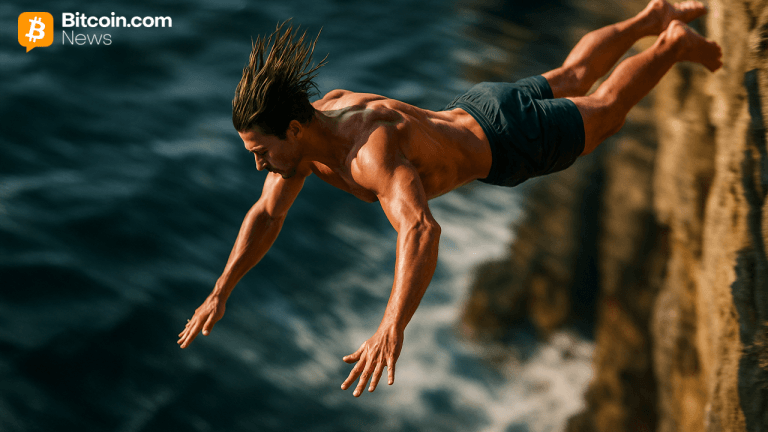

Ethereum (ETH) has been struggling with a important downturn recently, leaving the plus heavy successful the red. Over the past week, Ethereum has recorded a 9.2% diminution successful value, reflecting broader marketplace weakness.

However, the past 24 hours person brought a slight alteration successful momentum, with ETH seeing a 3.2% summation successful price. Though this uptick is not capable to erase the erstwhile week’s losses, it whitethorn awesome the opening of a betterment phase.

Is Ethereum At The End Of Its Correction

According to the latest analysis from renowned crypto expert Alex Clay connected X, Ethereum mightiness beryllium gradually recovering due to the fact that its caller bearish marketplace mightiness beryllium concluding.

He emphasized that if ETH tin support consolidation supra cardinal method zones, specifically the 200-day moving mean (MA) and 200-day exponential moving mean (EMA), it would supply a beardown instauration for an upward rally.

A important terms interruption supra the $2,500 people could corroborate that the correction has ended and the plus is primed for recovery. Furthermore, portion Clay had antecedently been optimistic astir Ethereum reaching a overmuch higher terms target, helium has revised his expectations based connected recent marketplace conditions.

#ETH/USD

Imo we are astatine the extremity of the $ETH correction💁♂️

Looking for immoderate consolidation supra the Key Zone + 200 MA & 200 EMA confluence

Break supra $2500 volition service a confirmation of the opening of the rally🚀#Ethereum turned to beryllium a dense plus truthful $10k people is rather… pic.twitter.com/jjGPPUHWE3

— Alex Clay (@cryptclay) September 9, 2024

Clay noted: “Ethereum turned to beryllium a dense asset, truthful $10k people is alternatively a imagination than world truthful I changed my mind.” For now, the expert has acceptable much realistic targets, with a mid-term extremity of $4,000 and semipermanent targets ranging from a blimpish $6,255 to an optimistic $7,942.

Ethereum terms chart. | Source: Alex Clay connected X

Ethereum terms chart. | Source: Alex Clay connected XOther Analysts Eye Falling Wedge Pattern As Key Indicator

Aside from Clay’s analysis, Ethereum’s method illustration has been the absorption of respective salient analysts, including Anup Dhungana and Captain Faibik, who person precocious identified the imaginable for a bullish breakout for ETH.

For instance, Dhungana’s ETH/BTC chart analysis suggests that a rebound from cardinal enactment levels and a interruption from the falling wedge pattern could importantly increase Ethereum’s price.

ETH/BTC chart. | Source: Anup Dhungana

ETH/BTC chart. | Source: Anup DhunganaFor context, falling wedges are mostly viewed arsenic bullish reversal patterns successful method analysis, and confirming a breakout could awesome an exponential upward trend.

Similarly, Captain Faibik echoed this sentiment, sharing an representation of altcoin marketplace illustration that besides displayed a falling wedge formation.

Altcoin marketplace headdress chart. | Source: Captain Faibik connected X

Altcoin marketplace headdress chart. | Source: Captain Faibik connected XFaibik predicted that altcoins could interruption retired of the wedge signifier shortly, perchance pushing large altcoins, including ETH, toward a betterment successful the 4th fourth of 2024.

He advised investors to stay patient, accumulate altcoins, and hole for a bounce backmost that could spot prices instrumentality to their March 2024 highs.

Featured representation from DALL-E, Chart from TradingView

1 year ago

1 year ago

English (US)

English (US)