In astir 3 days Ethereum is expected to modulation from a proof-of-work (PoW) blockchain web to a proof-of-stake (PoS) mentation via The Merge. Ahead of the transition, the liquid staking task Lido has seen a batch much enactment arsenic the worth locked successful the protocol accrued by much than 13% this week. Moreover, the project’s lido dao governance token has accrued 25.4% against the U.S. dollar during the past 7 days.

Lido TVL Jumps 13% Higher This Week, Project’s Wrapped Ether Represents More Than 30% of Staked Ethereum

Last week, Bitcoin.com News reported connected the decentralized concern (defi) task Lido arsenic the task started seeing much request up of The Merge. Lido Finance is simply a liquid staking task that allows radical to wrapper their crypto assets successful bid to stitchery a staking yield, but the process besides allows owners to clasp the assets successful a non-custodial manner and beryllium capable to commercialized them arsenic well.

Lido offers liquid staking solutions for blockchains similar Ethereum, Solana, Polygon, Polkadot, and Kusama. However, astir of the worth locked successful Lido derives from locked ether, arsenic ETH represents $7.61 cardinal of Lido’s $7.81 cardinal full worth locked (TVL).

During the past 7 days, metrics from defillama.com indicates that Lido’s TVL swelled by 13.08%, and the TVL has risen by 2.43% during the past 24 hours. While Makerdao is the largest defi protocol today, successful presumption of TVL stats, Lido is the 2nd largest defi protocol connected September 11.

The ether locked successful Lido’s exertion unsocial represents 12.60% of the $60.38 cardinal TVL successful defi today. Lido’s wrapped ether derivative token, STETH, is the 13th largest marketplace capitalization retired of the 12,907 tokens worthy $1.1 trillion. Lido’s governance token lido dao (LDO) has accrued 25.4% during the past 2 weeks.

Three Larges Exchanges and 8 Ethereum 2.0 Pools

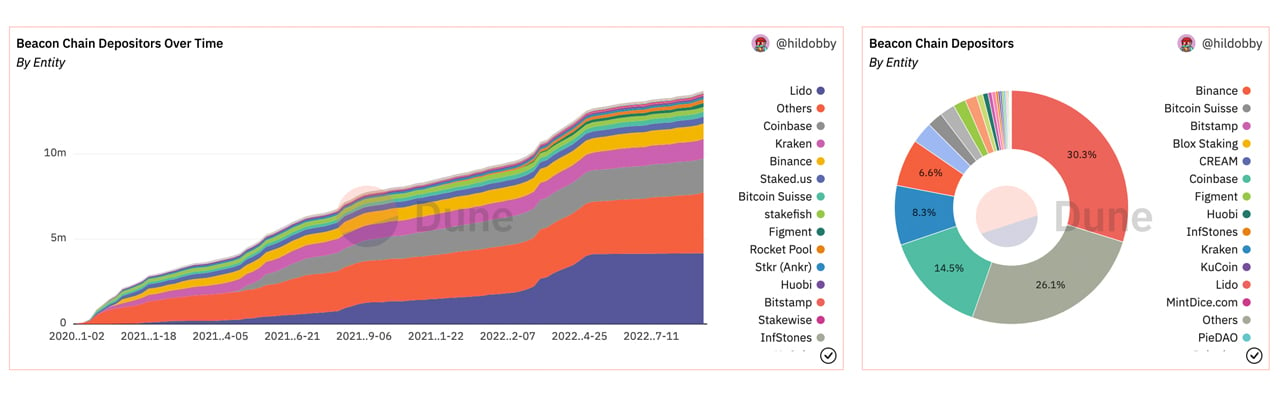

Data from Dune Analytics shows Lido is the largest Beacon concatenation depositor with 30.3% of the deposits stemming from Lido Finance. Coinbase is 2nd to Lido with 14.5% of the Beacon concatenation deposits and Kraken commands 8.3%.

Coinbase precocious launched a liquid staking token called coinbase wrapped ethereum (CBETH), and successful mid-August a JPMorgan marketplace expert said Coinbase could beryllium a worldly beneficiary of Ethereum’s Merge transition. At property time, there’s 13,638,351 ether locked into the ETH 2.0 declaration and determination are 426,198 validators. 30.49% of the 13.6 cardinal ETH staked is staked via Lido Finance.

Besides monolithic exchanges similar Coinbase, Kraken, and Binance, Lido competes with Stkr, Sharedstake, Stafi, Stakewise, Cream, Stakehound, and Rocketpool. Between Lido, Rocketpool, Stakehound, Stakewise, Stafi, Sharedstake, and Stkr, there’s astir $8.11 cardinal successful value.

While Lido commands 30.49% of the ETH staked, the aforementioned ETH 2.0 pools correspond 33.11% of the staked ether today. There is 4,585,038 locked ether held betwixt the 8 ETH 2.0 pools today.

What bash you deliberation astir the caller Lido Finance enactment and the magnitude of ether 8 pools person held? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)