April was a period filled with important enactment and volatility for Bitcoin miners. Most of the period was spent anticipating Bitcoin’s halving and the motorboat of Runes, with galore analysts and marketplace experts informing astir the outsized interaction they could person connected the mining sector.

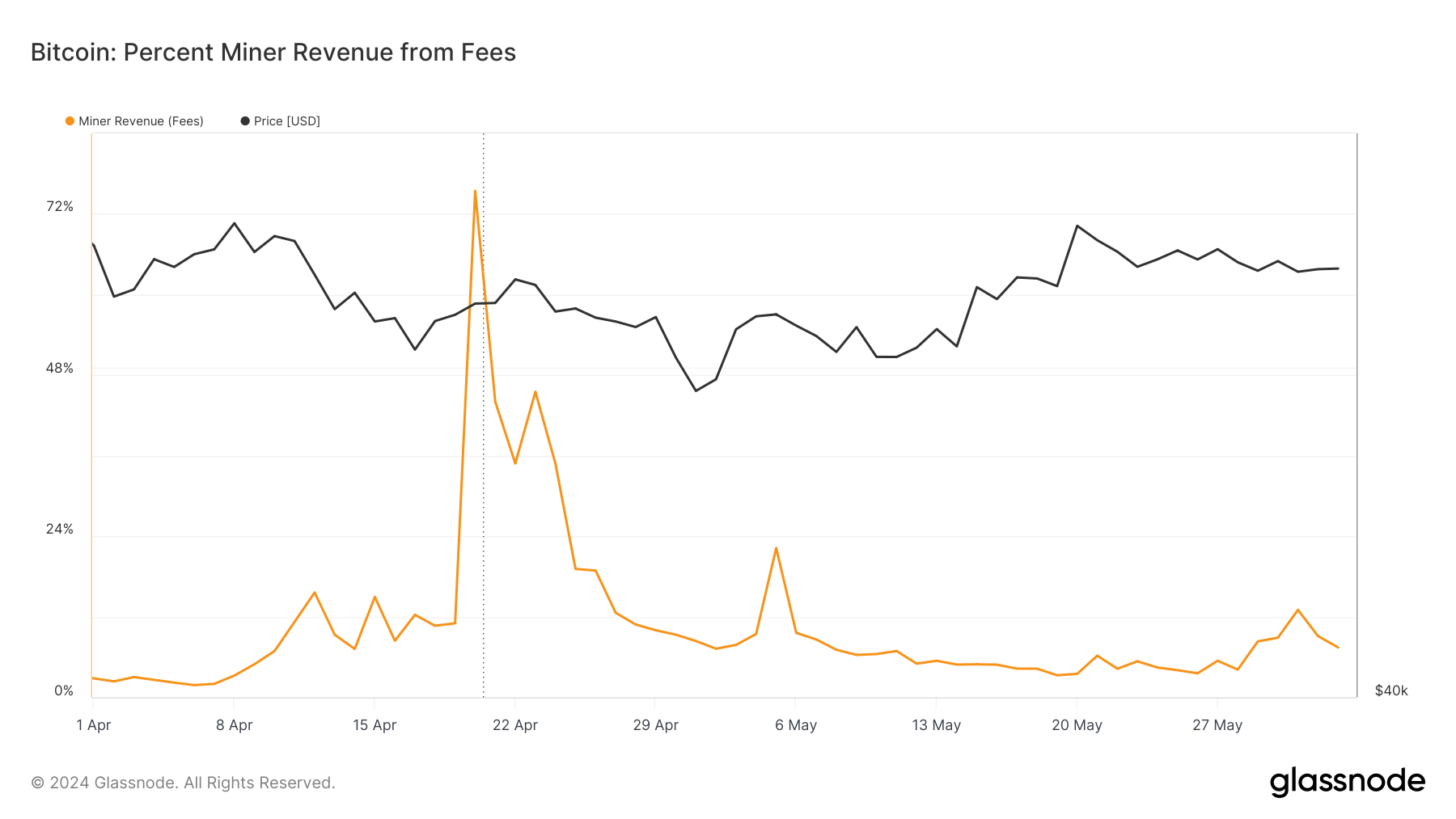

As expected, the operation of the halving and Runes propelled transaction fees and miner revenues to unprecedented heights. A full of 1,257 BTC successful fees was paid to miners, bringing their full gross from fees to 75.44%.

Graph showing the percent of miner gross derived from fees from April 1 to June 2, 2024 (Source: Glassnode)

Graph showing the percent of miner gross derived from fees from April 1 to June 2, 2024 (Source: Glassnode)Come May, the mining manufacture entered a calm and uneventful period. Data from Glassnode showed stableness crossed aggregate miner metrics contempt the broader marketplace experiencing important volatility.

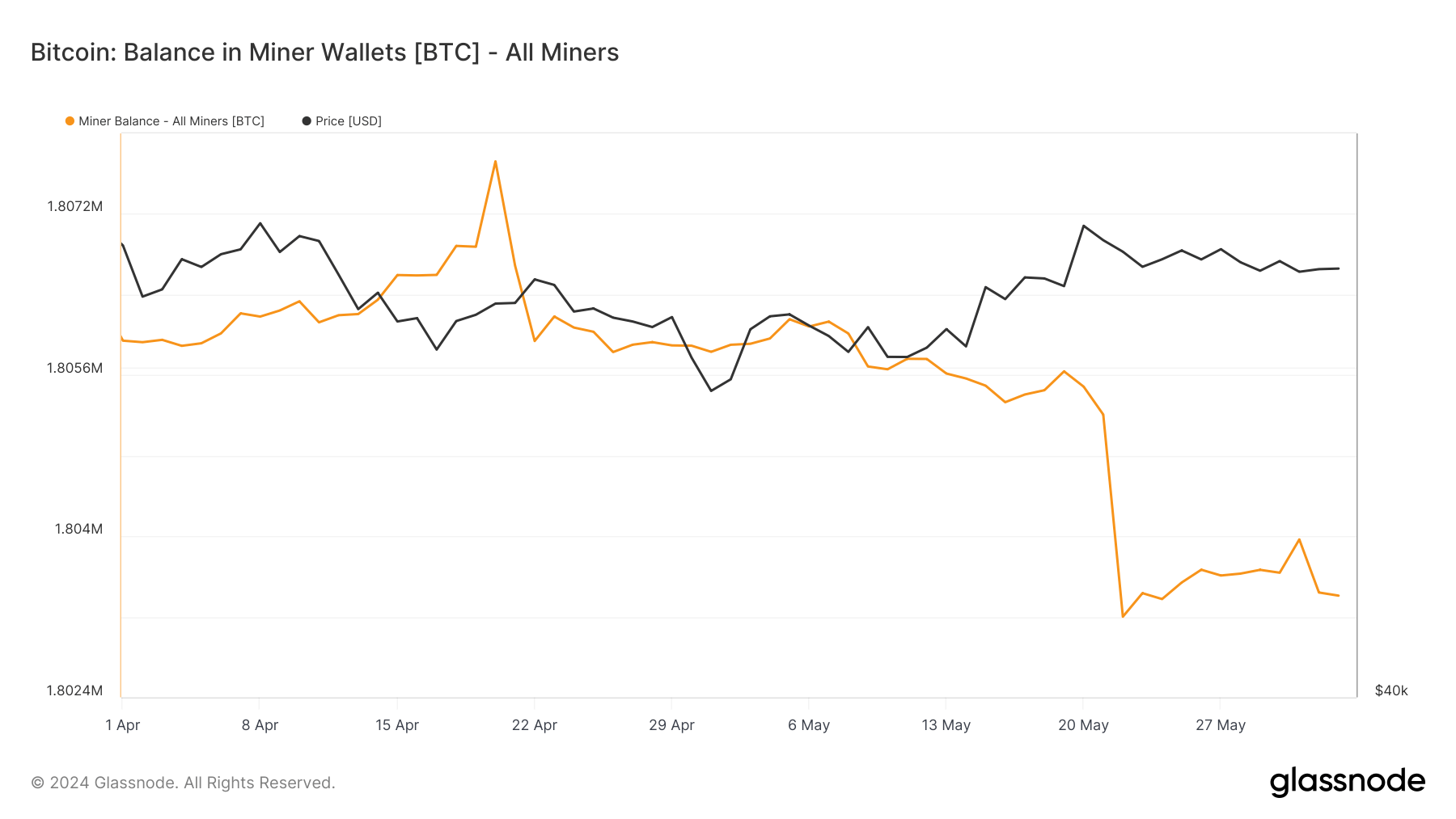

The magnitude of BTC held successful miner wallets saw a vertical spike connected April 20, passing 1.807 cardinal BTC. However, this spike was short-lived arsenic miners offloaded overmuch of their recently received profit. Balances reverted to 1.805 cardinal BTC by the extremity of April, remaining unchangeable passim May. We saw a flimsy alteration to 1.803 cardinal BTC by June 3. This equilibrium stability shows a play of equilibrium and reduced enactment compared to April. It indicates that miners were neither aggressively selling their holdings nor importantly accumulating caller coins, preferring alternatively to support their positions and lone screen operating costs.

Graph showing the full proviso of BTC held successful miner addresses from April 1 to June 2, 2024 (Source: Glassnode)

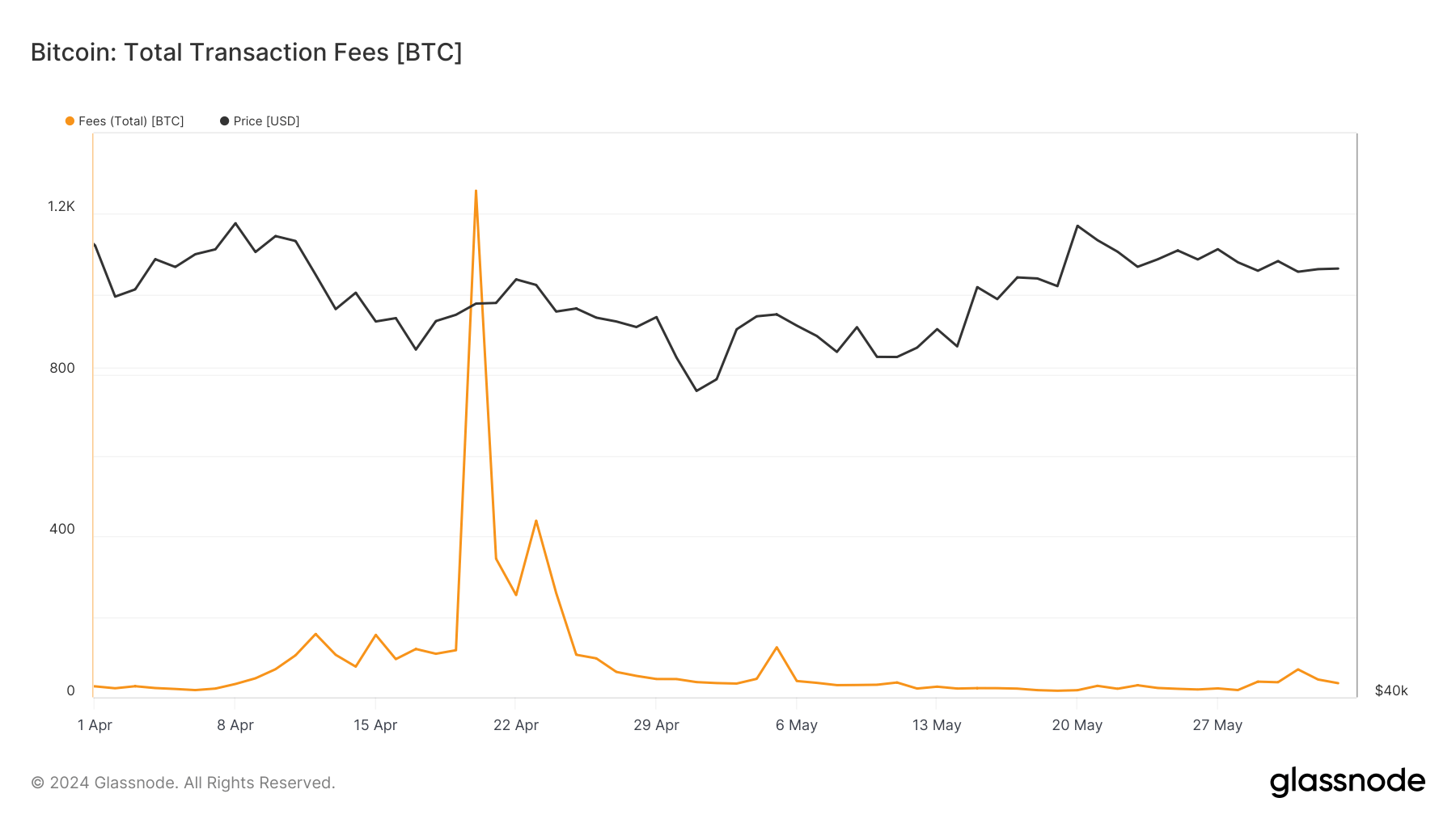

Graph showing the full proviso of BTC held successful miner addresses from April 1 to June 2, 2024 (Source: Glassnode)Transaction fees, a captious indicator of miner gross and web activity, besides reflected this shift. The explosive interest summation to 1,257.71 BTC connected April 20 was short-lived, dropping to 253.93 BTC by April 22 and further declining to a specified 16.35 BTC by the 2nd fractional of May. By June 2, fees had risen somewhat to 35.13 BTC, but this was inactive a acold outcry from the peaks seen successful April. This interest simplification tin mostly beryllium attributed to the waning attraction for Runes and an wide alteration successful web congestion and transaction volumes.

Graph showing the full magnitude of fees paid to miners from April 1 to June 2, 2024 (Source: Glassnode)

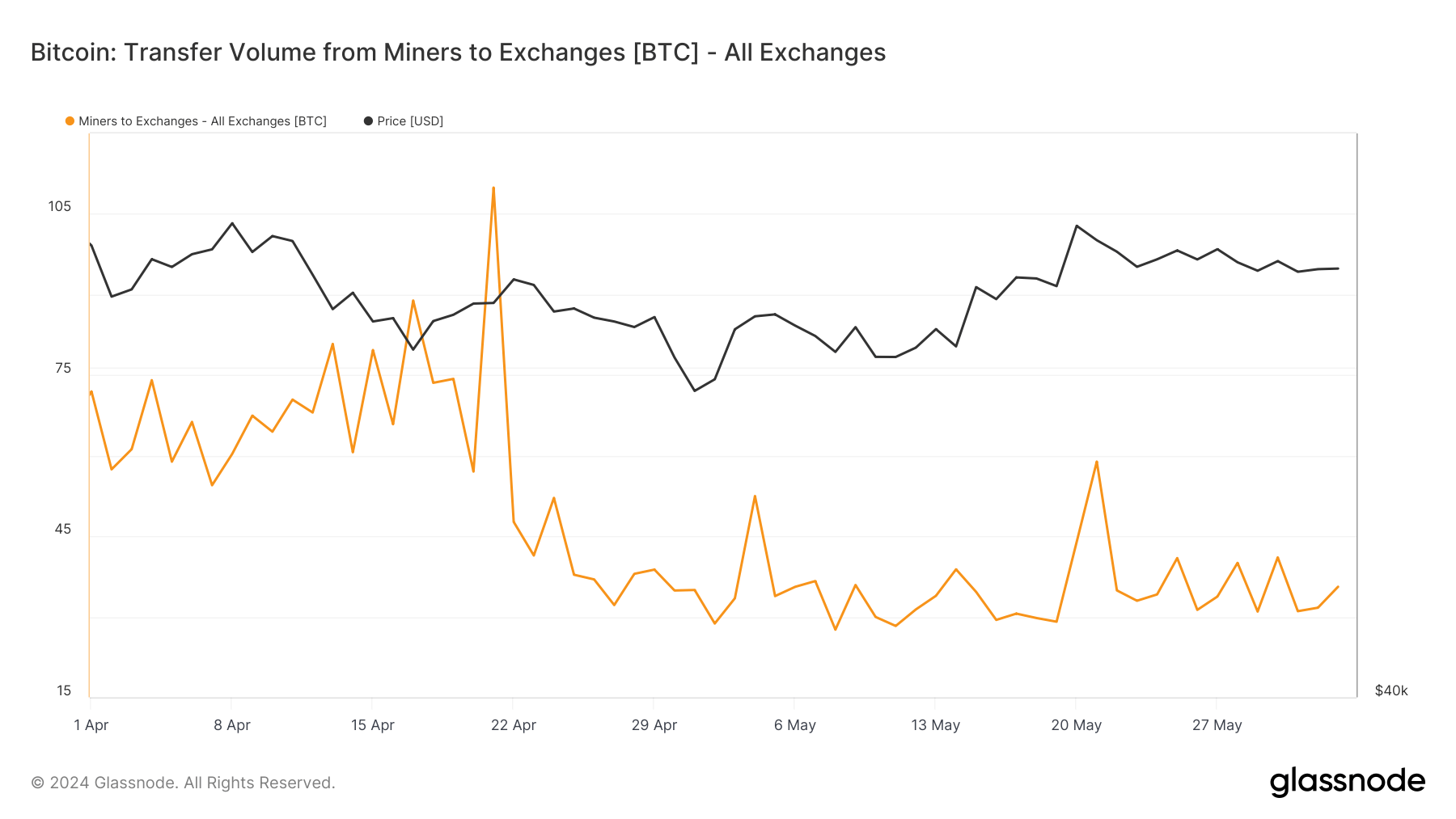

Graph showing the full magnitude of fees paid to miners from April 1 to June 2, 2024 (Source: Glassnode)Analyzing miner transfers to exchanges further shows conscionable however calm May was. Early April saw transfers of 71.95 BTC, which decreased to 57.03 BTC by April 20 and continued to decline, reaching 29.08 BTC by May 19. This metric remained comparatively stable, with 34.90 BTC transferred by May 22 and 35.59 BTC by June 2. The reduced question of BTC from miners to exchanges suggests that miners were not pressured to liquidate their holdings.

Graph showing the full magnitude of coins transferred from miners to speech wallets from April 1 to June 2, 2024 (Source: Glassnode)

Graph showing the full magnitude of coins transferred from miners to speech wallets from April 1 to June 2, 2024 (Source: Glassnode)The nett travel of coins into and retired of miner addresses encapsulates the wide sentiment and activity. April’s nett flows were highly volatile, peaking astatine 848.35 BTC connected April 20 earlier plummeting to -748.18 BTC by April 22. May exhibited a much tempered dynamic, with a nett inflow of 187.24 BTC connected May 19, followed by a important outflow of -2,007.13 BTC connected May 22, and settling astatine -31.15 BTC by June 2. It suggests sporadic selling unit but not astatine a level that indicates panic oregon a bearish outlook.

This contrasts with the volatility we saw successful Bitcoin prices past month. While the marketplace reacted to terms fluctuations with emblematic volatility, miners adopted a much measured approach, perchance indicating assurance successful the longer-term prospects of Bitcoin. This measured attack by miners could beryllium interpreted arsenic a motion of stableness and maturation successful the mining sector, wherever short-term terms movements are little impactful connected operational strategies.

Looking forward, the comparative stableness successful miner balances and reduced transaction fees suggest that miners are apt anticipating a play of consolidation and are perchance gearing up for aboriginal terms increases. The debased levels of BTC transfers to exchanges bespeak that miners are not nether contiguous fiscal pressure, allowing them to clasp their assets and perchance payment from higher prices down the line.

These metrics could besides suggest that web enactment and transaction volumes mightiness stay subdued unless catalyzed by important marketplace events oregon technological developments. This could effect successful little transaction fees and perchance reduced miner revenues unless offset by a important summation successful Bitcoin’s price.

The station A level period for miners aft a volatile April appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)