Maintaining enactment supra $2.204 is important for continued upward movement, portion a interruption supra $2.22 could pb to further gains.

Updated Dec 4, 2025, 4:13 a.m. Published Dec 4, 2025, 4:13 a.m.

(CoinDesk Data)

What to know:

- XRP broke done the $2.197 resistance, signaling renewed bullish momentum with organization buying astatine cardinal levels.

- Volume spiked importantly during a liquidity sweep, indicating nonrecreational information and improved broader crypto sentiment.

- Maintaining enactment supra $2.204 is important for continued upward movement, portion a interruption supra $2.22 could pb to further gains.

XRP extended its betterment with a cleanable propulsion done $2.197 resistance, signaling renewed bullish momentum arsenic organization accumulation reappeared astatine cardinal levels.

- Broader crypto sentiment improved arsenic BlackRock reiterated enactment for real-world plus tokenization themes

- Firelight, a caller DeFi protocol, allows XRP holders to involvement tokens and gain rewards portion providing onchain extortion against hacks.

- Built by Sentora and backed by Flare Network, Firelight introduces a capital-efficient extortion furniture to heighten DeFi's resilience.

- The protocol uses Flare’s FAssets strategy to integrate XRP into DeFi, offering a caller yield-earning accidental for XRP holders.Technical Analysis

- The accomplishment allows FSRA-licensed firms to usage RLUSD for regulated activities, expanding its beingness successful the Middle East.

- RLUSD's acceptance successful ADGM highlights its relation arsenic a stablecoin with wide reserve rules, appealing to banks and outgo firms successful the region.

Technical Analysis

- XRP’s determination supra $2.197 confirms a cleanable interruption of the micro-range that contained terms enactment for astir of the anterior session.

- Repeated defenses of the $2.17 transmission level exemplify request absorption astatine little levels. This enactment occurred alongside elevated backing rates, which climbed much than 120% implicit the past 24 hours. While this reflects increasing bullish conviction, it besides signals rising leverage hazard should terms neglect to travel through.

- The broader operation remains intact: an inside-day breakout setup, rising transmission enactment from November lows, and a processing Power-of-3 progression that suggests accumulation, manipulation, and expansion. XRP presently sits successful the modulation portion betwixt the 2nd and 3rd phases.

XRP traded betwixt $2.19 and $2.20 for astir of the league earlier a little liquidity expanse drove terms to $2.15 during the largest measurement lawsuit of the day. Buyers instantly absorbed the move, pushing the token backmost supra $2.17 and maintaining higher lows connected each consequent retest.

The breakout done $2.197 triggered a cleanable determination to $2.206, supported by hourly measurement rising from 450K to 553K. Price stabilized supra $2.204 into the adjacent portion $2.22 emerged arsenic the adjacent absorption level to clear.

Intraday momentum remained constructive, though upside continuation present depends connected maintaining operation supra $2.204 and avoiding deeper tests of $2.17.

• The $2.204 micro-support is present the contiguous pivot — holding supra it keeps the breakout active

• A interruption supra $2.22 opens nonstop continuation toward the $2.33–$2.40 absorption band

• Rejection astatine $2.22 combined with rising backing rates increases the hazard of a leverage flush

• Losing $2.17 would displacement absorption backmost to the broader $2.00 intelligence level

• Volume confirmation remains cardinal — sustained prints supra 600K/hour would enactment different enlargement leg

More For You

Protocol Research: GoPlus Security

What to know:

- As of October 2025, GoPlus has generated $4.7M successful full gross crossed its merchandise lines. The GoPlus App is the superior gross driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol astatine $1.7M.

- GoPlus Intelligence's Token Security API averaged 717 cardinal monthly calls year-to-date successful 2025 , with a highest of astir 1 cardinal calls successful February 2025. Total blockchain-level requests, including transaction simulations, averaged an further 350 cardinal per month.

- Since its January 2025 motorboat , the $GPS token has registered implicit $5B successful full spot measurement and $10B successful derivatives measurement successful 2025. Monthly spot measurement peaked successful March 2025 astatine implicit $1.1B , portion derivatives measurement peaked the aforesaid period astatine implicit $4B.

More For You

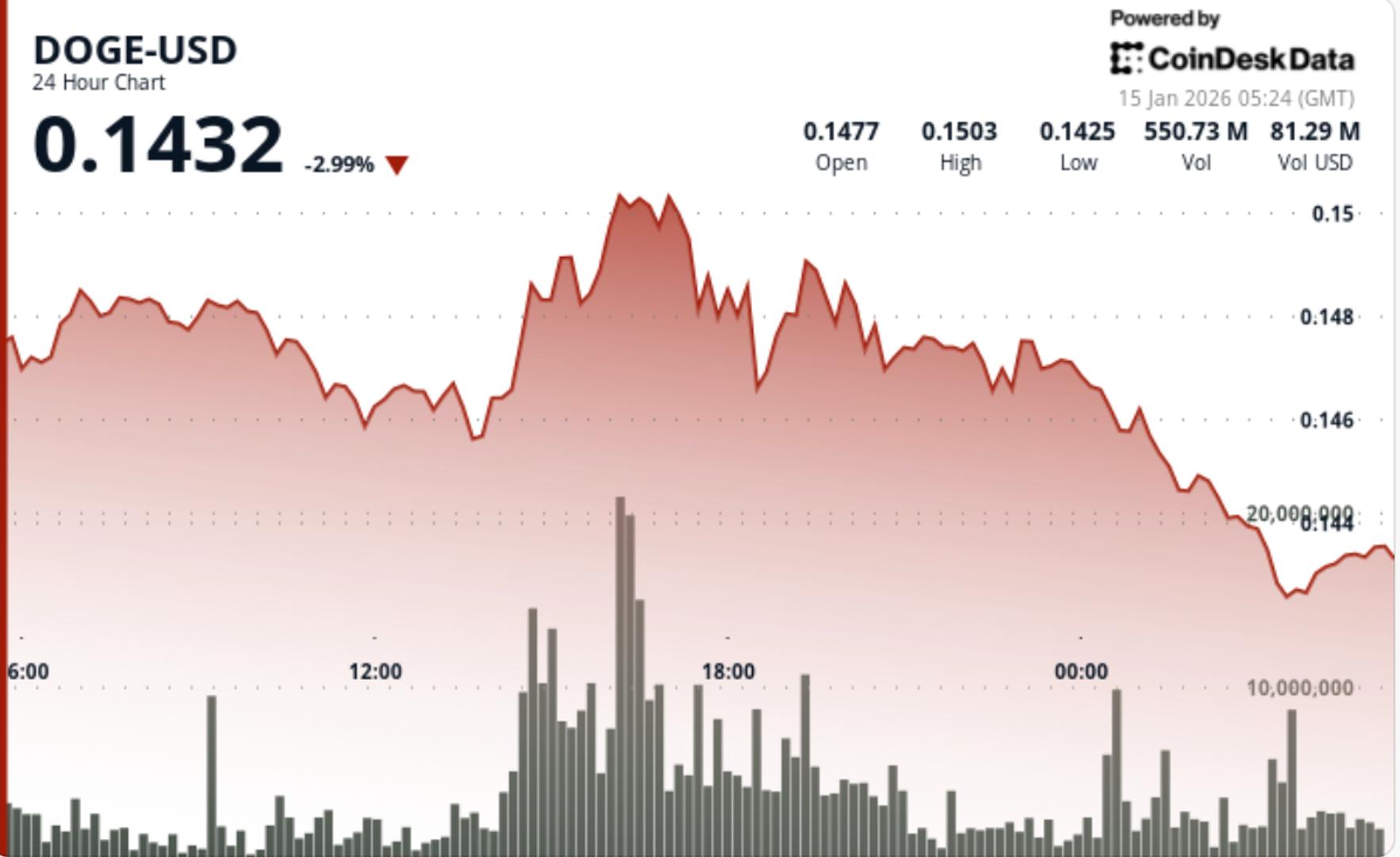

Dogecoin Reclaims Bullish Structure arsenic Whale Activity Hits 2-Month Low

Retail investors drove the rally, portion whale transactions fell to their lowest successful 2 months.

What to know:

- Dogecoin surged 2.7% arsenic it broke done cardinal absorption with a important summation successful trading volume.

- Retail investors drove the rally, portion whale transactions fell to their lowest successful 2 months.

- The $0.1470 level is important for maintaining the breakout structure, with $0.1530 arsenic the contiguous upside target.

1 month ago

1 month ago

English (US)

English (US)