Several bitcoin futures exchange-traded funds are present trading, with much to come. A spot bitcoin ETF remains elusive. Industry proponents anticipation that the caller support of a futures ETF filed nether the aforesaid instrumentality that governs spot bitcoin ETF applications whitethorn beryllium a hopeful sign, but the SEC has a laundry database of concerns that inactive request to beryllium addressed.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Sign up here to get it successful your inbox each Tuesday.

Another bitcoin futures exchange-traded money (ETF) was approved for the U.S. marketplace past week. And dissimilar the lawsuit for the others, the mode it’s structured opens the doorway for a spot bitcoin ETF, thing the manufacture has agelong clamored for. Recent spot bitcoin ETF rejections, however, suggest it whitethorn not beryllium that simple.

A spot bitcoin ETF would commercialized based connected the terms of bitcoin, arsenic opposed to futures ETFs, which commercialized based connected the terms of bitcoin futures. Bitcoin futures are a smaller marketplace than spot bitcoin and aren’t straight correlated to the terms of bitcoin (since again, they are futures). Crypto manufacture proponents person been calling for a spot ETF arsenic a harmless mode for traders to participate the bitcoin marketplace without straight investing successful the cryptocurrency itself.

The U.S. Securities and Exchange Commission (SEC) approved a bitcoin futures ETF past week. Unlike erstwhile futures ETF applications, this 1 was filed nether the “33 Act” (or the Securities Act of 1933) and the “34 Act” (or the Securities Exchange Act of 1934). All of the past bitcoin futures ETFs were filed nether “40 Act” (the Investment Company Act of 1940).

I asked past year whether 2021 would beryllium the twelvemonth of the bitcoin ETF and concluded – successful February – that the reply was fundamentally 🤷. The question present is whether 2022 volition beryllium the twelvemonth of the spot bitcoin ETF, and the reply seems to beryllium much 🙅 than 🤷.

SEC Chairman Gary Gensler said past twelvemonth helium felt much comfy with 40 Act funds due to the fact that of the capitalist protections enshrined wrong the law, arsenic good arsenic the marketplace surveillance tools overseeing the futures market. The bulk of the measurement is connected Chicago Mercantile Exchange, a accepted steadfast with long-standing surveillance tools successful place.

The SEC’s caller rejection orders look to echo this premise.

“The Commission concludes that BZX has not met its load nether the Exchange Act and the Commission’s Rules of Practice to show that its connection is accordant with the requirements of Exchange Act Section 6(b)(5), and successful particular, the request that the rules of a nationalist securities speech beryllium ‘designed to forestall fraudulent and manipulative acts and practices’ and ‘to support investors and the nationalist interest,’” SEC staffers wrote successful rejecting the ARK21Shares Bitcoin ETF.

The SEC used identical language a period earlier successful rejecting the NYDIG Bitcoin ETF.

But, radical privation a bitcoin ETF. A Nasdaq survey of 500 fiscal advisers recovered that 72% would beryllium much comfy investing successful crypto if determination was besides a spot ETF.

An important caveat present is this survey was of 500 fiscal advisers who are already considering allocating funds to crypto, and truthful the respondents weren’t needfully typical of fiscal advisers astatine ample successful the U.S.

Let’s backmost up. The crushed I’m talking astir this contiguous is that the SEC approved Teucrium’s bitcoin futures ETF to statesman trading past week. Unlike ProShares, Valkyrie oregon VanEck, Teucrium filed for a 33 Act fund. The support jump-started caller speculation that a spot bitcoin ETF whitethorn beryllium person to approval.

At the precise least, the 33 Act support would look to service arsenic grounds should a institution specified arsenic CoinDesk sister steadfast Grayscale determine to record a ineligible situation of immoderate benignant to a aboriginal SEC rejection.

Grayscale has already argued that the erstwhile futures ETF approvals make crushed for the support of a spot ETF (Grayscale filed to person its Grayscale Bitcoin Trust to an ETF).

The bitcoin derivatives markets person identical vulnerability to fraud and manipulation that the spot markets mightiness have, Grayscale’s attorneys wrote successful a letter to the regulator past year.

“It is of people foundational that the Commission – similar immoderate different national regulatory bureau – indispensable dainty similar situations alike absent reasoned justification,” the missive said.

The SEC took purpose astatine this statement successful its Teucrium support order, with staffers penning that they accepted NYSE Arca’s statement that for anyone to manipulate bitcoin futures ETF prices, they would person to manipulate CME’s bitcoin futures marketplace directly, and not conscionable the bitcoin spot market.

“The Commission has considered and rejected astir identical arguments successful past disapproval orders of spot bitcoin ETPs. Moreover, the Commission finds arguments centered astir the narration betwixt the bitcoin spot marketplace and the CME bitcoin futures marketplace to beryllium inapposite where, arsenic here, the projected ‘significant’ marketplace (i.e., the CME bitcoin futures market) is the aforesaid arsenic the marketplace connected which the projected ETP’s lone non-cash assets (i.e., CME bitcoin futures contracts) trade,” the SEC wrote.

In its caller rejections, the SEC wrote that the banal exchanges sponsoring spot crypto ETFs person “not sufficiently” argued against the agency’s concerns astir manipulation and fraud.

“Such imaginable sources person included (1) ‘wash’ trading, (2) persons with a ascendant presumption successful bitcoin manipulating bitcoin pricing, (3) hacking of the bitcoin web and trading platforms, (4) malicious power of the bitcoin network, (5) trading based connected material, non-public information, including the dissemination of mendacious and misleading information, (6) manipulative enactment involving the purported ‘stablecoin’ Tether (USDT), and (7) fraud and manipulation astatine bitcoin trading platforms,” the SEC wrote.

The bureau has besides said it’s acrophobic that the crypto spot exchanges are themselves unregulated (left unsaid is that they are unregulated astatine the national level, not the authorities level arsenic each U.S. crypto speech is expected to be).

Given that the SEC has consistently expressed concerns astir marketplace manipulation successful rejecting spot bitcoin ETF applications, it seems apt (to maine anyway) that the bureau volition proceed to cull spot ETF applications, astatine slightest for the foreseeable future.

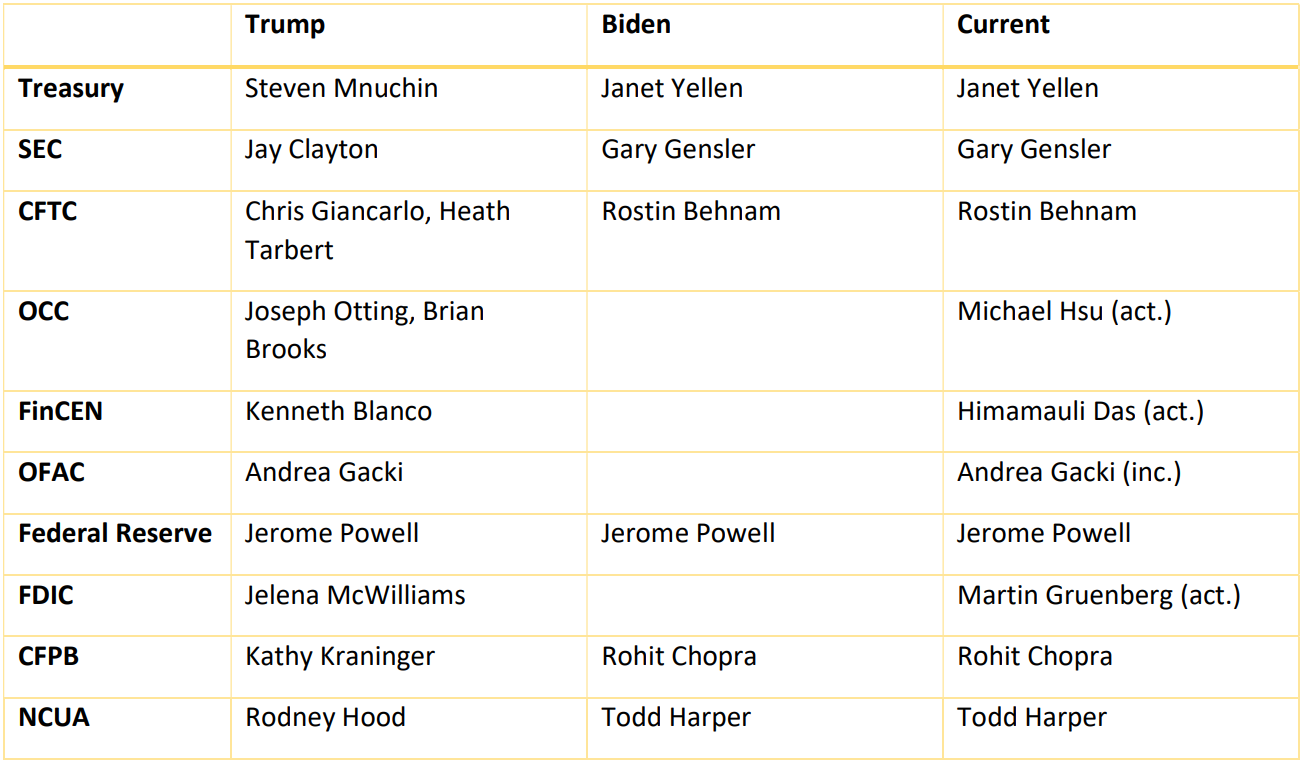

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

U.S. President Joe Biden has nominated Jaime Lizárraga and Mark Uyeda to capable 2 seats connected the SEC. Lizárraga is present a elder advisor to House Speaker Nancy Pelosi (D-Calif.), portion Uyeda is an SEC lawyer moving with the Senate Banking Committee number unit arsenic securities counsel, according to a White House property release.

Elsewhere, Politico’s Victoria Guida reports that Michael Barr, a erstwhile Treasury Department official, erstwhile Ripple committee subordinate and existent dean astatine the University of Michigan is nether information to beryllium the Fed’s Vice Chairman for Supervision, the relation Sarah Bloom Raskin was antecedently nominated for. Barr was besides nether information for Comptroller of the Currency last year but received pushback.

France's Presidential Candidates Ignore Crypto Issues: A fewer weeks ago, we published an nonfiction connected however South Korea’s statesmanlike candidates were pitching to crypto voters successful the country. Half a satellite away, crypto is hardly connected the radar successful France’s election, which saw incumbent Emmanuel Macron and challenger Marine Le Pen beforehand to a runoff.

Top US Lawmaker Proposes Sweeping Stablecoin Regulation Framework: Sen. Pat Toomey (R-Pa.), the ranking subordinate connected the Senate Banking Committee, circulated a treatment draught measure that would make a three-pronged attack for stablecoin regulation. As outlined, the measure would springiness stablecoin issuers the enactment of operating nether a caller licence issued by the Office of the Comptroller of the Currency, operating arsenic a accepted slope oregon operating arsenic a authorities wealth transmitter business, with strict disclosure and redemption rules successful place.

New York Senate Authorizes NYDFS to 'Assess' Crypto Companies: The New York Senate has authorized the authorities Department of Financial Services to make an “assessment,” oregon complaint for the crypto companies it oversees to assistance offset immoderate of the costs of this oversight. “The quality for DFS to complaint fees is successful enactment with modular signifier successful the banking and security sectors. With accrued funding, DFS volition person the capableness to prosecute further unit with a inheritance and expertise successful crypto, allowing DFS to germinate alongside the manufacture and enactment New York's presumption arsenic the halfway of fiscal innovation,” the Global Blockchain Business Council told CoinDesk’s Cheyenne Ligon.

(Wired) Wired has a long-form nonfiction detailing the takedown of “Welcome to Video,” a kid exploitation ringing unopen down a fewer years ago. Crypto was a heavy featured outgo tool, 1 which authorities took vantage of successful tracing the transactions.

(Wired) There was a truly bully Decrypt article a fewer years backmost astir however radical linking their existent Ethereum wallets to their Ethereum Name Service identities turned retired to beryllium a spot of a privateness boondoggle. Wired has the 2022 variation with a look astatine however tying an NFT to your wallet mightiness besides region immoderate privateness barriers you’d expect.

(Nashville Scene) Tennessee has passed authorities creating a regulatory model for decentralized autonomous organizations (DAOs).

(Bloomberg) Bloomberg newsman Michael McDonald tried utilizing thing but bitcoin portion successful El Salvador’s El Zonte for 5 days, and chronicled his efforts alongside lensman Cristina Baussan.

(BuzzFeed News) Worldcoin sent folks to a fistful of processing nations to scan their eyeballs successful speech for a committedness for its caller cryptocurrency. Some months in, the radical who had their eyeballs scanned are wondering wherever their coins are.

(FastCompany) Bitcoin Miami was past week! I did not go. But here’s a retrospective from idiosyncratic who did!

(The New York Times) The Times takes a look astatine authorities legislatures arsenic crypto becomes an progressively ample interest successful immoderate states.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for State of Crypto, our play newsletter examining the intersection of cryptocurrency and government

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)