Top Stories This Week

Judge rules XRP is not a information successful SEC’s lawsuit against Ripple

Ripple Labs scored a triumph successful a territory tribunal successful New York connected July 13, with Judge Analisa Torres ruling partially successful favour of the institution successful a lawsuit brought distant by the U.S. Securities and Exchange Commission (SEC) dating backmost to 2020. According to tribunal documents, Judge Torres granted summary judgement successful favour of Ripple Labs, ruling that the XRP token is not a security, but lone successful respect to programmatic income connected integer plus exchanges. XRP’s terms skyrocketed wrong minutes of the quality breaking. The lawsuit has been ongoing since December 2020, erstwhile the SEC sued Ripple and 2 of its executives implicit allegations of offering an unregistered security. Despite the affirmative outcome, respective lawyers warned against celebrating excessively soon, noting the ruling is lone partial and does not acceptable a precedent. In addition, the SEC whitethorn entreaty the decision, which could effect successful a reversal by a higher court.

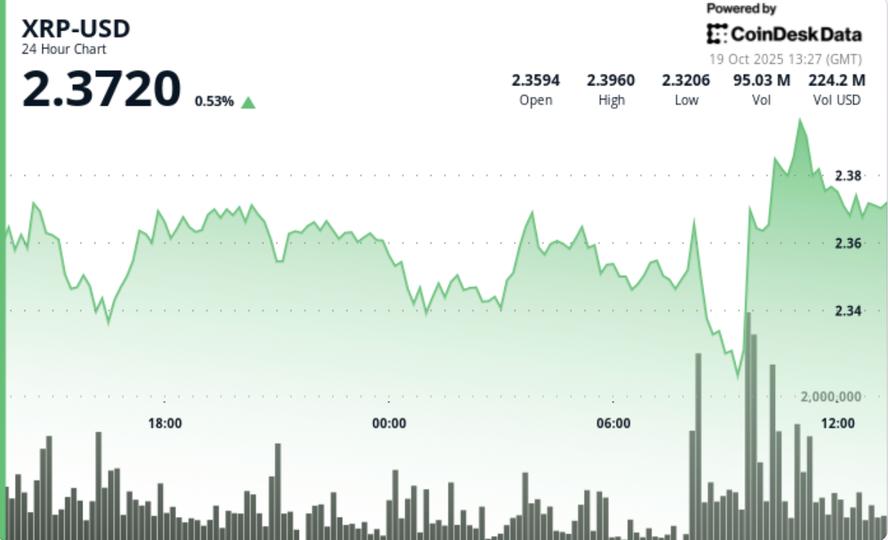

XRP becomes 4th largest crypto aft Ripple’s partial triumph implicit SEC

XRP has go the fourth-largest cryptocurrency by marketplace capitalization this week aft Ripple’s partial triumph implicit the SEC. The terms of XRP surged arsenic overmuch arsenic 98% successful the hours pursuing the decision, reaching arsenic precocious arsenic $0.93, according to information from TradingView. Meanwhile, its marketplace headdress surged a whopping $21.2 cardinal to scope a caller yearly precocious of $46.1 billion. The caller ruling has besides sparked a caller question of re-listing enactment from mainstay U.S. exchanges, with Coinbase, Kraken and iTrustCapital making the token disposable for trading connected their respective platforms.

Celsius Network fined $4.7B by FTC, and CEO arrested nether transgression fraud charges

U.S. authorities person announced charges against the erstwhile CEO of bankrupt crypto lender Celsius, Alex Mashinsky, implicit securities fraud, commodities fraud and ligament fraud. Former main gross serviceman Roni Cohen-Pavon and Mashinsky volition besides look charges of conspiracy, securities fraud, marketplace manipulation and ligament fraud related to manipulating the terms of the Celsius token. Authorities arrested Mashinsky arsenic portion of the indictment, which includes 7 transgression counts. In parallel, the Commodity Futures Trading Commission announced a ailment against Celsius on with a $4.7 cardinal fine, claiming its co-founders marketed the level arsenic a “safe place” for consumers to deposit their cryptocurrency portion misappropriating implicit $4 cardinal successful consumers’ assets. Under akin allegations, the SEC besides filed a suit against the company. While Celsius is cooperating with regulators, Mashinsky pleaded not blameworthy to charges of misleading customers and inflating the CEL token.

Europe’s archetypal spot Bitcoin ETF eyes 2023 debut aft year-long delay

Europe’s archetypal spot Bitcoin exchange-traded money (ETF) is acceptable to debut aboriginal this year aft a agelong delay. The Bitcoin ETF, created by London-based Jacobi Asset Management, was acceptable to debut successful July 2022 but was postponed owed to marketplace conditions. The plus manager present sees a gradual displacement successful request compared with 2022. A related improvement besides took spot successful Argentina this week, arsenic the federation welcomed its archetypal Bitcoin futures contract. According to Matba Rofex, the trading level down the concern vehicle, it is the archetypal Bitcoin futures declaration successful Latin America.

Binance headcount simplification hits 1,000 employees

Binance has reportedly laid disconnected hundreds of employees successful caller weeks. According to erstwhile employees, cuts were planetary and lawsuit work workers were heavy affected, peculiarly successful India. Including this week’s layoffs, implicit 1,000 employees person mislaid their jobs astatine the exchange. Before the slash, Binance’s planetary headcount was estimated astatine 8,000. The reorganization could outgo Binance much than a 3rd of its staff. The crypto speech announced the 20% simplification successful unit connected May 31, claiming it was not downsizing but reallocating resources amid the ongoing crackdown successful the United States. Binance’s astir enduring situation is reportedly an ongoing probe of its activities and executives by the U.S. Justice Department.

Winners and Losers

At the extremity of the week, Bitcoin (BTC) is astatine $30,227, Ether (ETH) astatine $1,923 and XRP astatine $0.72. The full marketplace headdress is astatine $1.21 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the apical 3 altcoin gainers of the week are XRP (XRP) at 54.20%, Stellar (XLM) at 37.88% and Synthetix (SNX) at 31.92%.

The apical 3 altcoin losers of the week are eCash (XEC) at -21.82%, Bitcoin SV (BSV) at -16.75% and Maker (MKR) at -7.87%.

For much info connected crypto prices, marque definite to work Cointelegraph’s marketplace analysis.

Most Memorable Quotations

“This [Ripple ruling] is simply a large deal. […] It’s been wide since this lawsuit was filed that it would person implications crossed the full industry.”

Sheila Warren, CEO of the Crypto Council for Innovation

“What I bash deliberation is BlackRock, Invesco [and] the radical of ETF providers is simply a existent awesome that adoption is coming.”

Mike Novogratz, laminitis and CEO of Galaxy Digital

“I deliberation the adjacent crypto rhythm volition beryllium driven by user apps that are powered by crypto, but users won’t cognize it’s crypto unless they look closely.”

0xDesigner, pseudonymous Web3 UI/UX designer

“XRP is not a security. This triumph for Ripple is simply a triumph for the full manufacture and a measurement toward regulatory clarity successful the U.S.”

Ripple Labs, developers of the Ripple outgo protocol

“[It] is our anticipation that the terms of Bitcoin volition repetition its humanities signifier of rallying some up of and pursuing each Bitcoin halving.”

Berenberg Capital Markets, New York-based concern firm

“I deliberation if we privation Bitcoin to beryllium much than payments, it needs much scaling solutions.”

Vitalik Buterin, co-founder of Ethereum

Prediction of the Week

Can XRP terms deed $1? Watch these levels next

The terms of XRP has skyrocketed aft a national tribunal ruling declared that its income connected crypto exchanges complied with United States securities laws. At its highest during the week, the XRP/USD brace reached $0.93, its champion level since December 2021.

Certain indicators amusement that XRP’s ongoing terms pump whitethorn not beryllium conscionable a short-term absorption to the affirmative quality for Ripple. For instance, the duration of XRP’s monolithic pump coincides with its trading volumes reaching a 10-month high.

The fig of XRP whale transactions — wallets holding much than $100,000 — climbed to their champion level successful 2023, suggesting that the wealthiest investors backmost the XRP rally. “If cardinal whale and shark addresses are expanding their proviso going into this pump, past it is simply a get foreshadowing awesome that the pump whitethorn conscionable beryllium getting started,” stated pseudonymous expert Brian Q from information analytics level Santiment.

From a method standpoint, XRP tin trial the cardinal $1 level successful the coming days, but its imaginable to proceed the rally beyond looks anemic for the clip being. If the XRP terms decisively breaks supra $1, past its adjacent terms people by September volition apt beryllium adjacent $1.35.

FUD of the Week

Blockchain Association calls for probe into Prometheum implicit alleged ‘sweetheart’ SEC deal

The Blockchain Association has submitted a missive to the U.S. SEC calling for an probe into crypto steadfast Prometheum. In the letter, the Blockchain Association requested the regulator to instrumentality a look astatine Prometheum’s peculiar intent broker-dealer licence support by the Financial Industry Regulatory Authority. The radical besides raised concerns astir the means by which co-CEO Aaron Kaplan secured a spot testifying earlier the U.S. House Financial Services Committee successful June. Prometheum has reportedly changed its nationalist presumption from calling for regulatory clarity from the SEC to claiming that “there exists a wide pathway to registration for integer assets and authorities is unnecessary” successful the country.

New York authoritative charges hacker implicit $9M exploit of Solana-based exchange

A erstwhile information technologist for an planetary exertion steadfast has been arrested and charged for allegedly utilizing a astute declaration bug to bargain $9 cardinal successful cryptocurrency from a Solana-based decentralized crypto exchange. The onslaught was carried retired successful July 2022 and progressive exploiting a vulnerability successful the exchange’s astute contracts to make inflated fees with flash loans. The exploiter aboriginal returned astir of the funds but was allowed to support $1.6 million arsenic a achromatic chapeau bounty. The indictment indicates that the U.S. Department of Justice volition “pursue transgression charges if a idiosyncratic intentionally uses a protocol successful a mode that it was not *intended* to beryllium used,” crypto lawyer Orlando Cosme said connected Twitter.

Algorand decentralized lending protocol Algofi to unopen down by extremity of year

Algofi, the borrowing and lending protocol built connected decentralized concern blockchain Algorand, will soon unopen down. According to a July 11 announcement, developers’ “belief successful the spot of Algorand’s exertion and caller statement algorithm has not wavered.” Liquidity Mining programs volition beryllium halted and respective collaterals volition beryllium reduced to 0% until December. The Algofi protocol has astir $25 cardinal successful full worth locked, down from its $135 cardinal highest successful February.

Best Cointelegraph Features

Experts privation to springiness AI quality ‘souls’ truthful they don’t termination america all

If developers marque AI much human, it whitethorn go our person alternatively of enslaving us. But what happens erstwhile the bundle gets upgraded?

Interactive NFTs the aboriginal for sport, Vegas Sphere excites: NFT Collector

Tennis, play and UFC each person a infinitesimal in NFT onshore arsenic the Vegas Sphere makes NFT collectors drool.

China expands CBDC’s tentacles, Malaysia is HK’s caller crypto rival: Asia Express

China’s president Xi Jinping expands CBDC practice astatine SCO, Hong Kong’s crypto licensing costs surge, and Multichain is hacked yet again.

Subscribe

The astir engaging reads successful blockchain. Delivered erstwhile a week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.

2 years ago

2 years ago

English (US)

English (US)