Payments-focused cryptocurrency XRP peaked astatine $3.40 successful January but has since dropped 30% to $2.40.

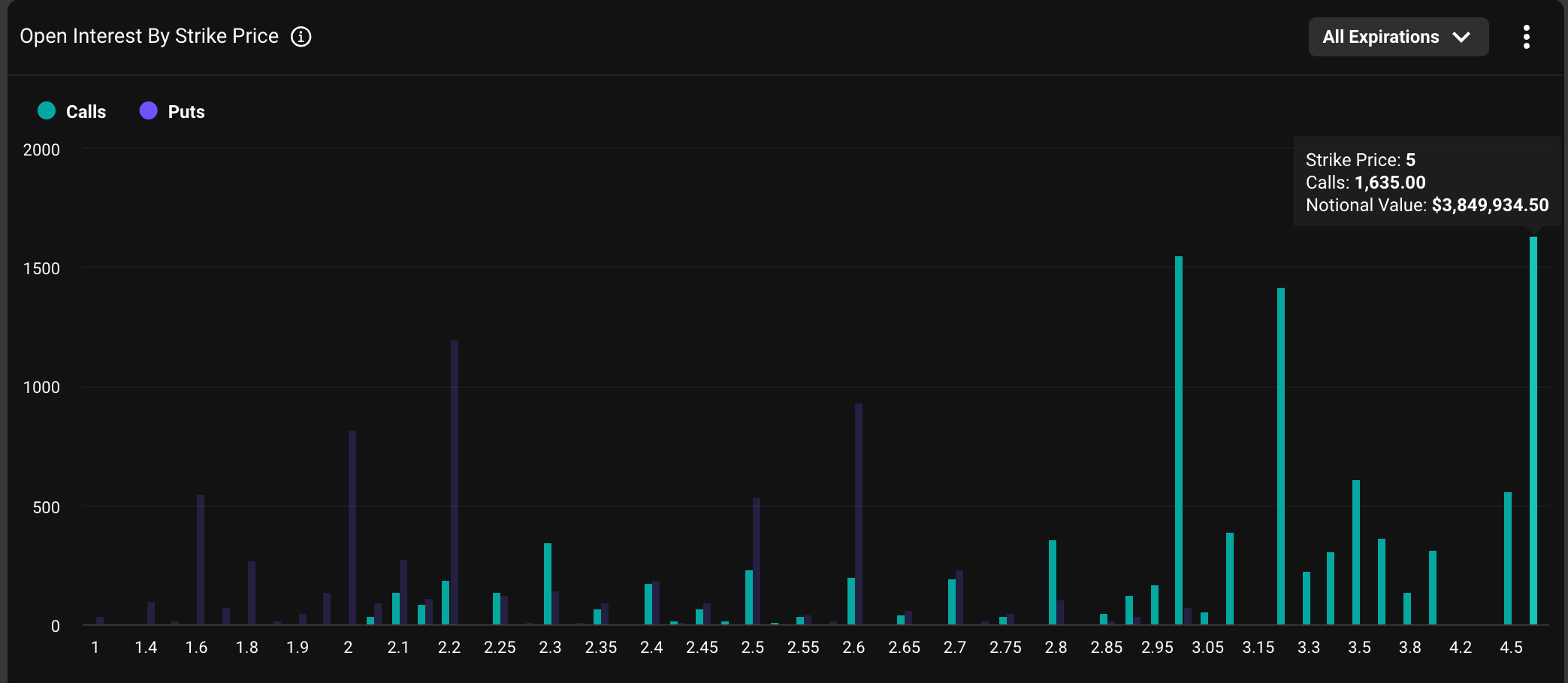

Despite this decline, the $5 telephone enactment remains the astir favored stake connected Deribit, offering important upside imaginable for buyers if the terms exceeds that level. However, this does not needfully bespeak an outright bullish positioning among traders.

At property time, the $5 telephone is the astir fashionable strike, with a notional unfastened involvement of $3.84 million—the highest among each XRP strikes connected the exchange, according to information root Deribit Metrics. Notional unfastened involvement reflects the dollar worth of each progressive options contracts astatine immoderate fixed time. On Deribit, 1 options declaration represents 1 XRP.

"Most of these are covered calls," explained Lin Chen, Deribit's Asia Business Development Head, successful an interrogation with CoinDesk. This explains the important buildup successful unfastened involvement for these out-of-the-money (OTM) calls.

The covered call strategy involves selling higher-level OTM calls portion holding the underlying asset—in this case, XRP. This attack allows traders to seizure the premium from selling oregon penning the telephone portion limiting imaginable losses from an unexpected marketplace rally.

This strategy not lone generates further output connected apical of their holdings but is besides fashionable successful accepted markets arsenic good arsenic successful bitcoin and ether trading.

9 months ago

9 months ago

English (US)

English (US)