern with Ripple to further utilize ODL for treasury absorption and supply the champion imaginable work for our customers.”

ODL leverages XRP to span betwixt 2 fiat currencies, enabling quick, low-cost colony without the request to pre-fund accounts successful the destination market.

The latest Ripple Report showed a 57% leap successful income from $1.354 cardinal successful Q1 to $2.126 cardinal successful Q2. The spike was attributed to “the maturation of adoption of ODL,” including the summation of Lithuanian-based wealth transportation supplier FINCI.

However, volumes were down quarter-on-quarter, dropping from $1.1 cardinal to $862 million. Macro factors were blamed.

The station XRP bucks marketplace merchantability disconnected to pb apical 100 amid drawstring of affirmative developments appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)