Summary:

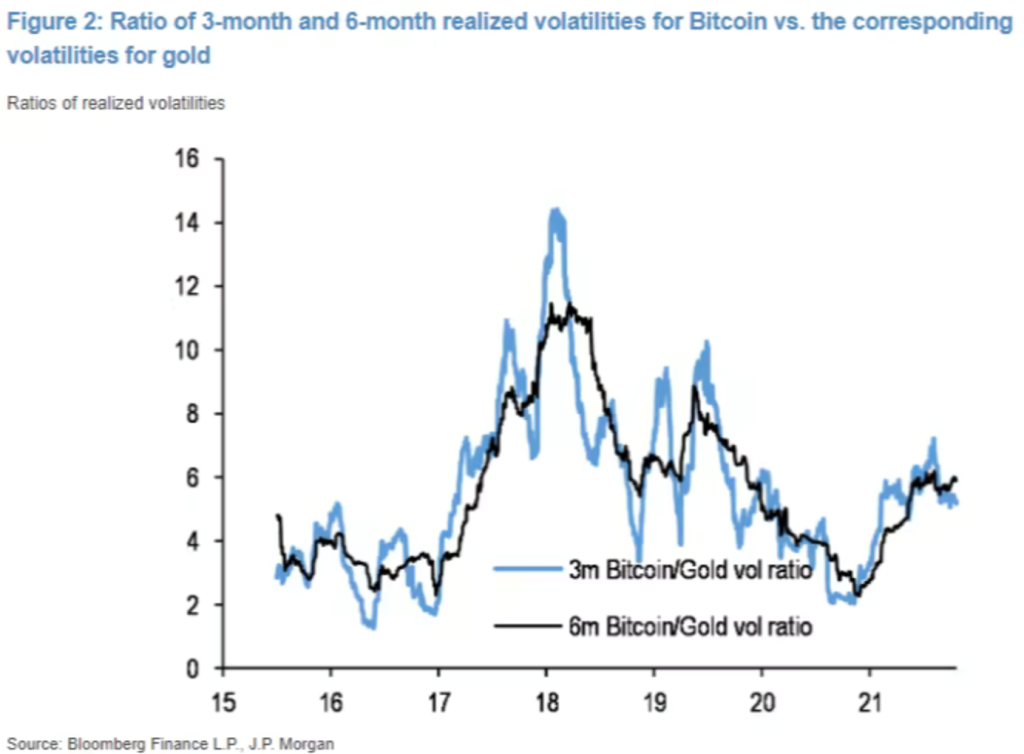

- A illustration by the squad astatine JP Morgan Chase superimposes Bitcoin’s and Gold’s ratios of realized volatilities and hints that BTC is acting a batch similar the second asset.

- Bitcoin’s marketplace headdress and that of Gold could yet equalize arsenic they service the aforesaid purpose.

- But Bitcoin’s volatility hinders its marketplace headdress from increasing to the level of Gold.

- Analysts forecast that Bitcoin could retest $20k oregon little this year.

- Guggenheim’s Chief Investment Officier sees Bitcoin retesting $8k oregon little arsenic it has yet to beryllium itself arsenic a credible organization investment.

A illustration by the squad astatine JP Morgan Chase hints that Bitcoin is presently acting a batch similar Gold. The chart, shared beneath and courtesy of the squad astatine Fortune magazine, shows the ratio of the three-month and six-month realized volatilities of Bitcoin versus that of Gold.

Bitcoin’s and Gold’s Market Cap could Equalize arsenic they Serve the Same Purpose.

Furthermore, the study by the squad astatine Fortune besides forecasts that the full marketplace headdress of Bitcoin and Gold could yet equalize arsenic they service the aforesaid purpose. But, the marketplace headdress of Bitcoin held by organization investors volition not summation soon till its volatility stabilizes to comfy levels, arsenic explained successful the pursuing statement.

…because volatility is truthful captious erstwhile it comes to organization investors’ hazard management, the marketplace headdress of Bitcoin held by institutions apt won’t scope gold’s level until its volatility subsides.

Guggenheim’s Chief Investment Officer sees Bitcoin retesting $8k

With respect to Bitcoin’s short-term terms movement, the study by the Fortune MAgazine squad hinted that BTC could fall to beneath $20k earlier the extremity of this year.

The imaginable of Bitcoin trading beneath $20k was besides shared by Guggenheim’s Chief Investment Officer, Scott Minerd, successful a Bloomberg interrogation astatine the World Economic Forum successful Davos, Switzerland. During the interview, Mr. Minerd stated that helium expected Bitcoin to autumn to $8,000 and that the crypto marketplace is filled with ‘a clump of yahoos.’

According to his analysis, Bitcoin, connected a cardinal level, should beryllium worthy $400,000 chiefly owed to the US Fed’s ‘rampant wealth printing.’ However, a flash to $8k mightiness beryllium indispensable to let for further growth. Additionally, helium stated that the Bitcoin and Crypto markets person yet to walk the trial arsenic credible organization investments. He said:

Bitcoin and immoderate cryptocurrency astatine this constituent has not truly established itself arsenic a credible organization investment.

Everything is suspect. No 1 has cracked the paradigm successful crypto. We person 19,000 integer currencies … astir of them are junk.

3 years ago

3 years ago

English (US)

English (US)