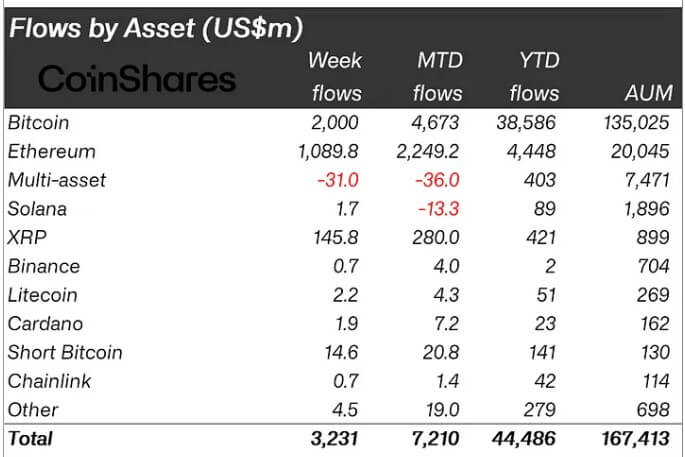

CoinShares’ latest report showed that the crypto assemblage experienced $3.2 cardinal successful inflow past week, extending its streak to 10 consecutive weeks of affirmative flows. This marks the longest streak of inflow this year.

The inflow besides brings full year-to-date flows to $44.5 billion, which is 4 times higher than immoderate erstwhile yearly record.

Trump’s predetermination triumph spur $11 cardinal inflow

Last week, Bitcoin-related concern products saw inflows totaling $2 billion. This means the flagship integer plus has recorded implicit $11 cardinal successful inflows since Donald Trump‘s predetermination triumph successful November.

The beardown post-election momentum successful Bitcoin ETPs is chiefly attributed to optimism astir imaginable regulatory clarity and a more crypto-friendly stance from the incoming US administration. This has led the US marketplace to predominate inflows, contributing $3.1 billion, followed by Switzerland ($36 million), Germany ($33 million), and Brazil ($25 million).

CoinShares’ Head of Research, James Butterfill, noted that trading volumes successful Bitcoin ETPs averaged $21 cardinal weekly, accounting for 30% of Bitcoin trading enactment connected trusted exchanges. Bitcoin volumes connected these exchanges reached $8.3 cardinal daily, showcasing a liquid and robust trading environment.

Crypto Products Inflows (Source: CoinShares)

Crypto Products Inflows (Source: CoinShares)Meanwhile, abbreviated Bitcoin products besides gained traction, with inflows of $14.6 cardinal pushing their assets nether absorption to $130 million. This inclination highlights increasing involvement successful hedging strategies arsenic Bitcoin’s price climbed to an all-time precocious of implicit $106,000.

Ethereum maintained its streak of inflows, marking its seventh consecutive week with $1 cardinal added. Over this period, Ethereum ETPs saw full inflows scope $3.7 billion, underlining improved sentiment.

Notably, spot Ethereum ETFs reported a 15-day inflow streak, capturing implicit $2 cardinal during the reporting period.

Altcoins besides experienced affirmative momentum. XRP drew $145 cardinal successful inflows, fueled by speculation astir a imaginable US-listed ETF. Meanwhile, Polkadot and Litecoin recorded $3.7 cardinal and $2.2 cardinal successful inflows arsenic investors diversified their portfolios.

The station $3.2 cardinal crypto inflow marks 10-week streak arsenic Trump predetermination triumph boosts confidence appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)