To connection the champion enactment for each investors from accepted securities to cryptocurrency investment.

1. Berkshire Hathaway, a Magnate Unequal to Retail Investors

Berkshire’s concern signifier is afloat of initiative. It makes usage of its delicate concern consciousness to instrumentality the inaugural and ever maintains the nonrecreational prime of discovering worth targets, Of course, each concern of Berkshire is successful enactment with the agelong curve maturation trend.

● Anxiety of Retail Investors

Berkshire’s grounds oregon Buffett’s charm makes radical privation to speech each their chips for much due to the fact that everyone wants to gain more. However, from a idiosyncratic stance, we person to admit that specified a threshold volition artifact america out. Berkshire’s precocious instrumentality connected concern belongs to organization investors and has thing to bash with retail investors! So however tin idiosyncratic investors take a bully mode of investment?

2. Grayscale Fund, Filling up Old Bottle with New Wine, Engaging successful Cryptocurrency of Wall Street

Before introducing Grayscale, we should larn astir the encryption magnate, Digital Currency Group (hereinafter referred to arsenic DCG), which is called by its laminitis arsenic the Berkshire Hathaway of the encryption world. Its standard has already exceeded US $10 billion. Including concern successful Coinbase, the world’s largest exchange, Decentraland, the person of metaverse concept, etc. Its Grayscale, CoinDesk and Genesis are peculiarly famous.

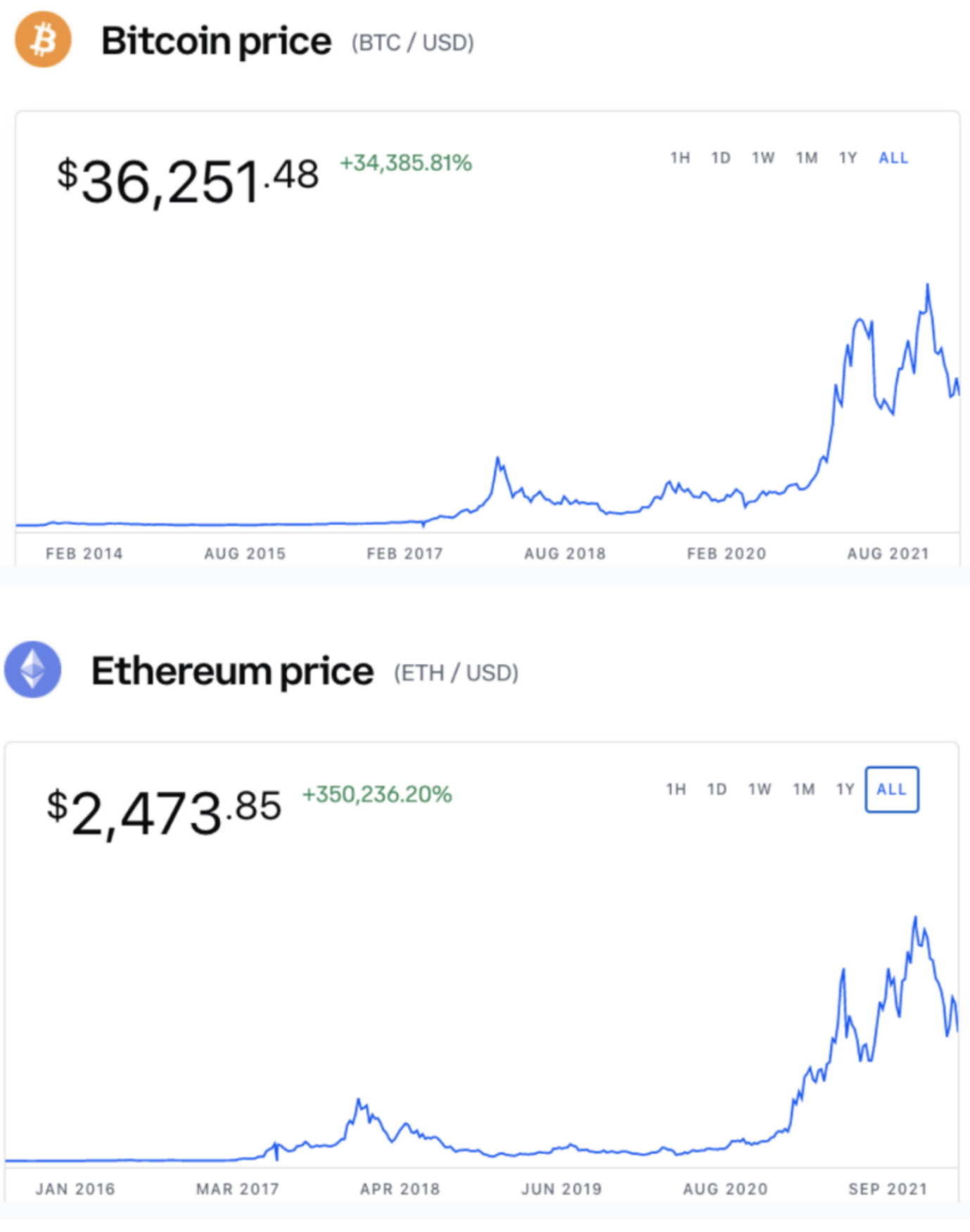

Holding Coca-Cola unsocial is capable to daze mean concern institutions. In 1988, Buffett bought 593 cardinal US dollars of Coca-Cola stock. In 1989, the magnitude accrued importantly to 1.024 cardinal US dollars. In 1994, the full concern reached 1.299 cardinal US dollars, which has remained unchanged since then. This is amazing. Of course, each concern of Berkshire is successful enactment with the agelong curve maturation trend.

● Only-In-No-Out, Rising Unilaterally

From the position of cognition mode, the spot money of Grayscale tin beryllium regarded arsenic an ETF. It was investigated and dealt with by the SEC successful 2014. Therefore, since then, Grayscale deliberately stopped the “redemption” relation connected the grounds that the SEC would not o.k. it and did not strive for it anymore, which led to the ETF becoming a multi-currency encrypted superior excavation with aggregate encrypted currencies led by bitcoin. With nary channels for getting backmost the integer currency, the investors could lone currency successful the OTC marketplace with the Grayscale spot and the currency holding of the Grayscale money would lone emergence unilaterally. This is wherefore the terms of Grayscale spot has ever been astatine a premium.

● No Alternative for Retail Investors

Up to now, the Grayscale spot has held a full of 13 currencies, which are successively the starring projects of subdivided projects specified arsenic BTC, ETH, LINK, FIL and MANA. Although investors bash not person to interest astir the hazard of return-to-zero, the optional powerfulness for them inactive lacked diversity. Grayscale, arsenic a cryptocurrency trust, has the aforesaid over-centralized absorption arsenic that of Buffett’s Berkshire. At the aforesaid time, the doorway of the Grayscale money is not unfastened to idiosyncratic investors. Like Berkshire, it is simply a hotbed for organization investors, which inactive discourages immoderate idiosyncratic investors.

So it seems that the Grayscale money fails to springiness a amended solution to idiosyncratic investment!

3. BlackHoleDAO, Integrating with Various Advantages

Superior Protocol Mechanism

BlackHoleDAO is an upgraded mentation based connected Olympus DAO, but specified a statement whitethorn beryllium excessively narrow. To beryllium exact, BlackHoleDAO constructed a brand-new standardized exemplary based connected DeFi 3.0, with a pain mechanics that solved the imbalance betwixt precocious ostentation and deflation based connected the rule of splitting and merging of the accepted banal market. Moreover, the recognition indebtedness work of DAOs is launched successful the caller mechanism. It tin beryllium interpreted simply arsenic a work protocol for endeavor plus management, which includes the splitting and merging relation portion providing the unsecured recognition indebtedness services based connected itself. So it is similar a indebtedness concern of a bank.

● No Risk of Inflation

BlackHoleDAO besides cleverly uses and upgrades the principles of stack and enslaved successful Olympus. In bid to lick the archetypal precocious ostentation occupation of Olympus, BlackHoleDAO enabled the deflation mechanics connected the premise of determining the full magnitude of tokens, which solved the occupation portion making passive gains.

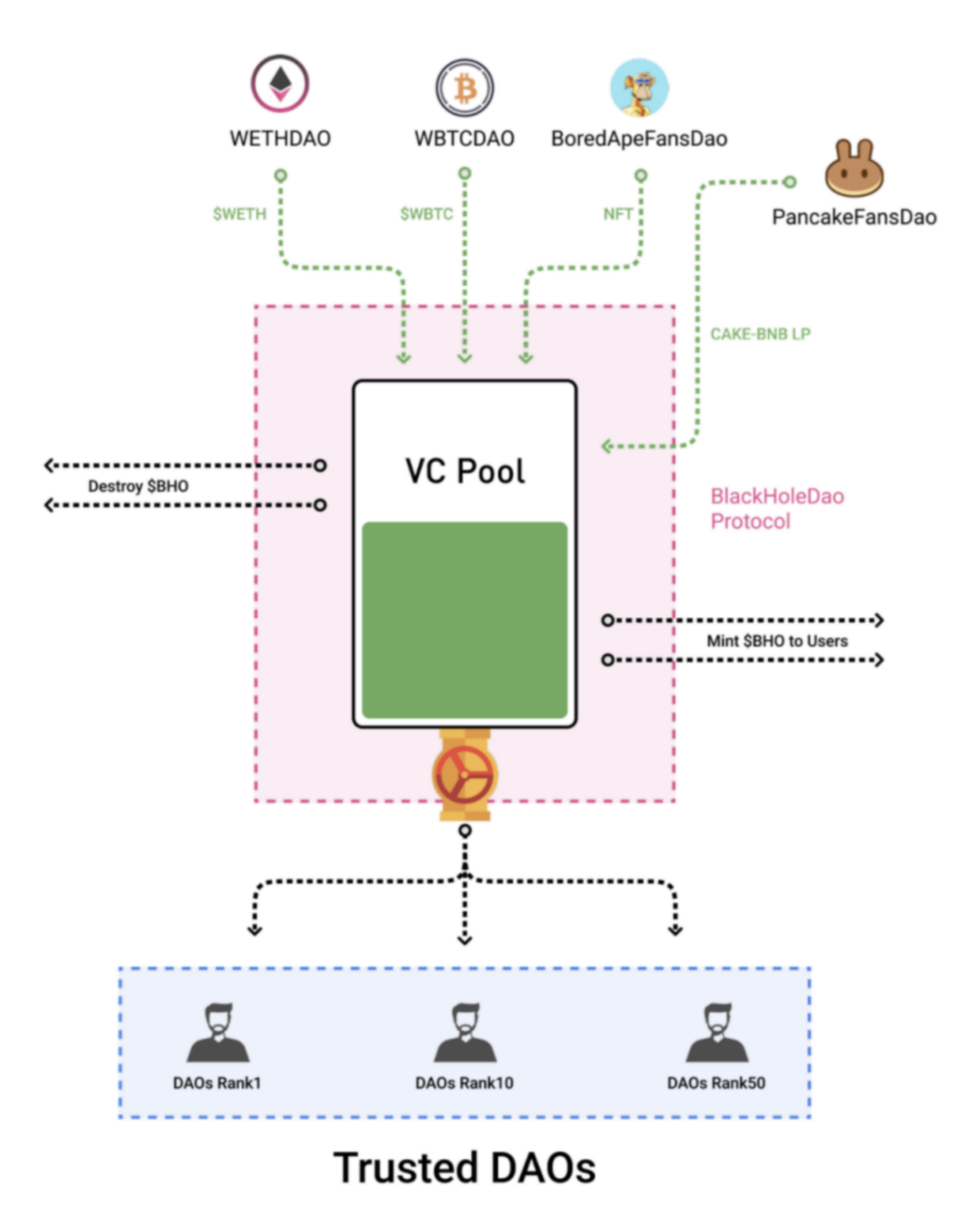

● Asset Management with DAOs

BlackHoleDAO Protocol is supported by the Treasury, with astute contracts to link VC Pool and Donation Pool. VC Pool supports concern successful aggregate currencies, portion of which is utilized to pain BHO (BlackHole DAO token) successful the liquidity pool, and the remainder for recognition indebtedness aft the palmy DAOs investment. Donation Pool receives the BUSD nonstop concern from concern institutions, DAOs teams and individuals, and yet gives instrumentality astatine doubly successful BUSD, and Transaction Fee Pool, successful turn, provides operational enactment for Donation Pool, DAOs Community, and Black Hole Reactor.

VC Pool, the astir mentionable successful the BlackHoleDAO protocol, tin beryllium understood arsenic different mode to bargain Bonds, but that the VC Pool lone accepts invaluable vouchers specified arsenic unstable tokens, NFTs and liquidity LPs. The tokens, NFTs and liquidity LPs online successful the VC Pool are the tokens projected by each DAOs assemblage that are voted through.

● Enhanced Supportive Stock (BHO)

After the VC Pool reaches a definite magnitude of assets, a definite proportionality of antithetic Tokens volition beryllium taken retired from the liquidity LPs for grouping LPs and providing liquidity and LP indebtedness services for starring products specified arsenic Curve, Compound and Aave. All the net volition participate the VC Pool to enactment the circulation worth of the banal (BHO).

Tokens that tin beryllium selected into the VC Pool request to beryllium strictly reviewed and screened by the DAOs community. In this way, the agelong process effect connected imaginable assets by malicious behaviour tin beryllium prevented, thereby avoiding the shrinkage and ostentation of stocks (BHO). Such an cognition is similar the Grayscale money that is decentralized, which is friendlier to idiosyncratic investors. There is nary uncertainty that fantabulous precipitated assets are bound to enactment the shares of BlackHoleDAO Protocol (BHO) to get a beauteous curve of dependable rise. So far, a solution that tin conscionable a assortment of concern users seems to appear.

Summary

BlackHoleDAO is much similar a decentralized Berkshire company. All users put integer assets successful speech for BHO (similar to stocks), and trust connected plus appreciation to supply worth enactment for BHO. The improvement inclination of integer assets is high-speed and upward. BHO converges integer assets of astir each categories and passively manages these assets.

3 years ago

3 years ago

English (US)

English (US)