The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Realized Market Capitalization Trends

Today, we’re providing an in-depth breakdown of realized marketplace capitalization. Traditional plus classes on with bitcoin itself are often quoted successful presumption of their marketplace capitalization, which is calculated by uncovering the merchandise of terms and circulating supply. With bitcoin, and the instauration of a wholly transparent acceptable of spot rights, you tin cipher the realized marketplace capitalization, which values each portion of proviso astatine the terms it was past moved crossed the network.

The realized marketplace capitalization of bitcoin is 1 of the champion ways to quantify the monetization process of the asset, arsenic the infamous volatility of the plus is seemingly lone occurring to the upside. The fluctuations successful the speech complaint are not astir arsenic volatile arsenic the gradual-then-sudden appreciation of the realized marketplace worth of the asset.

The realized marketplace capitalization of bitcoin is 1 of the champion ways to quantify the monetization process of the asset, arsenic the infamous volatility of the plus is seemingly lone occurring to the upside. The fluctuations successful the speech complaint are not astir arsenic volatile arsenic the gradual-then-sudden appreciation of the realized marketplace worth of the asset.

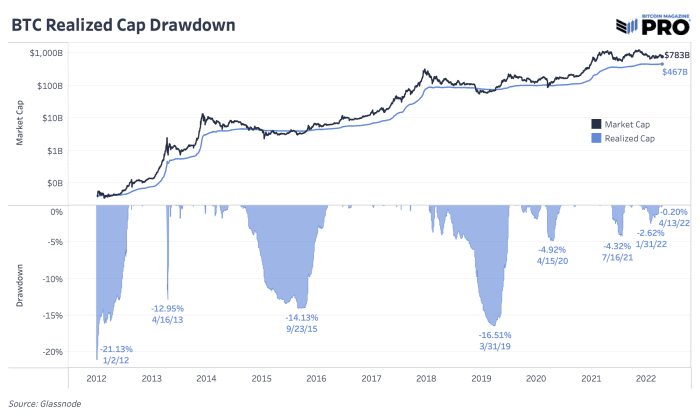

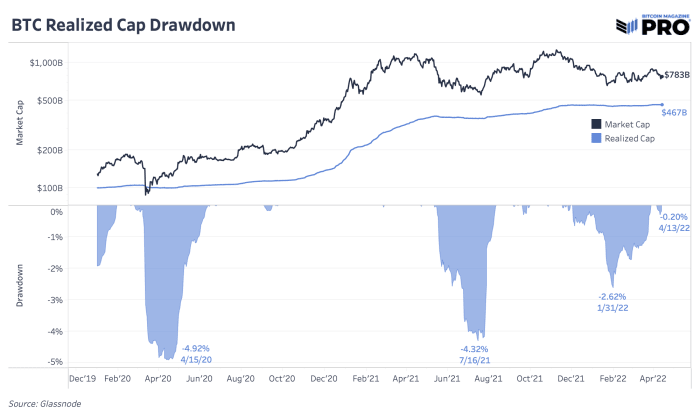

Currently the realized headdress of bitcoin is $467 billion, a specified 0.20% disconnected of its all-time high. Despite falling by much than 50% disconnected of the highs since November, the realized marketplace worth of bitcoin has lone fallen from highest to trough by 2.62%.

A thread written successful December 2021 covers this dynamic extensively, citing the patterns of realized terms during bitcoin marketplace cycles.

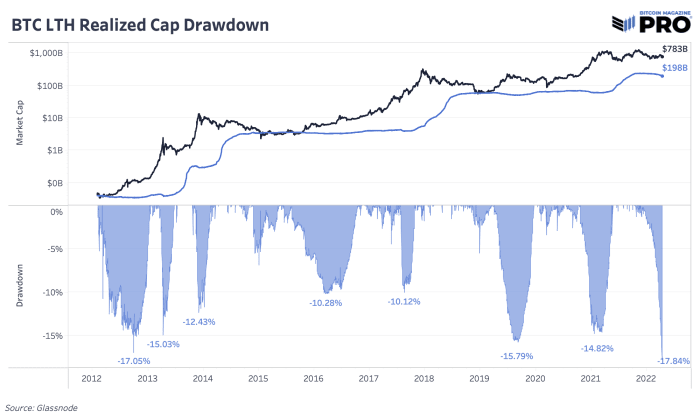

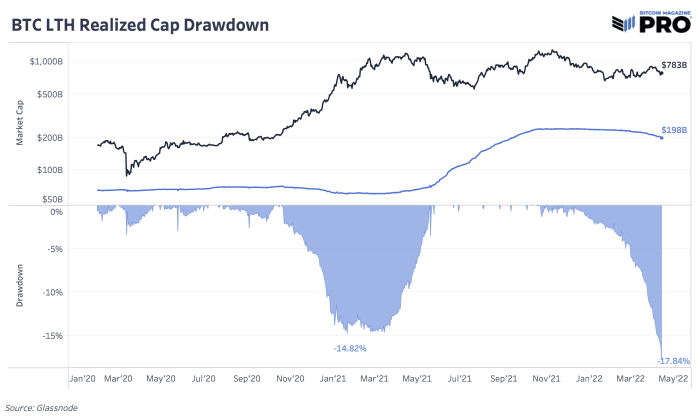

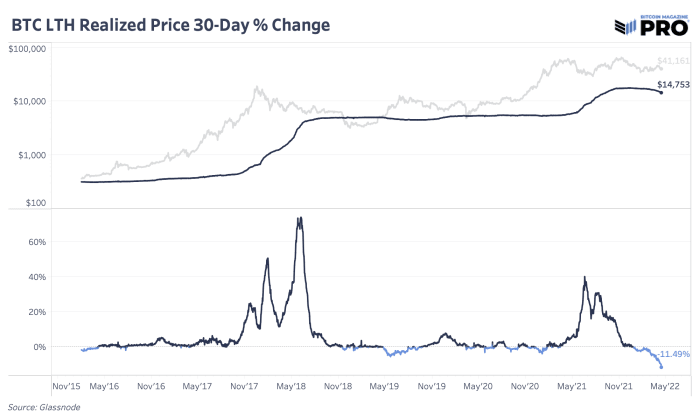

We tin besides interruption down realized capitalization into antithetic cohorts including long- and short-term holders. Under the surface, we’re seeing the largest drawdown successful semipermanent holder realized capitalization successful bitcoin’s history.

Although semipermanent holder proviso is reasonably neutral since the commencement of the year, up 0.6% arsenic accumulation and coins aging into this radical continues, the information shows that there’s been plentifulness of selling too. Long-term holders realized capitalization and realized terms falls arsenic coins with higher outgo ground are sold. This lowers the wide mean outgo ground which is down 11.49% implicit the past 30 days.

With this information and the process by which long-term holders are quantified, the people of 2021 holders that precocious aged into the cohort are the ones moving their holdings.

Re-accumulation has been our basal lawsuit since the commencement of Q1 2022, and the authorities of these metrics proceed to enactment that marketplace outlook contempt the caller emergence successful semipermanent holder selling pressure.

3 years ago

3 years ago

English (US)

English (US)