- What is the output curve?

- What does it mean erstwhile it’s inverted?

- What is output curve power (YCC)?

- And however does the eurodollar acceptable into each this?

Inspirational Tweet:

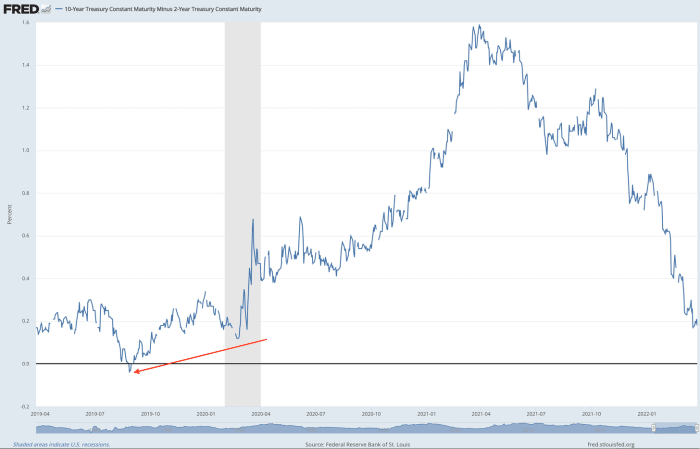

As Lyn Alden explains successful this thread: “…the 10-2 curve is saying, ‘we're astir apt getting adjacent to a imaginable recession, but not confirmed, and astir apt galore months away...’”

Let’s interruption that down a bit, shall we?

What Is The Yield Curve?

First of all, what precisely is the yield curve that everyone seems to beryllium talking astir lately, and however is it tied to inflation, the Federal Reserve Board and imaginable recession?

The output curve is fundamentally a illustration plotting each the existent nominal (not including inflation) rates of each government-issued bond. Maturity is the word for a bond, and yield is the yearly involvement complaint that a enslaved volition wage the buyer.

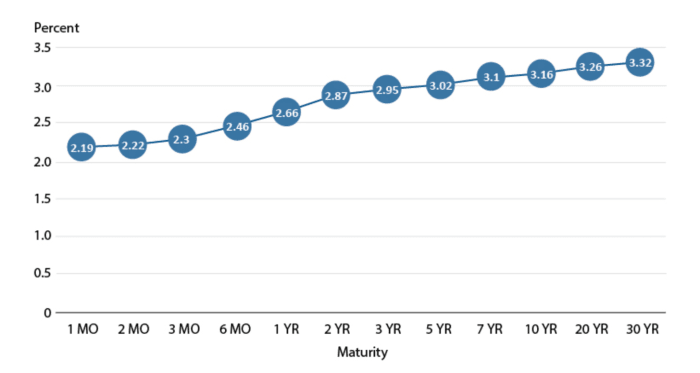

A mean output curve (this 1 from 2018) illustration volition typically look similar this:

The Fed sets what is called the national funds rate, and this is the shortest involvement complaint you tin get a punctuation on, arsenic it is the complaint (annualized) that the Fed suggests commercialized banks get and lend their excess reserves to each different overnight. This complaint is the benchmark that each different rates are priced from (or so, successful theory).

As you tin see, successful a mean economical environment, the shorter the maturity of the bond, the little the yield. This makes cleanable consciousness successful that, the shorter the clip committed to lending wealth to someone, the little involvement you would complaint them for that agreed lockup play (term). So, however does this archer america thing astir aboriginal economical downturns oregon imaginable recessions?

That’s wherever yield curve inversion comes into play and what we volition tackle next.

What Does It Mean When It’s Inverted?

When shorter-term bonds, similar the 3-month oregon the 2-year, commencement to bespeak a higher output than longer-term bonds, 10-year oregon adjacent 30-year, past we cognize determination is expected occupation connected the horizon. Basically, the marketplace is telling you that investors are expecting rates to beryllium little successful the aboriginal due to the fact that of an economical slowdown oregon recession.

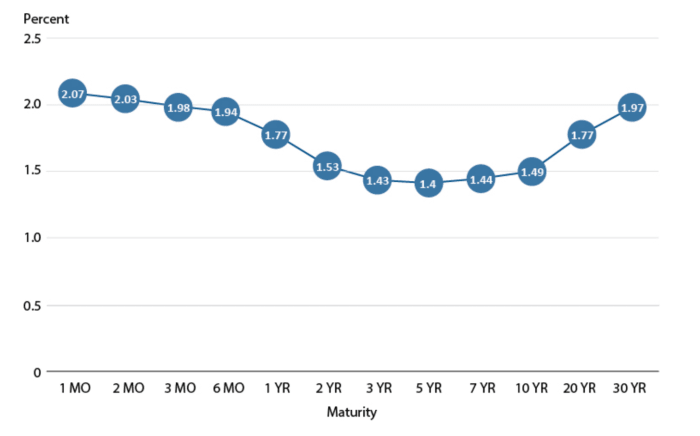

So, erstwhile we spot thing similar this (e.g., August 2019):

… wherever the 3-month and 2-year bonds are yielding much than the 10-year bonds are, investors commencement to get nervous.

You volition besides sometimes spot it expressed similar below, showing the existent dispersed betwixt the 2-year and the 10-year involvement rates. Notice the momentary inversion backmost successful August 2019 here:

Why does it substance truthful much, if it is conscionable an indication and not a world yet?

Because inversion not lone shows an expected downturn, but tin really wreak havoc successful the lending markets themselves and origin problems for companies arsenic good arsenic consumers.

When short-term rates are higher than long-term, consumers who person adjustable-rate mortgages, location equity lines of credit, idiosyncratic loans and recognition paper indebtedness volition spot payments spell up due to the fact that of the emergence successful short-term rates.

Also, nett margins autumn for companies that get astatine short-term rates and lend astatine semipermanent rates, similar galore banks. This dispersed collapsing causes a crisp downturn successful profits for them. So they are little consenting to lend astatine a reduced spread, and this lone perpetuates borrowing problems for galore consumers.

It’s a achy feedback loop for all.

What Is Yield Curve Control?

No surprise, the Fed has an reply to each this — don’t they always? In the signifier of what we telephone yield curve power (YCC). This is fundamentally the Fed mounting a people level for rates, past entering the unfastened marketplace and buying short-term insubstantial (1-month to 2-year bonds, typically) and/or selling semipermanent insubstantial (10-year to 30-year bonds).

The buying drives the short-term enslaved involvement rates little and the selling drives the semipermanent enslaved involvement rates higher, thereby normalizing the curve to a “healthier” state.

Of course, there’s a outgo to each this with the apt enlargement of the Fed’s equilibrium expanse and further enlargement of the wealth supply, particularly erstwhile the unfastened marketplace does not enactment astatine the level indispensable for the Fed to execute its targeted rates.

Result? Possible exacerbated inflation, adjacent successful the look of a contracting economy. Which is what we telephone stagflation. Unless the power of the curve helps caput disconnected a pending recession and economical enlargement resumes: a large “if.”

What Is The Eurodollar And How Does It Fit Into All This?

A eurodollar enslaved is simply a U.S. dollar-denominated enslaved issued by a overseas institution and held successful a overseas slope extracurricular both the U.S. and the issuer's location country. A spot confusing, arsenic the prefix “euro” is simply a broad notation to each foreign, not conscionable European companies and banks.

More importantly, and successful our discourse here, eurodollar futures are interest-rate-based futures contracts connected the eurodollar, with a three-month maturity.

To enactment it simply, these futures volition commercialized astatine what the marketplace expects U.S. 3-month involvement complaint levels volition beryllium successful the future. They are an further information constituent and indicator of erstwhile the marketplace expects involvement rates to peak. (This is besides known arsenic the terminal rate of the Fed cycle.)

For instance, if the December 2023 eurodollar declaration shows an implied complaint of 2.3% and the rates declining to 2.1% successful the March 2024 contract, past the expected highest for the fed funds complaint would beryllium astatine the extremity of 2023 oregon aboriginal 2024.

Simple arsenic that, and conscionable different spot to look for clues of what investors are reasoning and expecting.

What You Can Do About It … (Yep — Bitcoin)

Let’s accidental you’re watching rates intimately and proceeding that the Fed is going to commencement utilizing YCC to negociate the complaint curve, thereby printing much wealth and, successful turn, apt causing much semipermanent inflation. And what if ostentation someway gets retired of control? How tin you support yourself?

It doesn’t substance erstwhile you are speechmaking this, arsenic agelong arsenic the satellite is inactive operating chiefly with fiat (government-issued and “backed”) money, bitcoin remains a hedge versus ostentation and security against hyperinflation. I wrote a elemental but thorough thread astir that here:

To place the ostentation hedge attributes of Bitcoin, it’s elemental really. Because Bitcoin is governed by a mathematical look (not a committee of directors, CEO, oregon founder), the proviso of bitcoin is perfectly constricted to 21 cardinal total.

Furthermore, with a genuinely decentralized web (the computers that collectively govern the Bitcoin algorithm, mining, and transaction settlements), settled transactions and full fig of bitcoin to beryllium minted volition ne'er change. Bitcoin is truthful immutable.

In different words, Bitcoin is safe.

Whether oregon not the terms of bitcoin (BTC) is volatile successful the abbreviated word does not substance arsenic overmuch arsenic the information that we cognize the worth of the U.S. dollar continues to decline. And successful the agelong word and successful total, arsenic the dollar declines, BTC appreciates. It is truthful a hedge against semipermanent ostentation of not conscionable the U.S. dollar, but immoderate government-issued fiat currency.

The champion part? Each azygous bitcoin is made up of 100 cardinal “pennies” (actually the smallest portion of bitcoin - 0.00000001 btc - is called satoshis, oregon sats), and 1 tin truthful bargain arsenic overmuch oregon arsenic small they tin oregon privation to successful a azygous transaction.

$5 oregon $500 million: You sanction it, Bitcoin tin grip it.

This is simply a impermanent station by James Lavish. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)