Bloomberg expert Eric Balchunas has reduced the accidental of the SEC denying a spot Bitcoin ETF to conscionable 5%, with chap Bloomberg newsman James Seyffart indicating lone achromatic swan interventions from Gary Gensler oregon the Biden medication imaginable routes to denial.

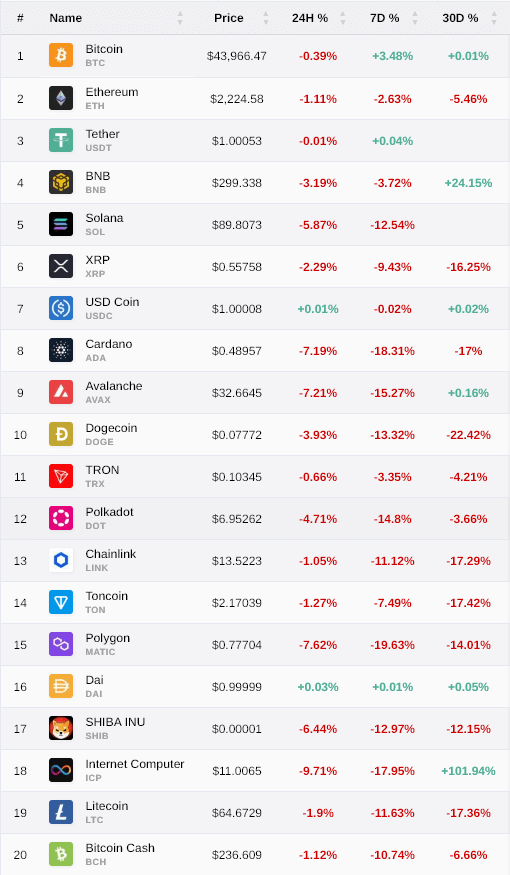

Interestingly, implicit the weekend, with the accepted markets closed, crypto continued to commercialized arsenic usual, with Bitcoin trading sideways and the remainder of the marketplace signaling a sizeable sell-off. Bitcoin traded betwixt $43,500 and $44,400, showing a specified 2% swing. As of property time, the largest integer plus by marketplace headdress is bang successful the mediate of this scope astatine $44,000 per CryptoSlate data.

However, altcoins specified arsenic BNB, Solana, Cardano, Avalanche, Dogecoin, Polkadot, Polygon, Shiba Inu, and ICP are each down astatine slightest 3% and arsenic overmuch arsenic 9.7% arsenic of property time.

Altcoins autumn arsenic Bitcoin trades sideways.

Altcoins autumn arsenic Bitcoin trades sideways.The astir resilient altcoins look to beryllium Ethereum, XRP, Tron, Chainlink Litecoin, and Bitcoin Cash, which, portion each inactive down, person recorded little than a 3% diminution implicit the past 24 hours.

Since Saturday, Jan. 6, Bitcoin dominance has risen by 1.5%, reaching a highest of 54% earlier retracing somewhat this morning, indicating the starring integer plus is solidifying its presumption successful the marketplace up of a imaginable landmark support this week.

Bitcoin dominance (Source: TradingView)

Bitcoin dominance (Source: TradingView)One of the biggest losers of the weekend, Solana, fell arsenic overmuch arsenic 13% against Bitcoin implicit the play and is inactive down astir 9%. Solana peaked astatine $126 connected Dec. 26, 2023, yet it has fallen 28% successful the 13 days since to trade, arsenic of property time, astatine $90.

Bitcoin has recovered from its rhythm debased of 38% dominance successful the crypto marketplace successful mid-2023 to claw backmost to 54% connected the hype of a imaginable spot Bitcoin ETF. This 39% surge puts its dominance astatine the highest level since April 2021, erasing each of the crushed the remainder of the altcoin marketplace made connected the plus during the past bull run.

Since Ethereum’s motorboat successful 2015, Bitcoin dominance peaked astatine the commencement of 2021 astatine 75% earlier falling dramatically passim the bull market, yet trading wrong the 39% – 48% scope for astir 760 days. However, pursuing the past 2 Bitcoin halves, BTC dominance has fallen consistently, with a driblet of 64% and 38%, respectively, marking bottoms aft astir 510 days.

BTC dominance with halvings (Source: TradinvView)

BTC dominance with halvings (Source: TradinvView)Most interestingly, arsenic highlighted connected the indicator astatine the bottommost of the supra chart, Bitcoin dominance has had a near-perfect correlation with Bitcoin’s terms since the commencement of 2023, the longest play of correlation since Ethereum’s entranceway into the market.

This week is acceptable to beryllium 1 of the biggest ever for Bitcoin arsenic each eyes are connected the spot Bitcoin ETF support process. A determination either mode is definite to person an effect connected the full marketplace with volatility expected crossed the board.

The station Altcoins drop, Bitcoin level arsenic spot ETF denial accidental falls to 5%: Bloomberg Analysts appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)