In a not-so-surprising crook of events, the bearish orientation of the Bitcoin terms has continued into the period of December, suggesting that the premier cryptocurrency could extremity the twelvemonth successful the red. Interestingly, caller on-chain information has offered insights into the apt absorption of Bitcoin based connected the integrity of an important terms level.

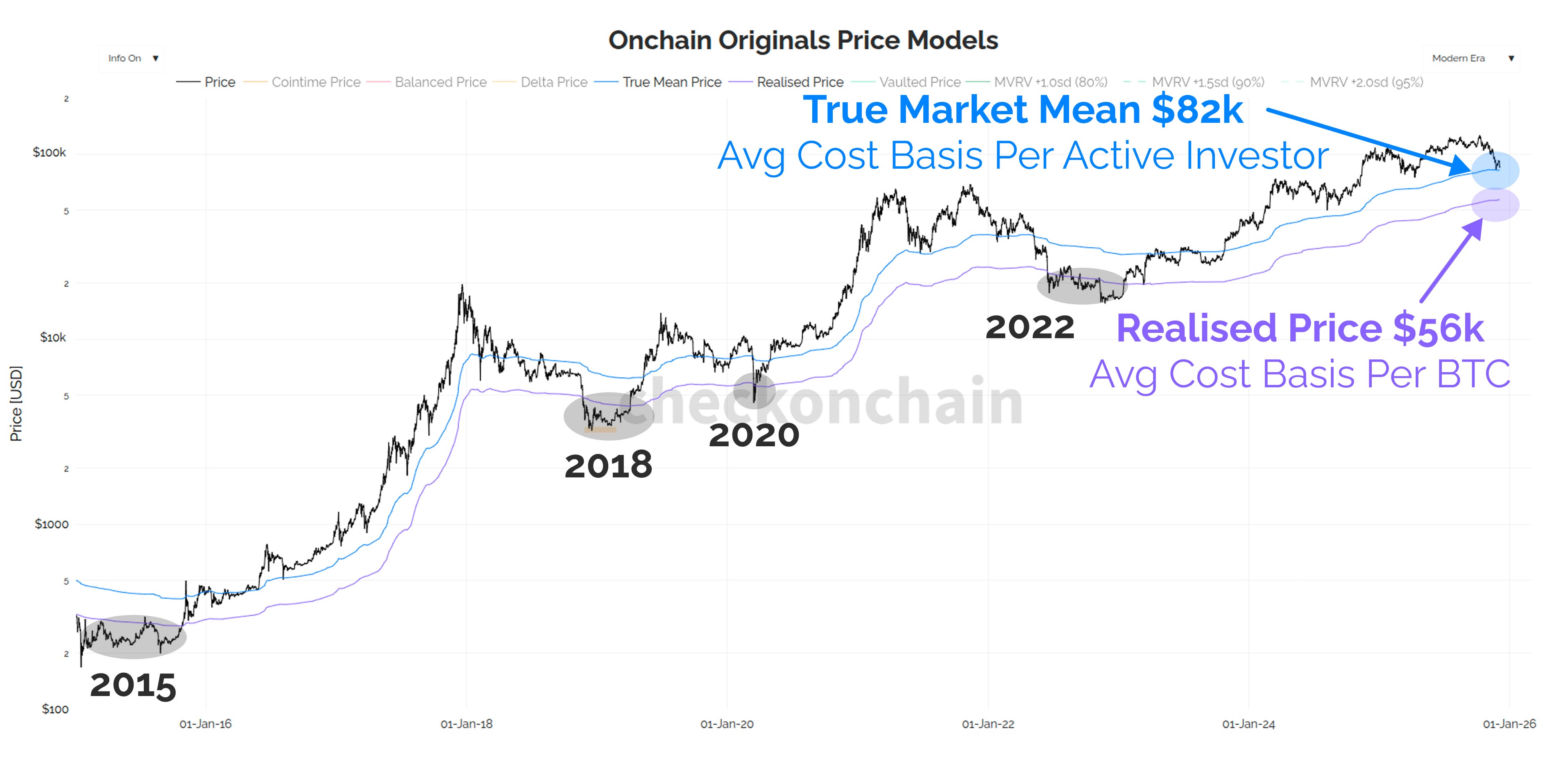

Active Market Participants’ Cost Basis At $82,000

In a December 5 station connected the X platform, marketplace expert Burak Kesmeci shared an absorbing outlook connected the absorption of the Bitcoin price.

The expert disclosed that immoderate happens astir the $82,000 people could marque oregon mar Bitcoin’s trajectory successful the adjacent term. To show wherefore this terms portion is truthful important, Kesmeci pointed retired that it appears to beryllium the convergence constituent of 2 highly influential outgo bases successful Bitcoin’s history.

Kesmeci revealed that the Bitcoin spot exchange-traded funds person an mean acquisition outgo of astir $82,000. Because ETFs are 1 of Bitcoin’s strongest request sources, tracking the values of their mean cost-basis could service arsenic a bully means to archer wherever the marketplace stands institutionally.

Source: @burak_kesmeci connected X

Source: @burak_kesmeci connected XThe crypto pundit besides referenced the Bitcoin True Market Mean metric, which monitors the outgo astatine which progressive investors procured their holdings—except for mined oregon rarely-moved BTC. Notably, successful the existent marketplace cycle, Bitcoin’s progressive participants mostly purchased their coins astir a valuation of $82,000.

What Happens If $82,000 Fails?

Usually, erstwhile terms slips beneath immoderate large terms support, determination is, successful turn, an summation successful wide selling pressure, arsenic buy-side liquidity is converted to bearish momentum via losses incurred by investors. Hence, successful the script wherever $82,000 fails to hold, a wave of bearish pressure is expected to ensue, arsenic Bitcoin’s progressive investors effort to chopped their losses.

However, Kesmeci expects thing adjacent much circumstantial to follow. According to humanities data, whenever Bitcoin falls beneath its progressive marketplace subordinate outgo basis, it often falls further downwards, arsenic though it is targeting its Realized Price.

At the moment, the Bitcoin Realized Price sits adjacent $56,000 — a terms level importantly beneath its investors’ mean outgo basis. Kesmeci truthful warned that a gaffe beneath $82,000 could precede Bitcoin’s crisp downturn towards $56,000.

This would correspond an astir 40% diminution from the existent terms point. As of this writing, the terms of BTC stands astatine astir $89,310, reflecting an implicit 3% dip successful the past 24 hours.

Featured representation from iStock, illustration from TradingView

54 minutes ago

54 minutes ago

English (US)

English (US)