The pursuing is simply a impermanent station from Shane Neagle, Editor In Chief from The Tokenist.

Bitcoin pushed the fiscal innovation envelope successful galore directions. As a distributed integer ledger, it opened up abstraction for transparency and offered a viable alternate to banking. Relying connected its proof-of-work algorithm, Bitcoin established integer scarcity. Digital but inactive anchored to the carnal satellite of hardware assets and vigor requirements.

All this portion being open-source. And Bitcoin’s open-source quality birthed implicit a 100 hard forks. These are ledgers governed nether antithetic rulesets, truthful overmuch truthful that they are incompatible with erstwhile blocks, resulting successful a caller blockchain version.

When a caller hard fork is created, propelled by antithetic visions of P2P wealth and incentives, a caller mentation of Bitcoin is born. By marketplace cap, the largest ones are Bitcoin Cash (BCH), Bitcoin SV (BSV), Bitcoin XT (BTCXT) and Bitcoin Gold (BTG). Although nary of them travel adjacent adjacent to the monolithic Bitcoin (BTC) marketplace headdress of $1.47 trillion, they person injected galore ideas that are applicable to Bitcoin’s future.

What Are Bitcoin Forks All About?

From the precise onset of Bitcoin mainnet motorboat successful January 2009, with the archetypal mined genesis block, it became evident that changes volition person to instrumentality spot to marque Bitcoin A Peer-to-Peer Electronic Cash System as Satoshi Nakamoto primitively intended.

For that benignant of imaginativeness to enactment successful the satellite of near-instant online payments, Bitcoin’s web would person to execute connected par with Visa oregon Mastercard networks. The occupation is, those networks trust connected centralized databases (ledgers), specified arsenic VisaNet, emphasizing ratio successful transaction processing supra each else.

After all, arsenic a wealth intermediary betwixt banks, Visa is not acrophobic with immoderate benignant of fiscal sovereignty, successful opposition to Bitcoin’s vision.

But however would that beryllium imaginable with a decentralized machine network? To stay so, each transaction has to beryllium verified by different nodes to get astatine the proof-of-work consensus. Bitcoin’s existent show is astir 7 transactions per second, arsenic it takes 10 minutes to corroborate each artifact stuffed with transactions (3,347 transactions per artifact astatine present).

There are respective implications of this attack to ledger management:

- With the summation successful transactions, Bitcoin transaction fees spell up. Bitcoin miners inject this friction due to the fact that they get to acceptable the caller level of interest precedence successful the available Bitcoin mempool space, arsenic the request for the Bitcoin mining web increases.

- If the popularity of Bitcoin increases transaction fees, it makes Bitcoin a mediocre substitute for “daily money” which ideally should person minimal friction to beryllium adopted astatine wide scale.

- If the evident solution of expanding transaction artifact sizes is implemented, the Bitcoin web would get much centralized due to the fact that much computing and retention would beryllium required to process transactions.

In different words, Bitcoin hard forks person been chiefly acrophobic with the balancing enactment of artifact sizes. Case successful point, erstwhile Mike Hearn launched Bitcoin XT arsenic a fork of Bitcoin Core successful August 2015, this mentation of Bitcoin was expected to summation artifact size from 1 MB to yet 8 MB, which could treble further each 2 years.

If we instrumentality a look astatine different Bitcoin hard forks, we spot a akin signifier of failure.

How Are Hard Forks Created?

Bitcoin hard forks are created by the instauration of caller Bitcoin Improvement Proposals (BIPs). Alongside bug fixes, they are the staging crushed for caller features. However, those caller features are implemented lone if an activation threshold is reached, constituting ~95% miner support.

Effectively, the past 2,016 blocks (about 2 weeks of mining) would person to awesome their enactment for a caller BIP to beryllium implemented.

When Mike Hearn and Gavin Anderson introduced their BIP 101 connection to summation maximum artifact size, from 1 MB to 8 MB, it failed to walk the activation threshold. This caused immoderate contention arsenic Hearn declared that “Bitcoin has failed”, but lone his BIP 101 failed. The resulting hard fork, Bitcoin XT, is the aborted version.

Forks similar these pb to caller coins, unlike tokens – the second of which are often created connected pre-existing blockchains. In turn, it was Bitcoin Classic (BXC) that subsequently emerged from Bitcoin XT, arsenic the artifact size was reverted from XT’s 8 MB to 2 MB. Once again, this showcases that Bitcoin hard forks manifest the balancing enactment of artifact sizes.

From these “block wars”, Bitcoin Cash (BCH) besides emerged successful August 2017, having yet accrued artifact size to 32 MB. Out of each the hard fork, BCH remains the astir palmy one, presently astatine a $7.26 cardinal marketplace cap.

Even specified moderately palmy splits person their ain forks. Australian entrepreneur Craig Wright introduced a BCH fork called Bitcoin Satoshi Vision (BSV) a twelvemonth later, successful November 2018. Claiming to beryllium the idiosyncratic down the pseudonym Satoshi Nakamoto, helium was aboriginal revealed arsenic a fraud successful the UK High Court, having leveraged extended forgery and lawfare tactics against critics.

Forged In the Crucible of Adversity

Given that Gavin Anderson was erstwhile a cardinal subordinate of Bitcoin Core, the superior model for Bitcoin, it is just to accidental that adjacent failed BIP contributions successful the signifier of hard forks service their purpose.

Although Block Size Wars ended up connected the broadside of “small blockers”, the contested statement did effect successful Segregated Witness (SegWit) implementation arsenic a brushed fork, having been activated astatine artifact 477,120 successful August 2017.

Through BIPs 91, 141, and 148, SegWit made Bitcoin transactions much businesslike by segregating witnesser metadata from the main transaction. This efficaciously accrued the artifact size by introducing artifact weight, which allowed for 4x much transactions per block.

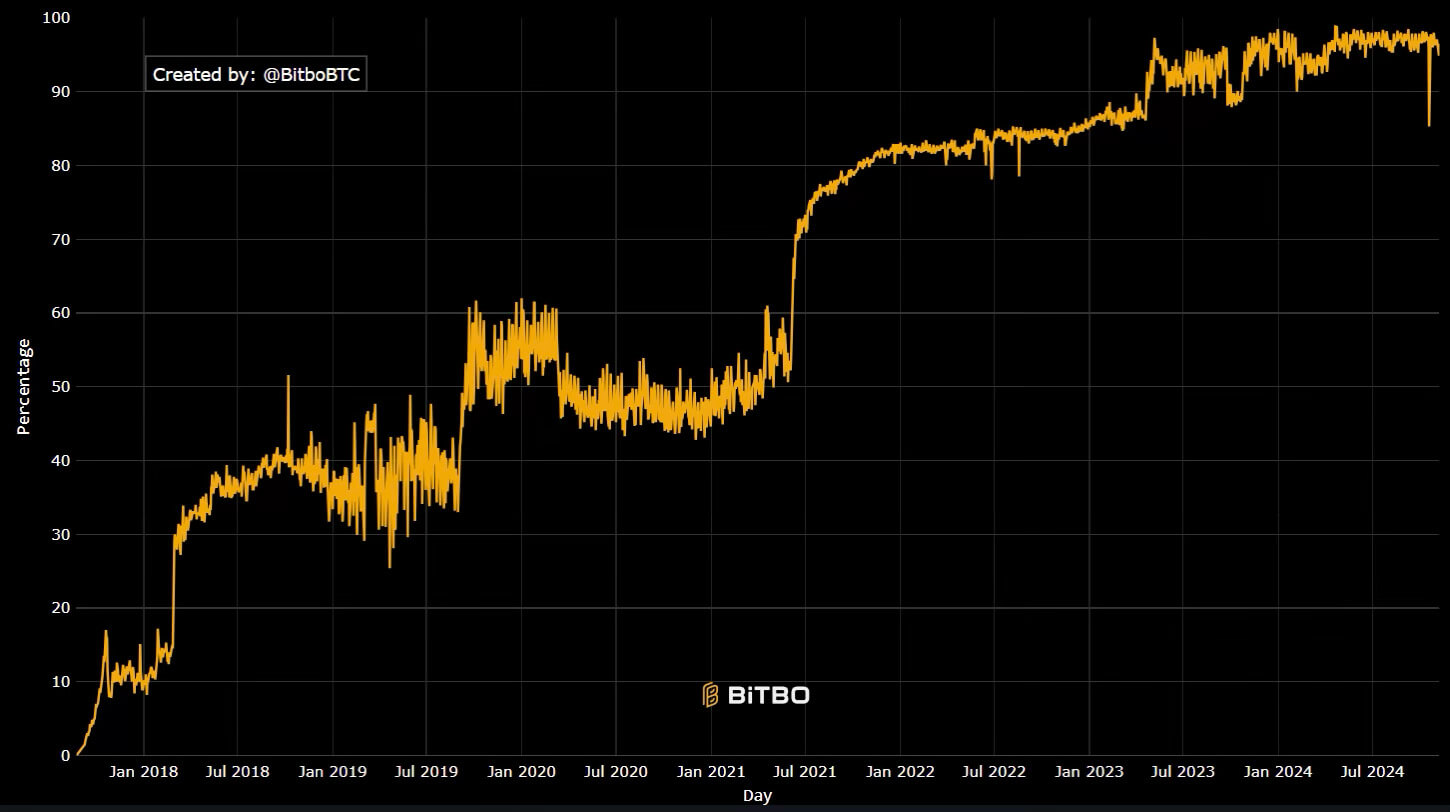

Adoption advancement of SegWit arsenic Bitcoin’s brushed fork feature. Image credit: BiTBO

Adoption advancement of SegWit arsenic Bitcoin’s brushed fork feature. Image credit: BiTBOMost importantly, SegWit paved the roadworthy for Bitcoin’s ain furniture 2 scaling solution, Lightning Network, due to the fact that it enabled Schnorr signatures. These not lone marque it imaginable to person Atomic Multi-Path Payments (AMP) for LN, which splits ample payments into tiny bits, but they minimize on-chain information footprint with much efficient, smaller signatures.

The AMP diagnostic besides allows users to optimize outgo routing done LN channels, arsenic the payer lone has to cognize the nationalist cardinal of the recipient. Ultimately, what started arsenic a bid of Bitcoin hard forks, with astir failing to summation traction, facilitated different benignant of Bitcoin scaling.

The frictionless scaling enabled by LN, combined with astute contracts, whitethorn adjacent pb to futures contracts indirectly, arsenic they would necessitate specified velocity and deeper liquidity. Even the Federal Reserve Bank of Cleveland recognized that Lightning Network gets Bitcoin person to “daily money” successful the paper titled The Lightning Network: Turning Bitcoin into Money.

“Our findings suggest that the off-chain netting benefits of the Lightning Network tin assistance Bitcoin to standard and relation amended arsenic a means of payment. Centralization of the Lightning Network does not look to marque it overmuch much efficient, though it whitethorn summation the proportionality of debased interest transactions.”

In the payments arena, it whitethorn beryllium apt that specialized hard forks could find their niche. There is ever a request for online invoice factoring oregon obtaining commercialized recognition for tiny to mean concern (SMBs).

But the information that Bitcoin remained with a blimpish artifact size portion adding LN arsenic a scaling solution is not that astonishing successful hindsight.

Security Risks and Network Vulnerabilities

In the archetypal stages of Bitcoin’s improvement and adoption, arsenic a large monetary novelty, it was captious to support a blimpish approach. If the nationalist is to comprehend Bitcoin arsenic dependable money, it has to support halfway features, nary pun intended.

Inherently, by diluting the hash complaint power, hard forks present a information vulnerability. The underlying worth of Bitcoin comes from the mining network’s hash complaint power. It is the measurement of calculations needed for mining rigs to lick cryptographic puzzles and adhd a valid transaction block, successful instrumentality for BTC arsenic artifact reward.

During this mining competition, those with higher hashrate person a greater accidental to gain BTC. And arsenic much computing powerfulness is added to the network, Bitcoin’s web trouble auto-adjusts each 2,016 blocks, oregon astir 2 weeks.

Conversely, a driblet successful hash complaint powerfulness would marque it much apt for a 51% web attack effort to succeed. A caller hard fork would not lone siphon distant computing power, but this divergence and dilution would make a heightened authorities of hazard during the caller mentation rollout.

What this amounts to is that Bitcoin miners are biased toward web information implicit innovation.

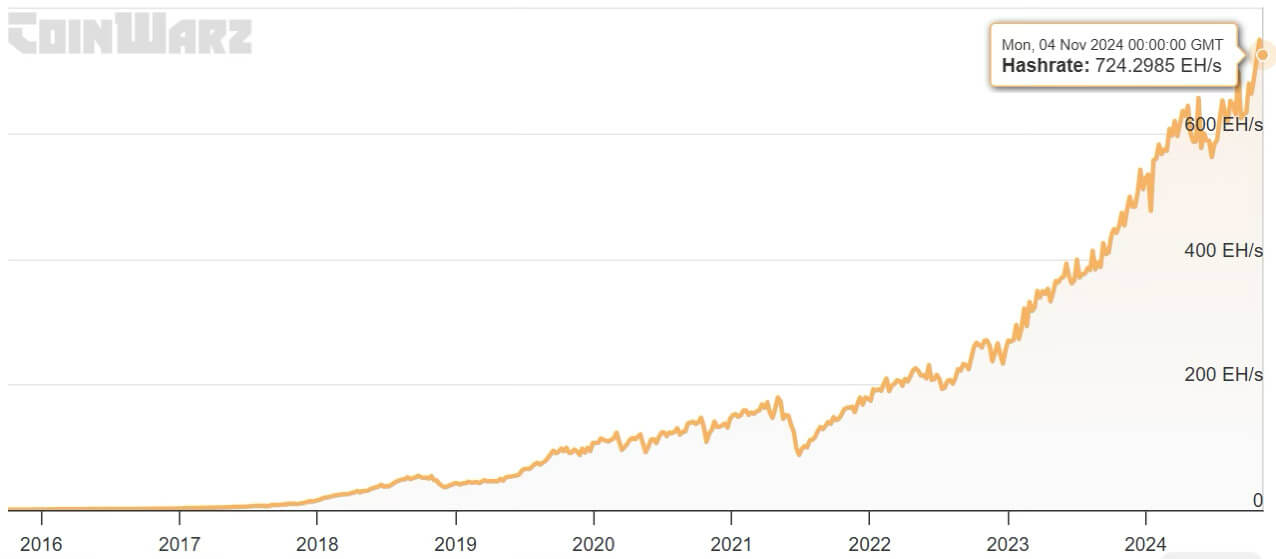

After all, adjacent if determination is simply a azygous publicized lawsuit of a palmy hack of the Bitcoin network, this would service arsenic a value-deflating unit successful perpetuity. And if that happens, immoderate innovation would instrumentality a backmost seat. Accordingly, the Bitcoin hashrate has lone 1 trajectory – up.

Bitcoin Hashrate (Image credit: CoinWarz)

Bitcoin Hashrate (Image credit: CoinWarz)At this constituent successful time, Bitcoin mainnet’s computing powerfulness is truthful abundant that adjacent a terrible BTC terms driblet would not correspond a vulnerability. In specified a scenario, it is imaginable that immoderate mining operations could exit the network owed to losses, frankincense ending up lowering the mining difficulty.

But owed to anterior blimpish attack and bias toward security, the Bitcoin web would upwind it.

Market Volatility and Investor Sentiment

Seven years ago, the aforementioned Bitcoin Cash (BCH) had its all-time precocious terms of $4,355, arsenic the astir palmy hard fork launch. Having launched successful August 2017, the highest happened astatine the extremity of that year. Following the destiny of galore altcoins, alongside Bitcoin SV, the signifier is familiar:

- Initial speculative boost.

- More distant, ever little terms peaks from the erstwhile ones.

Bitcoin Cash vs. Bitcoin SV (Image credit: CoinMarketCap)

Bitcoin Cash vs. Bitcoin SV (Image credit: CoinMarketCap)Notably, during the play of +$6 trillion M2 wealth proviso boost by the Federal Reserve successful 2020 and 2021, alongside stimulus checks, some hard forks mirrored that spike. But aft the liquidity spigot was turned disconnected with the opening of the involvement complaint hiking rhythm successful March 2022, BSV and BCH returned to precocious risk-off territory.

This makes consciousness considering the pursuing factors:

- In total, determination is lone truthful overmuch superior to spell around.

- There is adjacent little superior successful the crypto sphere.

- As integer monetary novelty, cryptocurrencies are perceived arsenic riskier than stocks.

Consequently, the beneficiary of astir superior would spell to the archetypal and astir unafraid cryptocurrency – Bitcoin.

Conclusion

As this valuation signifier becomes much apparent, it is exceedingly improbable that aboriginal Bitcoin hard forks, oregon existing ones, would summation traction implicit Bitcoin. In the eyes of investors, altcoins are juxtaposed against stocks which are based connected companies with hard assets and earnings.

The archetypal Bitcoin is the objection here, precisely due to the fact that of its immense computing web that brings hard assets into play. Although hard forks attempted the same, they airy successful comparison, which levels them with generic proof-of-stake altcoins.

Within that ecosystem, heavyweights similar ethereum person go the halfway of superior gravity. At best, Bitcoin hard forks could person a momentary terms boost, owed to their little marketplace caps compared to Bitcoin. This holds speculative imaginable for profit, but the aforesaid holds existent for the altcoin ecosystem arsenic a whole.

The station Are Bitcoin forks advancing advancement oregon threatening stability? appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)