The pursuing is simply a impermanent nonfiction from Vincent Maliepaard, Marketing Director astatine IntoTheBlock.

Staking

Staking is simply a cardinal output procreation strategy successful DeFi. It involves locking a blockchain’s autochthonal tokens to unafraid the web and validate transactions, earning rewards successful transaction fees and further token emissions.

The rewards from staking fluctuate with web activity—the higher the transaction volume, the greater the rewards. However, stakers indispensable beryllium mindful of risks specified arsenic token devaluation and network-specific vulnerabilities. Staking, portion mostly stable, requires a thorough knowing of the underlying blockchain’s dynamics and imaginable risks.

For example, immoderate protocols, similar Cosmos, necessitate a circumstantial unlock play for stakers. This means that erstwhile you’re withdrawing your assets from staking, you won’t beryllium capable to really determination your assets for a 21-day period. During this time, you are inactive taxable to terms fluctuations and can’t usage your assets for different output strategies.

Liquidity Providing

Liquidity providing is different method of generating output successful DeFi. Liquidity providers (LPs) usually lend an adjacent worth of 2 assets to a liquidity excavation connected decentralized exchanges (DEXs). LPs gain fees from each commercialized executed wrong the pool. The returns from this strategy beryllium connected trading volumes and interest tiers.

High-volume pools tin make important fees, but LPs indispensable beryllium alert of the hazard of impermanent loss, which occurs erstwhile the worth of assets successful the excavation diverges. To mitigate this risk, investors tin take unchangeable pools with highly correlated assets, ensuring much accordant returns.

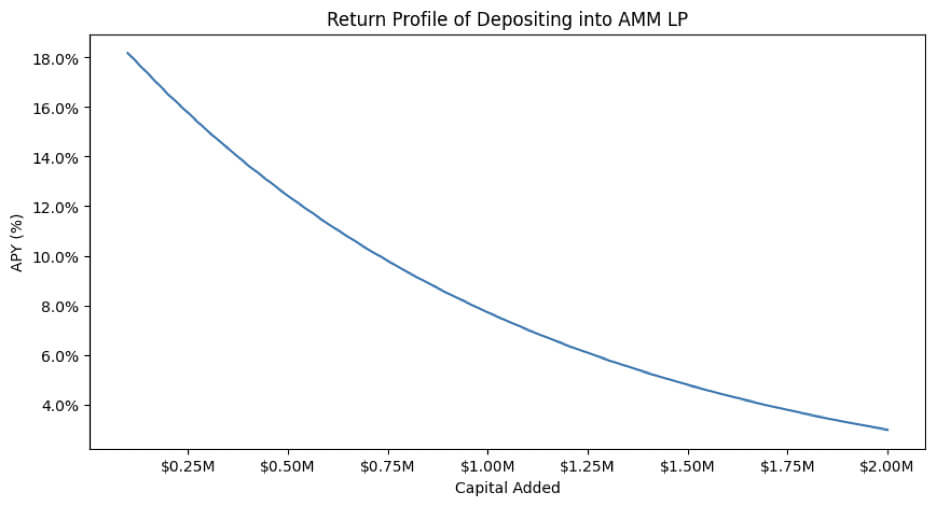

It is besides important to retrieve that the projected returns from this strategy are straight babelike connected the full liquidity successful the pool. In different words, arsenic much liquidity enters the pool, the expected reward decreases.

Source: IntotheBlock

Source: IntotheBlockLending

Lending protocols connection a straightforward yet effectual yield-generation method. Users deposit assets, which others tin get successful speech for paying interest. The involvement rates alteration based connected the proviso and request for the asset.

High borrowing request increases yields for lenders, making this a lucrative enactment during bullish marketplace conditions. However, lenders indispensable see liquidity risks and imaginable defaults. Monitoring marketplace conditions and utilizing platforms with beardown liquidity buffers tin mitigate these risks.

Airdrops and Points Systems

Protocols often usage airdrops to administer tokens to aboriginal users oregon those who conscionable circumstantial criteria. More recently, points systems person emerged arsenic a caller mode to guarantee these airdrops spell to existent users and contributors of a circumstantial protocol. The conception is that circumstantial behaviors reward users with points, and these points correlate to a circumstantial allocation successful the airdrop.

Making swaps connected a DEX, providing liquidity, borrowing capital, oregon adjacent conscionable utilizing a dApp are each actions that would mostly gain you points. Points systems supply transparency but are by nary means a fool-proof mode of earning returns. For example, the caller Eigenlayer airdrop was constricted to users from circumstantial geographical areas and tokens were locked upon the token procreation event, sparking statement among the community.

Leverage successful Yield strategies

Leverage tin beryllium utilized successful output strategies similar staking and lending to optimize returns. While this increases returns, it besides increases the complexity of a strategy, and frankincense its risks. Let’s look astatine however this works successful a circumstantial situation: lending.

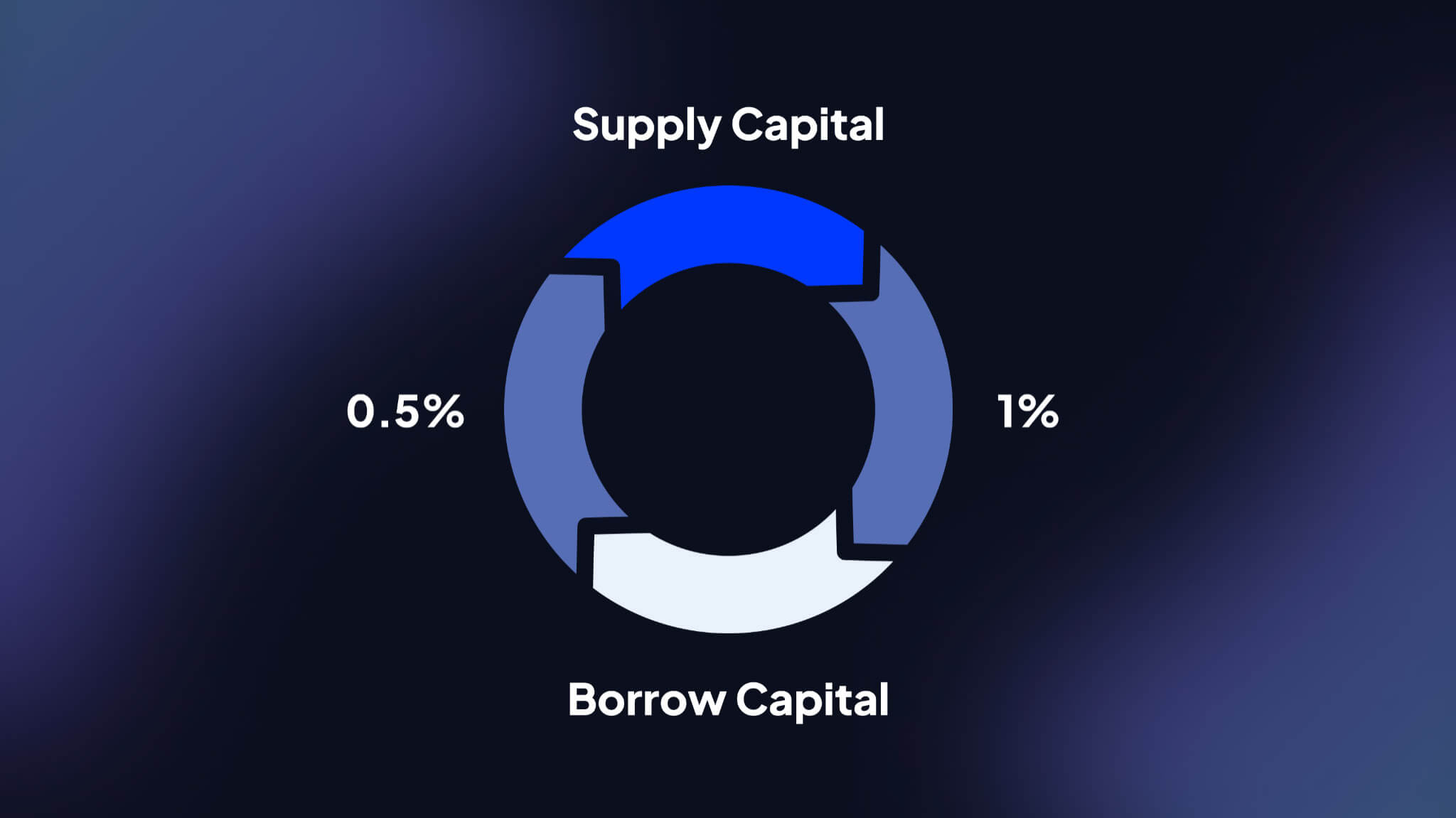

Recursive lending capitalizes connected inducement structures wrong DeFi lending protocols. It involves repeated lending and borrowing of the aforesaid plus to accrue rewards offered by a platform, importantly enhancing the wide yield.

Here’s however it works:

- Asset Supply: Initially, an plus is supplied to a lending protocol that offers higher rewards for supplying than the costs associated with borrowing.

- Borrow and Re-Supply: The aforesaid plus is past borrowed and re-supplied, creating a loop that increases the archetypal involvement and the corresponding returns.

- Incentive Capture: As each loop is completed, further governance tokens oregon different incentives are earned, expanding the full APY.

For example, connected platforms similar Moonwell, this strategy tin alteration a proviso APY of 1% to an effectual APY of 6.5% erstwhile further rewards are integrated. However, the strategy entails important risks, specified arsenic involvement complaint fluctuations and liquidation risk, which necessitate continuous monitoring and management. This makes strategies similar this 1 much suitable for institutional DeFi participants.

The aboriginal of DeFi & Yield Opportunities

Until 2023, DeFi and accepted concern (TradFi) operated arsenic abstracted silos. However, expanding treasury rates successful 2023 spurred a request for integration betwixt DeFi and TradFi, starring to a question of protocols entering the “real-world asset” (RWA) space. Real-world assets person chiefly offered treasury yields on-chain, but caller usage cases are emerging that leverage blockchain’s unsocial characteristics.

For example, on-chain assets similar sDAI marque accessing treasury yields easier. Major fiscal institutions similar BlackRock are besides entering the on-chain economy. Blackrock’s BUIDL fund, offering treasury yields on-chain, amassed implicit $450 cardinal successful deposits wrong a fewer months of launching. This indicates that the aboriginal of concern is apt to go progressively on-chain, with centralized companies deciding whether to connection services connected decentralized protocols oregon done permissioned paths similar KYC.

This nonfiction is based connected IntoTheBlock’s astir caller probe insubstantial connected organization DeFi. You tin work the full study here.

The station Yield strategies successful DeFi: From staking to recursive lending appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)