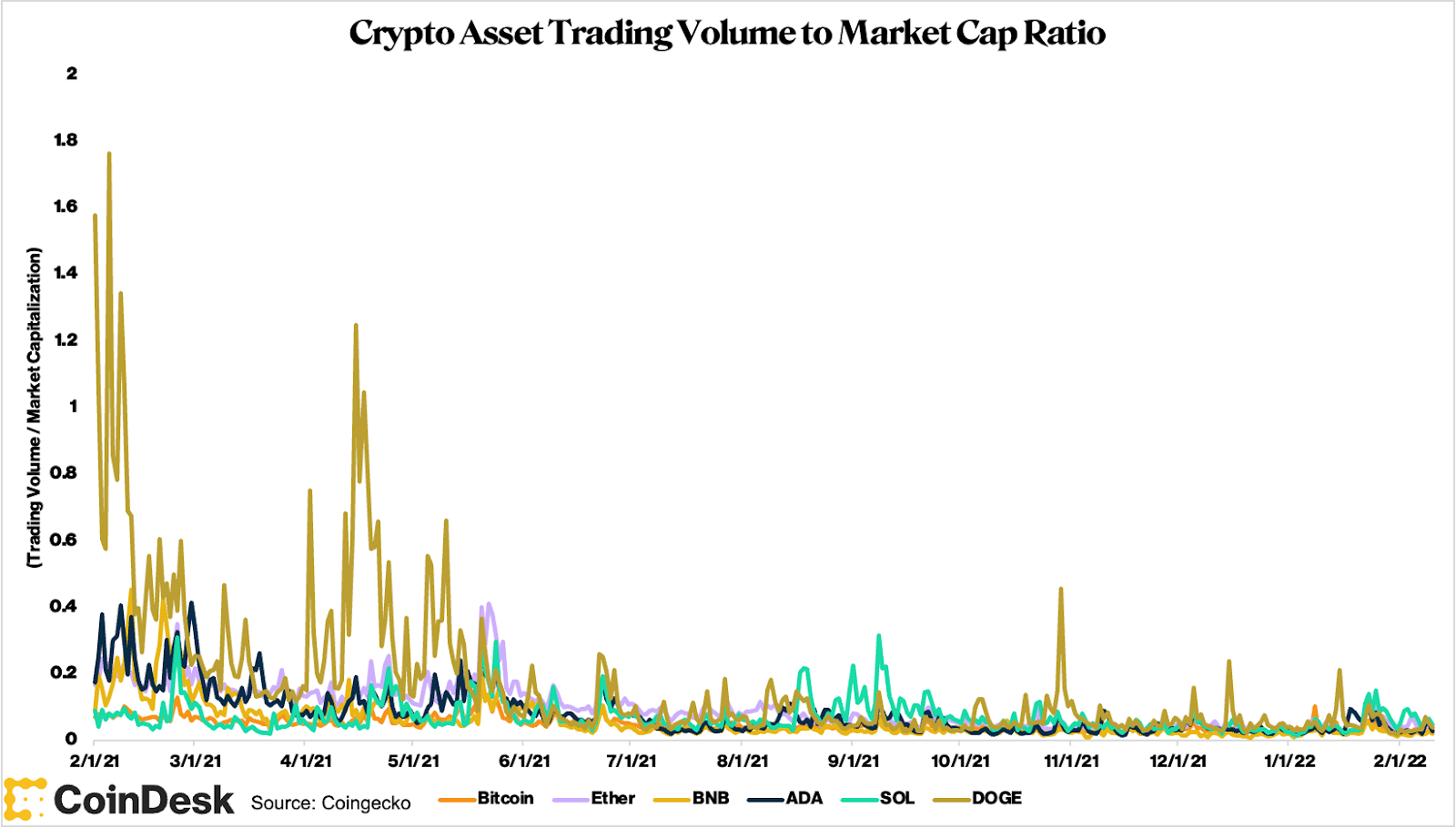

If it someway feels arsenic if cryptocurrency markets are comparatively quiet, that’s due to the fact that they are. That is, trading volumes arsenic a percent of marketplace headdress successful galore of the large cryptocurrencies are little compared with erstwhile months. The extremity effect is that it whitethorn instrumentality smaller amounts of superior to determination the markets wildly.

Just a twelvemonth agone — Feb. 13, 2021 — bitcoin was trading astatine astir $47,000. The day’s trading measurement connected centralized and decentralized exchanges taken unneurotic was astir $62 cardinal and the marketplace headdress was conscionable shy of $840 billion, according to information from CoinGecko. Thus, measurement was astir 8% of marketplace cap.

You’re speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Sunday.

On Wednesday, Feb. 9, 2022, bitcoin changed hands astatine $44,000, putting marketplace headdress astatine $837 billion. Yet measurement was conscionable $29 billion, oregon 3% of value.

That the market cap present is conscionable astir the aforesaid arsenic a twelvemonth agone drives location the constituent that the comparative measurement driblet isn’t needfully a relation of price. The 2 examples fixed are typical alternatively than aberrations; for the period of February 2021, regular bitcoin volumes averaged astir 8% of marketplace cap, and implicit the past 30 days, it’s been 3%.

The drop-off for ether is adjacent much dramatic. A twelvemonth ago, the ratio of measurement to worth averaged 20% each time successful February. Now it’s 4%.

Fine, those are the large 2 successful crypto, but surely the aforesaid hasn’t happened elsewhere, you whitethorn say. However, you’d beryllium wrong.

Layer 1s whitethorn beryllium the speech of the municipality these days, but trading volumes connected exchanges haven’t kept up with skyrocketing marketplace caps. A twelvemonth ago, February regular volumes versus worth successful BNB, cardano, solana and avalanche averaged 22%, 25%, 9% and 17%, respectively. Over the past 30 days, it’s been 2%, 5%, 6% and 4%.

As this information includes decentralized exchanges, the driblet can’t beryllium attributed each that overmuch to the emergence of decentralized finance (DeFi). Besides, decentralized speech volumes successful February 2021 were supra $60 billion, according to information from Dune Analytics and published on DeFiPrime.com. That works retired to a small much than $2 cardinal per day. In January, the full was $100 cardinal oregon northbound of $3 cardinal per day.

Yet ether, inactive the astir important currency successful decentralized finance, saw mean regular volumes implicit the past period of $15.6 billion, but that’s down from $38 cardinal a twelvemonth ago.

Speaking of DeFi, ratios successful that assemblage besides took a tumble, failing to support gait with exploding values. Uniswap, which has the lion’s stock of DeFi transactions and marketplace headdress for its token, was worthy $6.8 cardinal a twelvemonth agone and saw its token alteration hands to the tune of $1.5 cardinal daily. Now its marketplace headdress is $5.6 billion, and volumes connected the uniswap token mean conscionable $223 million. Aave and cakeswap person suffered akin fates, albeit utilizing smaller values.

Thinner markets, of course, mean that it doesn’t instrumentality arsenic overmuch to determination prices arsenic it erstwhile did. For an example, look nary further than a week ago, Saturday, Feb. 5, erstwhile bitcoin yet broke supra $40,000 and stayed determination for the archetypal clip successful implicit a week. Volumes the erstwhile time were $16 billion, and connected Saturday they were $25 billion. Again, these figures are debased adjacent by caller standards, but they service arsenic a reminder that it doesn’t instrumentality overmuch to determination a market.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)