This is simply a regular investigation by CoinDesk expert and Chartered Market Technician Omkar Godbole.

XRP: Prints spinning bottom

XRP (XRP) chalked retired a "spinning bottom" candlestick signifier connected Monday, which occurs erstwhile prices plaything backmost and distant successful a wide range, but extremity the time adjacent the opening price. The shadows representing the intraday precocious and debased bespeak that some buyers and sellers were active, but neither broadside could summation a ascendant position.

When the signifier appears aft a notable terms driblet and astatine cardinal support, arsenic successful XRP's case, it signals that the selling unit whitethorn beryllium waning and buyers are stepping successful to support the price.

As seen connected the regular chart, XRP's spinning bottommost has appeared pursuing a 25% pullback from the July highest of $3.65 and astatine a cardinal enactment level adjacent the August 3 low, a constituent wherever the marketplace antecedently rebounded sharply.

XRP's spinning bottommost does not warrant an contiguous bullish move, but it acts arsenic an aboriginal informing of a imaginable bullish inclination reversal. Technical analysts and traders typically look for confirmation from consequent terms action—such arsenic a bullish candle closing supra the spinning bottom’s high.

In different words, absorption is connected Monday's precocious of $2.84, with XRP presently changing hands astatine $2.80.

Not retired of the woods yet

The 5- and 10-day elemental moving averages, wide utilized to filter retired short-term marketplace noise, proceed to inclination downward, signaling ongoing bearish momentum. Additionally, the Guppy aggregate moving mean set has precocious turned bearish, with the bearish awesome remaining intact arsenic of now.

In different words, momentum remains tilted successful favour of sellers, and, if Monday’s debased of $2.69 is breached, XRP could acquisition a sharper decline

Bullish undercurrents?

The MACD histogram, an indicator gauging momentum utilizing 12- and 26-week exponential moving averages, has been consistently antagonistic since precocious July. Still, XRP's terms has not experienced a steep downtrend, fundamentally trading betwixt $2.70 and $3.00.

The comparative resilience of prices means a imaginable bullish crossover of the MACD could people the onset of a crisp rally. The BTC marketplace displayed a akin dynamic successful September past twelvemonth erstwhile it traded beneath $60,000.

- Support: $2.69 (Monday's low), $2.65 (the plaything precocious from May), $2.48 (the 200-day SMA)

- Resistance: $2.84 (Monday's high), $3.38 (the August high), $3.65 (the July high).

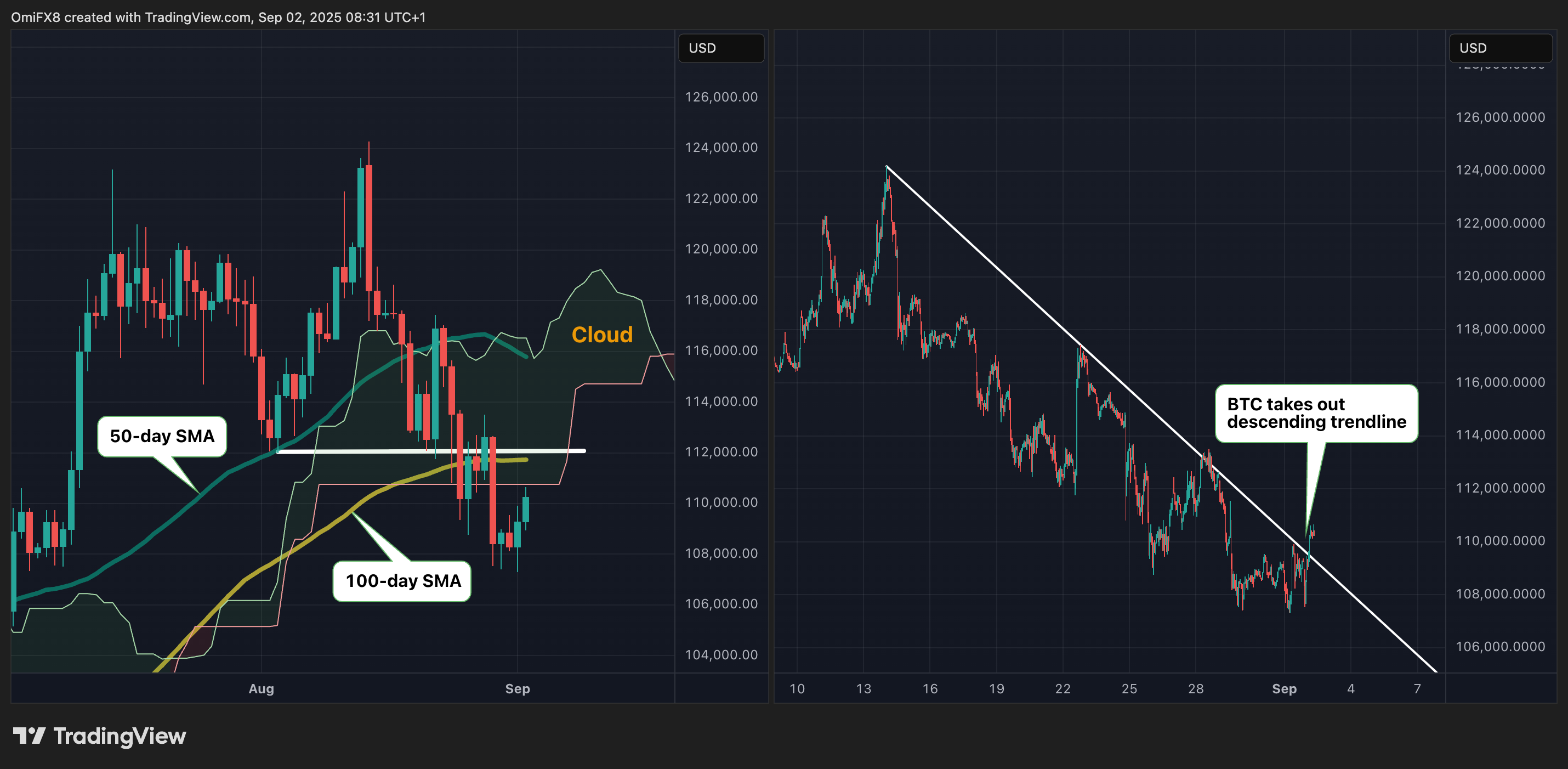

Bitcoin takes retired cardinal trendline

BTC has surged past a descending trendline that marked the pullback from grounds highs supra $124,000. However, the contiguous outlook remains bearish arsenic prices enactment beneath cardinal absorption levels, including the Ichimoku cloud, the 50- and 100-day elemental moving averages, and the August 3 low. Additionally, a bearish divergence is evident successful the RSI connected the monthly chart.

Taken together, these signals overgarment a bleak representation of the market, wherever upward moves could brushwood selling pressure. A wide negation of this bearish outlook would necessitate BTC to successfully interruption and clasp supra the Ichimoku cloud, which presently acts arsenic a captious absorption zone.

- Support: $107,286 (Monday's low), $100,000, $98,330 (the plaything debased from June 22).

- Resistance: $110,756 (the Ichimoku cloud), $111,728 (the 100-day SMA), $115,780 (the 50-day SMA).

Read more: Bitcoin Floats Around $110K arsenic Traders Look Toward Friday Data for Upside

3 months ago

3 months ago

English (US)

English (US)